While Panama and Paradise Papers had majorly focused on foreign entities created by entities, corporates or individuals overseas, Pandora is about the new method adopted by wealthy elites by setting up multiple layered complex trust structures.

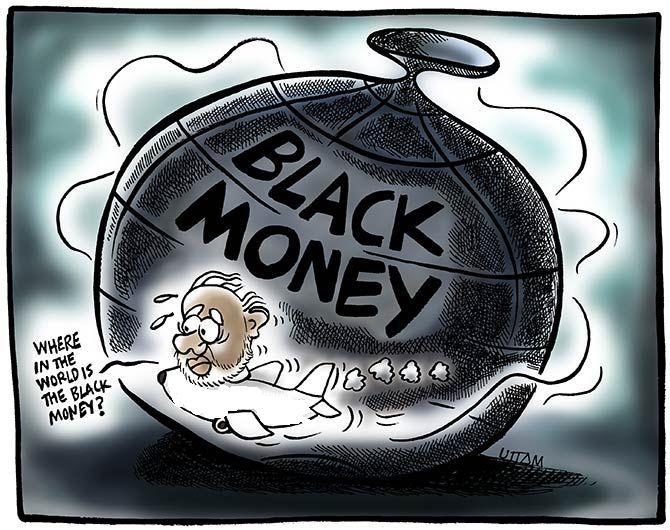

Several countries' ramped up drive against the black money menace has forced wealthy elites, including from India, to adopt a new method to ring fence their wealth, revealed the 'Pandora Papers', the latest leak of offshore files.

Pandora Papers talks about those beneficial owners who have assets placed in an offshore trust -- in conjunction with foreign entities -- holding all sorts of investments, cash, properties, shareholdings on behalf of these owners.

About 30,000 private foreign trusts had been set up across the globe in not just tax friendly jurisdictions, where the laws are comparatively lenient, but also in those jurisdictions such as US, Singapore, which have very rigorous tax laws.

Why the Pandora Papers leak is crucial from India's perspective?

There are about 12 million leaked documents from global service firms, which have also featured about 350 Indians, including some prominent names like Anil Ambani, Vinod Adani, Kiran Mazumdar-Shaw, Niira Radia, Sachin Tendulkar, Jackie Shroff and Satish Sharma among others. Many of those who are named have denied any wrongdoing, while some of them have already been under the scanner of Indian investigative agencies.

How are the latest revelations different from the earlier global leaks?

There are about six-seven global leaks, including Panama and Paradise Papers, which had majorly focused on foreign entities created by entities, corporates or individuals overseas.

Pandora, on the other hand, is about the new method adopted by wealthy elites by setting up multiple layered complex trust structures. The paper claims how several ultra rich used trusts as a vehicle for the sole purpose of holding their investments.

The consortium of global journalists claims that scrutiny of these leaked papers showed that these people set up trust to hide their identity so that they never come under the lens of authorities and also for safeguarding investments.

How do these trusts work?

Simply put, setting up a trust is basically an arrangement, where a trustee (third party) holds the assets on behalf of beneficial owners. A trustee is a legal entity and governed by laws of respective countries.

Isn't it legitimate to set up trust? Why the facade?

In India, it is legitimate to set up a trust both in the country and outside. The trust is governed by Indian Trusts Act, which does not see trust per se as a legal entity but does recognise the trustee. It allows trustees to manage and make use of assets for the beneficiaries’ benefits.

The rule also allows setting up trust in foreign jurisdiction. Many corporate, large business houses set up trusts for legit purposes and are genuine in nature.

The issue arises if the said entity does not disclose about it to their respective authorities and in the tax filing.

Why do elite prefer setting up a trust outside India?

A trust on a foreign soil is bound by secrecy clauses of that foreign jurisdiction. However, if the investigator has strong evidence against the beneficial owner showing ill intention by the trust, then foreign court of that jurisdiction can back the authority looking for recovery.

Will Indian authorities go after all the names that appear in the new list?

Tax authorities would discreetly enquire about each name by scrutinising the data and sources available with them. If they find something fishy in their book, they will seek explanations through notice and may also do survey operations.

If they unearth undisclosed foreign assets, they will invoke the Black Money Act, which deals with undisclosed foreign assets by Indians. The law is very stringent in nature and attracts both rigorous penalty and prosecution.

However, being named as beneficial owner of a trust is not an offence as it's not a violation under any Indian laws. So, agencies would see whether the investment done was through a legal route and if disclosure has been made.

© 2025

© 2025