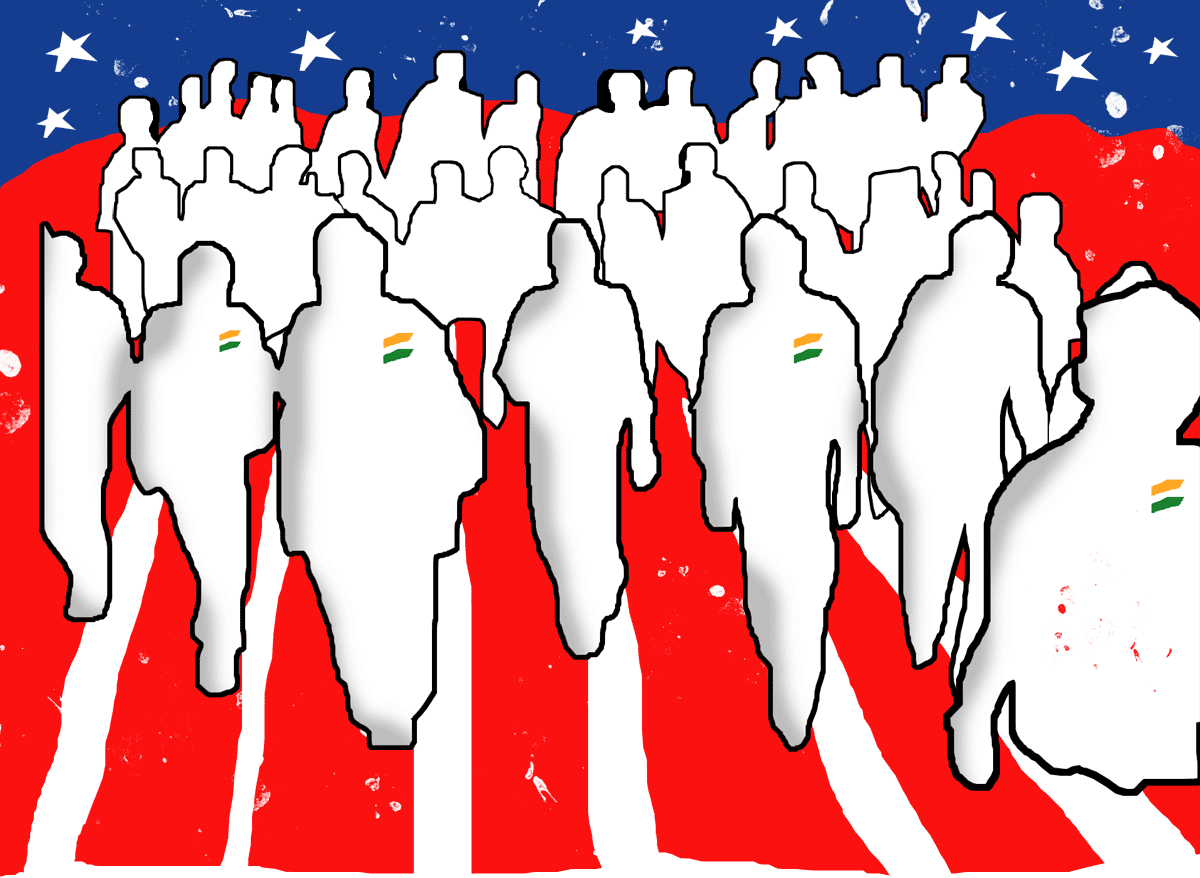

Looking under the hood, I see India on the terrible, but commonplace, road to prosperity failure, warns Rathin Roy.

The post-Covid macroeconomic fundamentals of the Indian economy are sound.

Since financial year 2022, GDP growth has averaged 7.2 per cent.

Consumer price inflation has oscillated between 5 and 6 per cent. The current account deficit is extremely comfortable, averaging between 1 and 2 per cent of GDP.

The general government fiscal deficit is also under control at around 9 per cent of GDP in FY23, down from 13 per cent in FY21, and is expected to fall further this fiscal year.

Tax revenue targets, though modest, are being met comfortably.

Gross capital formation at 33 per cent of GDP and gross saving at around 31 per cent of GDP are adequate to support an average growth rate of 7 per cent.

Looking at the performance of the Indian economy as one would look at the performance of an automobile while seated in it, things appear to be going smoothly.

However, under the hood, there are issues that merit close attention.

Private final consumption expenditure is growing slower than GDP, indicating a slowdown in aggregate demand.

This could be due to an increase in investment, but private investment has been declining as a share of GDP, a trend observed since FY12 but now exacerbating.

In FY24, fresh investments announced by the domestic private sector have fallen by 15 per cent; foreign investment in fixed capital formation has also declined.

Historically, when growth rates rise, private consumption growth picks up, as new investments create jobs and earnings are lifted by increases in growth. But this is not happening

Central government budgetary increases in capital expenditure have largely substituted for declines in investments by public enterprises.

The positive effect of government investment on overall investment has been very small, and largely due to increased capital spending by the states.

Consumption increases when people earn money, for which they need to have paying jobs.

Government claims that 47 million jobs were added in FY24.

But most of these are in unpaid or low-paid self-employed work, and in agriculture.

These are less 'jobs' than low-paid activities. The contemporary Indian economy is one where:

- 45 per cent of the labour force works in agriculture.

- The share of manufacturing in GDP has fallen to 13 per cent.

- 800 million people need subsidised food.

- Over 100 million people between the ages of 18 and 35 are neither in education nor actively looking for employment.

Such an economy can support neither increased household consumption, nor saving.

Household financial savings are at a recent low of 5.2 per cent of GDP, while household debt has risen to a peak of 40 per cent of GDP. Much of this is consumption debt.

India confronts stark regional imbalances in economic performance.

The majority of the population lives in the North and East, with least developed country (LDC) levels of per capita income and human development.

Most growth and prosperity is concentrated in the South and West, where a minority of the population lives.

The opposite is true in other large countries like the US, Japan, and China, where a minority lives in poor regions and the majority in rich regions.

Hence, simple fixes like fiscal transfers, which work in these countries, do not work in India, except as palliatives.

Above the hood, a look at how growth is distributed between different factors of production provides a dashboard warning.

The overall wage share is declining, and real rural wages are falling, as is demand for investment credit.

Hence returns to labour are low, as are returns to debt capital.

However, the stock market is booming, as are asset valuations, hence returns to equity are high.

This is leading to an unprecedented boom in demand for luxury and 'high-end' consumption of expensive imported products, from scotch whisky to business class travel to destination weddings.

This is not a new story in the history of development. It is, in fact, the default.

From the Philippines to Thailand, from Egypt to Brazil, countries have experienced 'prosperity failure' -- a trap of their own making from which exit is near impossible.

Even as they exited LDC levels, there was no diffusion of prosperity to the general populace.

All the problems of poor countries -- poverty, malnutrition, poor education, ill health, third-rate housing, difficult public transport, poor sanitation -- persisted, even as the rich enjoy globally opulent lifestyles.

These are failed economies, in contrast to the handful -- Ireland, Japan, South Korea, Taiwan, China -- where universal access to basic needs and prosperity became available to all as these countries grew richer.

The failed economies exhibited the same 'under the hood' characteristics that now mark the Indian economy. The successful ones did not.

India has only recently become a middle-income country.

My hope has always been that India will join the minority of nations that will secure a successful development transformation.

But looking under the hood, I see India on the terrible, but commonplace, road to prosperity failure.

There is still scope to remedy these matters, but this will require structural change.

The Budget, I understand, will spell out a road map for development up to 2047.

I fervently hope this road map will look under the hood to fix the very serious problems that beset India's development transformation.

Rathin Roy is distinguished professor, Kautilya School of Public Policy, and visiting senior fellow, ODI, London

Feature Presentation: Aslam Hunani/Rediff.com