'Binary fission will happen -- startups will lead to more startups.'

Nandan Nilekani's 8 recommendations for India's economy to hit the $8 trillion mark by 2035.

Peerzada Abrar listens in.

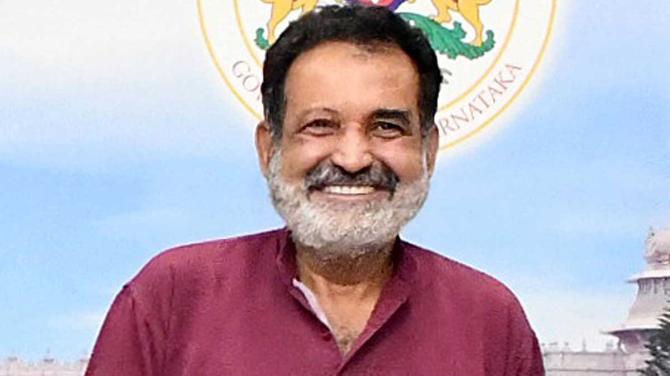

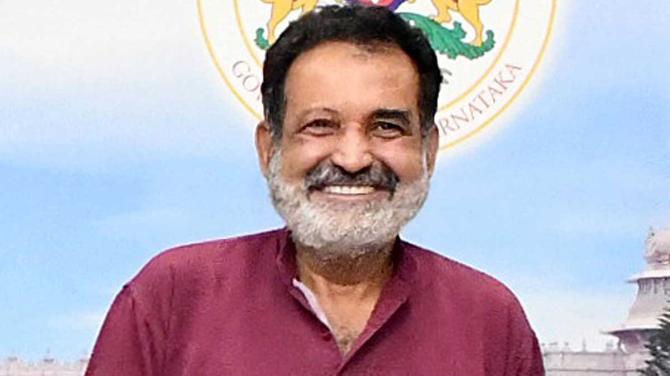

IMAGE: Nandan Nilekani, cofounder, Infosys. Photograph: ANI Photo

India is ready to become the most preferred initial public offering (IPO) market globally by 2035, according to Nandan Nilekani, cofounder of Infosys, who spearheaded the country's massive unique identification project.

India already has the largest number of IPOs, Nilekani pointed out, but their value is lower compared to the US. However, companies want to return and list in India.

Nilekani spoke about the necessary "key unlocks" required to accelerate the country's growth rate from 6 to 8 per cent and achieve an $8 trillion economy by 2035. These include technology, capital, entrepreneurship, and formalisation.

"Ghar wapsi is happening. Companies that were incorporated in Singapore or the US are flipping back, paying a tonne of taxes so that they can list in India," said Nilekani at the Arkam Annual Meet 2025, organised by venture capital firm Arkam Ventures.

"I remember seven to eight years ago, we had to persuade companies to come back and list here. Now, they are returning on their own and paying premium taxes."

He cited examples of companies such as PhonePe, Razorpay, Pine Labs, and Zepto that have made such a move.

"That only shows that the Indian capital market will be the most attractive place for IPOs in the next 10 years.

"So, it's a perfect environment where you have all the capital to go from seed to IPO, and then you have a willing market to absorb it," said Nilekani.

Nilekani also predicted a surge in startups across India.

"We expect 1 million startups by 2035. In 2016, we may have had a few thousand startups, of which about 1,000 were funded.

"Today, we have 150,000 startups. We expect that the number will grow at a 20 per cent compound annual growth rate.

"In other words, when the economy grows at 8 per cent, startups will grow at 20 per cent, reaching 1 million by 2035.

"Binary fission will happen -- startups will lead to more startups," said Nilekani.

Nilekani said this is a phenomenon that has not been seen before.

"So, we don't know what it means if a million companies are all roaming around trying to fix problems. And I think that's the exciting thing that is going to happen by 2035.

"Interestingly, more and more startups are emerging outside the metros, solving different issues," he said.

The power of 8

Nilekani gave eight recommendations for India's economy to hit the $8 trillion mark by 2035.

These include artificial intelligence (AI) for a billion Indians, focusing on Indian languages, last-mile consumers, and micro, small and medium enterprises (MSMEs), as well as emphasising agriculture, health, and education.

"There are many other uses of AI. I'm just saying that if you want to change the trajectory of growth, this is what you have to do," said Nilekani.

To accelerate capital, he suggested maximising AI penetration and leveraging land monetisation using 'finternet' architecture, which refers to the convergence of finance and the Internet, where financial services are seamlessly integrated into digital platforms.

"This will unlock even more capital and provide further momentum on the capital side," said Nilekani.

To boost entrepreneurship, he recommended increasing funding outside the metros.

"If we want to reduce spatial inequality, we need entrepreneurs in small towns, villages, and rural areas. That has to be done very proactively.

"And, of course, we must ensure that those 10 million MSMEs striving to modernise have access to technology, markets, credit, and other resources," said Nilekani who also advocated accelerating formalisation, emphasising its transformational potential.

He highlighted the importance of creating a truly national market for trustworthy credentials, allowing individuals to showcase them anywhere and secure a job.

He also stressed the need for a genuine national market for benefits, enabling people to carry their benefits wherever they go.

He called for deregulation, simplifying laws and compliances, and decriminalisation, noting that such changes would unlock opportunities.

Nilekani said that entrepreneurs will come, raise funds, and go public, ultimately generating value for everyone.

However, he said that if friction is not reduced for them, they will seek opportunities elsewhere.

He believes that by addressing these issues through eight specific recommendations, growth of 6 to 8 per cent is achievable.

Murthy Warns: Don't Hype AI, Think Big

Jaden Mathew Paul

IMAGE: Co-Founder and Infosys Chairman N R Narayana Murthy. Photograph: ANI Photo

Infosys Co-founder N R Narayana Murthy on Wednesday cautioned against what he called "exaggerated" claims surrounding artificial intelligence in India, while asserting that poverty can be tackled by innovation and job creation and not by freebies.

Murthy pointed out that many systems labelled as AI are just conventional programmes.

"I find that most of the so-called AI, I see, is silly and old programming," he said while speaking at TiEcon Mumbai 2025.

"It has become a fashion in India to talk of AI in everything. Ordinary programmes are touted as AI," he said, adding that true AI involves two fundamental principles: Machine learning, which enables large-scale correlation for predictive analysis, and deep learning, which mimics human brain functions to handle unsupervised algorithms.

"Unsupervised algorithms which use deep learning and neural networks are the ones that have much greater potential to do things that will mimic human beings better and better," he said.

Murthy highlighted that with every technological advancement, certain jobs may be eliminated, but if implemented in an assistive manner, it can drive economic growth.

"In each tech, certain jobs will be eliminated, but if used in an assisted manner, we can grow the economy," he said.

Drawing parallels with AI, he explained that while automation may replace certain roles, it also has the potential to create new industries and employment opportunities.

"AI for example, if you use it in autonomous vehicles for transport, hospital care, it will lead to expansion of those companies and create jobs," he said.

He urged startups to benchmark themselves against the best global standards.

"In the beginning, it looks impossible, but the moment the mind-set has been created, you'll start making progress," he said.

He also stressed the need to hire talent that is "smarter than you" and to foster a workplace that is open to new ideas.

"That's how you solve the problem, and not with freebies. Our poverty will vanish like dew on a sunny morning," he added.

"Every startup that failed did not follow this," said Murthy.

An advocate of compassionate capitalism, Murthy took a critical stance on government freebies, arguing that subsidies should be tied to measurable outcomes.

"What you can do is, when subsidies are provided, you can ask for something in return.

"If you give free electricity for the first six months, at the end of it, we'll find out if children are reading more and if their performance is better in school," he added.

Offering guidance to entrepreneurs, Murthy emphasised the importance of earning respect from all stakeholders, including customers, employees, investors, and regulators.

"If you think in terms of doing good to society, you'll get repeat business, employees will join and investors, vendors will put up with you in difficult times, politicians will want you to succeed," he said.

Mohandas Pai: India Needs Frugal AI Innovation

Ajinkya Kawale

IMAGE: Former Infosys CFO Mohandas Pai. Photograph: ANI Photo

India cannot afford to put billions of dollars annually into AI research and development (R&D) and it should rather focus on cost-effective ways to scale AI advancements, former Infosys CFO Mohandas Pai said while citing the example of China's DeepSeek.

Pai, chairman at Aarin Capital, was speaking at the TiEcon Mumbai 2025 event.

"We can't put billions of dollars in R&D every single year because we don't have that kind of money.

"What DeepSeek did is very unique. They brought down the computing requirement by 75 per cent," he added.

Pai highlighted that Indian companies should focus on developing vertical large language models (LLMs) for domains like financial services, healthcare, and high-tech manufacturing, rather than competing with general-purpose horizontal LLMs like ChatGPT or DeepSeek.

He believes this approach could position India as a dominant digital power in the coming decade.

As AI takes over routine tasks and streamlines workflows, innovation cycles will accelerate, Pai noted.

"Greater discoveries and innovation will happen faster.

"Innovation cycles will come down because innovation includes search, reasoning, and the creation of models, which can be done by AI," he explained.

Pai suggested that India prioritise five to six areas of technology including artificial intelligence and machine learning, robotics, hyper quantum computing, biogenomics and biotechnology, and high-tech manufacturing.

"We've got to pick these five areas and invest in them through public money, put a billion dollars a year in each one of them, get a coalition of hundreds of our best engineering schools, get a coalition of industry working with them and join together to accelerate the process of innovation," he said.

Pai also added that India needs to have better methods for the ease of doing business in the country highlighting the need to attract foreign capital.

"The problem in India is the detail. We talk about ease of business, but what is it? What are the things you must do?

"I would urge startups and make a document on what law, regulation has to be carved out and given an exemption," Pai said.

Pai added there was a need to ease the process to attract capital referring to the extensive bureaucracy required to enable foreign investments in the country.

"The Chinese got all the money in and they grew the country. We don't allow money to come in...we harass them.

"For all the things that the Reserve Bank of India did the last two years, FDI has become negative.

"Foreign capital is not coming in and they're getting harassed. I think we've got to clean this up," he said.

Net foreign direct investment (FDI) in India -- inflows minus outflows -- declined to $1.18 billion during April-December 2024 from $7.84 billion in the same period in 2023 due to a rise in repatriation and overseas investments by Indian firms.

Gross inward FDI during April-November 2024 increased by 20.6 per cent year-on-year (Y-o-Y) to $62.5 billion from $51.8 billion a year ago, according to the RBI's data (February 2025 bulletin).

Feature Presentation: Ashish Narsale/Rediff.com

© 2025

© 2025