Photographs: Amul Website Kalpesh Damor, inputs from Sapna Agarwal

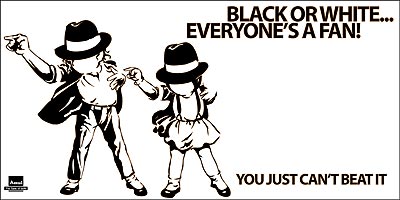

So while the ponytailed Amul girl will continue to be the brand ambassador with her Utterly Butterly spoofs, the brand has started changing its lingo to cater to Generation X, Y and even Z. So the new television commercials, created by DCB Ulka, position the products on the 'Utterly Healthy' platform where thin is in.

At 60, what Amul plans to do

Image: Sylvester Dacunha created the Amul girlPhotographs: Amul Website

Generations after generations have got to know her and love her. So we can't change it, Dacunha says. But market research showed that the company needs something new to promote its new product categories of milk, cheese spread and lassi. That explains the questions youngsters ask you in the new TV commercials: Dude, where's da doodh?

It was necessary, says R S Sodhi, chief general manager of the Gujarat Co-operative Milk Marketing Federation (GCMMF). Milk products are usually associated with housewives and children. As a result, teenagers tend to shy away from drinking milk. We want to make milk popular among youth, he says.

At 60, what Amul plans to do

Image: Amul eyes more metrosPhotographs: Amul Website

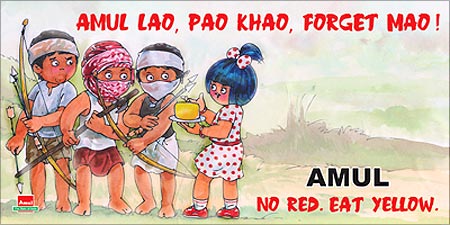

Amul, which accounts for 15 to 20 per cent of the organised liquid milk market, has a daily supply of 8.7 million litres. By 2020, the milk procurement will be doubled and the company has earmarked over Rs 2,600 crore (Rs 26 billion) for capacity expansions, says Parthi Bhatol, chairman, GCMMF.

To save on costs and increase its distribution reach, GCMMF now plans to set up its own satellite dairies in Delhi, Mumbai and Kolkata with a combined processing and liquid milk packaging capacity of an additional 5 million kg per day. At present, the processing and packaging is leased out to local units.

At 60, what Amul plans to do

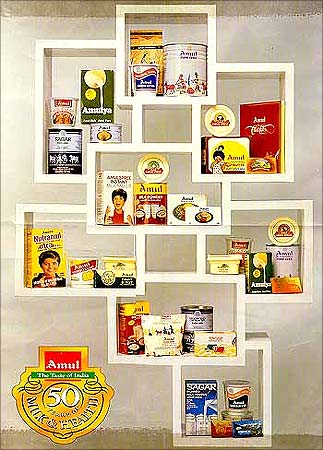

Image: Amul offers a variety of productsPhotographs: Amul Website

The move makes sense as Amul has to shell out Rs 1.50 per litre more on transportation costs alone to sell its milk in the metros. That explains its not-so-strong presence in these markets now.

Take Delhi, for example. Mother Dairy accounts for 55 per cent of the 5.5 to 6.6 million litres-per-day liquid milk market in the city compared to Amuls 20 per cent. GCMMF feels it can easily double its milk supply to the Delhi, Mumbai and Kolkata markets once the satellite dairies are in place.

Cities such as Kanpur, Lucknow and Bhopal are also on our radar, says Sodhi. The strategy will be to tie up with milk co-operatives and unions in these cities.

At 60, what Amul plans to do

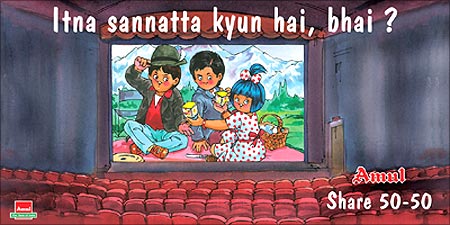

Image: Tough competition for AmulPhotographs: Amul Website

Competitors are dismissive about Amul's plans and say it will take years for the company to make its presence felt in the metros. Amul does not have a strong distribution network like that of Mother Dairy in Delhi. So it will be a long haul, one of them says.

At 60, what Amul plans to do

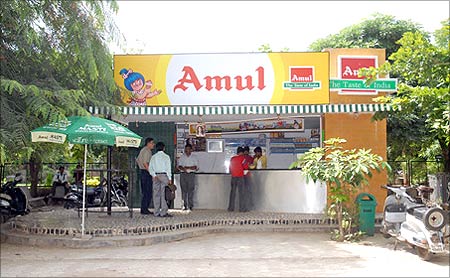

Image: Amul is adding more parlours.Photographs: Amul Website

Amul is also trying to keep pace with time by looking at newer value-added products. While the company is tightlipped on this, pro-biotic products is one area it is trying to concentrate on.

That again is in keeping with the health consciousness among todays youth. So, its time to 'chill your dil' as one youngster says - in one of Amul Milks new commercials.

article