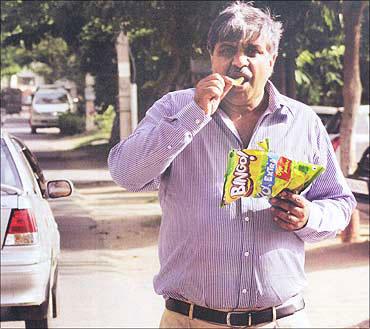

Photographs: Courtesy, Business Standard Bhupesh Bhandari

In August 2001, ITC made a modest entry into the food business with its Kitchens of India ready-to-eat preparations.

The company ran popular restaurants, Bukhara and Dum Pukht, in its hotels. These restaurants, the company felt, were successful because it understood the Indian palate well. Hence, the new line of business.

A more serious effort was made a year later when ITC launched its flour under the Aashirvaad brand. This was followed by candies, biscuits, snacks, salt, pasta and spices. The size of the food market was just too tempting.

Within fast-moving consumer goods, food has always been the largest category. A large part of that is still sold loose; so the upside for packaged foods remains sizeable.

The news is that ITC has crossed the first hump in terms of volume, market share and profits. Its food business is over Rs 2,500 crore (Rs 25 billion) in size. If beverages are excluded, investment analysts reckon, this should put ITC amongst the top three food companies in the country after Nestle and Hindustan Unilever.

ITC Foods chief executive Chitranjan Dar runs 40 food factories across the country and a product development centre in Bangalore. It is the market leader in one category -- flour -- and is second in confectionery, salt and packaged snack, and third in biscuits. It has in its portfolio six brands (Aashirvaad, Sunfeast, Bingo, Kitchens of India, Minto and Candyman).

. . .

The secret of ITC Foods' terrific success

Photographs: Reuters

And it has turned profitable. Till recently, profitability of this division was a huge concern for ITC. Not any longer. Investment analysts say the profit margins are below 5 per cent, and the company's next task should be to raise it to the industry norm of 5 to 10 per cent.

ITC's competitive advantage from day one has been procurement of commodities. The agri-business division of ITC connects with 5 million farmers in 170 districts of 16 states.

The company leverages this to good advantage for all the commodities it requires for the food business: Wheat, sugar, edible oil, potatoes et al. Such commodities account for almost 60 per cent of the costs of the business. This is the reason why Dar is not too bothered about the private food labels of large retailers.

Most of them buy commodities from the spot market. So, when prices rise, like wheat from September to December, they find themselves in a jam. "The sharbati variety of wheat this year is not available. It's fully sold out. That's where our strength lies," says Dar. ITC uses sharbati wheat for its premium flour called Aashirvaad Select.

The other advantage has been ITC's retail network for cigarettes. About a third of the company's food products apart from flour (snacks, biscuits and candies) are retailed through these shops.

Local preferences

The company was also quick to realise that the foods business in India requires sound knowledge of local tastes and preferences. Food habits in the country change after every hundred miles. So, this is a business in which local companies stand a better chance of success.

. . .

The secret of ITC Foods' terrific success

It is an entry barrier for multinational corporations, though the two largest food companies in the country are foreign-owned. "Food is a very personalised category. It's not like soap. You can get some space if you can create differentiation," says Dar, a veteran of 25 years at ITC. "Brands will need to be fragmented to cater to local tastes and preferences. So there can be no omnibus product which can be a national hit."

ITC's biggest brand is Sunfeast -- biscuits and now pasta. In biscuits, ITC is ranked third after Britannia and Parle. The journey so far may have been easy because ITC has grown at the cost of local brands. The days ahead could be tough.

"In biscuits," says Dar, "you can take on formidable rivals with formidable products. The most successful products are 30 to 40 years old. Cookies or glucose biscuits belong to the 1980s and before." In the mid to premium category, Dar feels there are several taste buckets and categories available on the health & nutrition, indulgence and convenience platforms.

"In these three platforms there is still a lot to be exploited. It is possible to innovate around that. One who does it the best will walk away with the market."

Some time back, ITC came out with Sunfeast pasta. This remains a small category. Market estimates suggest that it was till six months ago just 2.5 per cent of the Rs 1,100-crore (Rs 11 billion) market for instant noodles, which may have doubled with Nestl 's entry into the segment. This has fuelled the buzz that the next stop for Sunfeast will be instant noodles.

Dar denies there's any plan for instant noodles, "at least not in the next quarter". The problem here will be to create a product that stands out from Nestle's Maggi.

. . .

The secret of ITC Foods' terrific success

Over the years, Nestle has come out with so many variants of the product that there isn't much left to add. Dar admits that ITC's product development team has worked on instant noodles but could not come out with a killer recipe. There has also been speculation that ITC will take Sunfeast to newer categories like packaged water, tea and bread. Dar denies all such talk.

Flourishing with flour

Aashirvaad is ITC's brand for staples. Branded flour sales in the country are around Rs 4,000 crore (Rs 40 billion), which is just 4 per cent of the market -- rest is all sold loose. (Conversion to packaged flour is happening at about 8 per cent per annum.)

Out of this, national brands like Aashirvaad, Shaktibhog, Annapurna and Pilsbury sell around Rs 1,700 crore (Rs billion). Aashirvaad's share of the market is above 50 per cent, market analysts say. This perhaps is the reason why the brand is not heavily advertised in mass media.

"Somebody has to pay for it. In the South we do advertise, because it a nascent concept there. In the North, we work at the points of purchase," says Dar. Aashirvaad is available in outlets that sell 80 per cent of the packaged flour in the country. The product is tweaked, claims Dar, for different markets.

The one sold in Delhi, for instance, is a blend of four flours. The mix is changed right through the year to give the same quality to consumers, says he.

ITC first extended the brand to salt. Its market share is 10 per cent, next only to Tata Chemicals' Tata Salt (over 30 per cent). Here, ITC's focus is on the rural markets. Unlike flour, rural households have converted swiftly to packaged salt. So, its retail network is not the same as packaged flour.

. . .

The secret of ITC Foods' terrific success

ITC, says Dar, has therefore appointed a whole army of traditional wholesalers to reach these remote markets. Since this market is not scientifically tracked, Dar says he doesn't know how deep he has penetrated.

Next was the turn of Aashirvaad spices. This industry has a handful of national bands like Ashok, MDH and Everest which are personally driven by their promoters. This makes them formidable opponents. ITC's strategy here has been to go for blends, so that the brand can charge a premium over others. The problem is that all rivals have come out with various blends.

To create a differentiation, ITC will have to come out with something really new and different. That's the challenge that the company's researchers in Bangalore face. To begin with, ITC has decided to sell in the South where consumers are a little particular about the spices they buy. The northern markets will come later.

Would ITC like to come out with other staples under the brand, like rice and sugar? Dar rules out the possibility. For rice, he says that ITC does not have a procurement infrastructure in place.

Basmati rice, that is what Aashrivaad could look at, is grown in Punjab, Haryana, Jammu and parts of Uttarakhand -- not ITC's stronghold. "As and when our agri-business division begins to export basmati rice, we will also start to sell in the local market," says he. Sugar too doesn't excite him because there is no opportunity to create differentiation.

Bang on with Bingo

ITC's most audacious move in foods so far has been Bingo, its ready-to-eat snack, which took on the might of Frito Lays (market share: 60 per cent; brands: Lays, Kurkure, Aliva and Uncle Chipps.) Bingo has grown through some innovative products and kickass promotion.

. . .

The secret of ITC Foods' terrific success

Its share of the Rs 3,000-crore (Rs 30 billion) market is 10 to 12 per cent. Frito Lays has hit back with its new range of Indian snacks. Parle too has entered the market with aggression. Sector experts point out another challenge: Bingo's positioning is such that it needs to come out with new flavours and advertisements all the time.

"It's a dangerous game," says a Mumbai-based analyst. "Customers can lose interest if we do not innovate continuously," Dar admits, "So you need to look at new textures, flavours and shapes regularly. In terms of flavours, our target is one or two launches a year. In texture and shape, there should be one new product in two years. There are eight to ten flavours always in the pipeline in various stages of development."

In confectionery, ITC lags behind Perfetti because it doesn't have a chewing gum in its portfolio, though it has candies, eclairs, toffees, chews, lacto and so on.

"There is a lot of proprietory work in gums that needs to be done. You need to develop the gum base, for instance. We don't want to outstretch our limited means," says Dar.

That leaves in Dar's portfolio Kitchens of India, which is small. That category may not be more than Rs 30 crore (Rs 300 million). In fact, export of the brand could be five times more than domestic sale. But the North American markets, which ITC has in its crosshairs, could be tough because of the inability to export meats there.

Dar says the company could look at local production to get over the problem. But that can wait: Dar's hands are full with other brands now.

article