Half of the nation’s 100 richest saw gains rising a collective 14% to $517.5 billion, says Forbes.

The Covid-19 pandemic may have hit India hard, but nine newcomers joined the ranks of India’s top richest Indians.

Forbes released 2020’s top 100 richest Indians on Thursday, which included newcomers, Sanjeev Bikhchandani, co-founder of Info Edge (India), who owns popular job and property websites; siblings Nithin and Nikhil Kamath, co-founders of discount stock brokerage Zerodha Broking, and three specialty chemicals producers - Vinod Saraf, founder of Vinati Organics, Arun Bharat Ram, the patriarch of SRF, and brothers Chandrakant and Rajendra Gogri of Aarti Industries.

Other newcomers included Delhi-based brothers Ramesh Kumar and Mukand Lal Dua of Relaxo Footwears, which owns affordable footwear brands; dairyman, R G Chandramogan of Hatsun Agro; Premchand Godha, who chairs IPCA Laboratories, manufacturing formulations, bulk drugs and drug intermediates; G Rajendran, founder of jewellery chain, GRT Jewellers.

Half of the nation’s 100 richest saw gains, rising a collective 14 per cent to $517.5 billion even as the benchmark Sensex remained flat from a year ago, said Forbes.

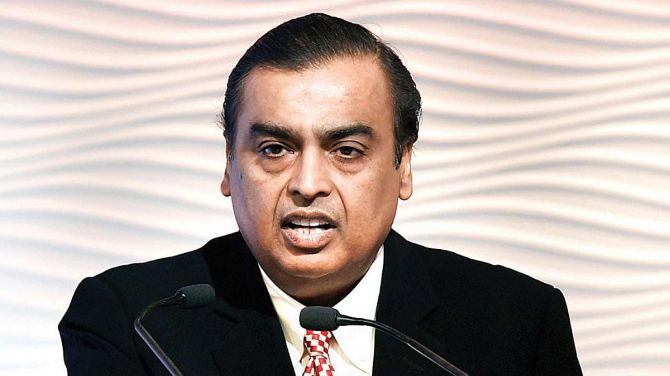

More than half of the increase can be ascribed to one individual: Mukesh Ambani at No. 1 for the 13th year, who added $37.3 billion to his fortune - a rise of 73 per cent - to a net worth of $88.7 billion, it added.

Gautam Adani retained his No. 2 spot, as his net worth was boosted 61 per cent to $25.2 billion while tech tycoon, Shiv Nadar jumped three places to No. 3 with $20.4 billion.

Vaccine maker, Cyrus Poonawalla, whose Serum Institute has joined the race to produce Covid-19 vaccines, entered the Top-10.

The impact of the pandemic showed up on the list as all pharmaceutical billionaires on the list saw their wealth rise.

Biocon’s Kiran Mazumdar-Shaw became the highest wealth gainer in percentage terms, said Forbes.

Biocon is set to start phase 4 trials of a potential Covid-19 drug.

Despite the pandemic, fewer billionaires saw their wealth erode this year than they did in 2019 and about and more than a third of the listees saw their wealth decline, notably those with interests in real estate.

Photograph: PTI Photo

© 2025

© 2025