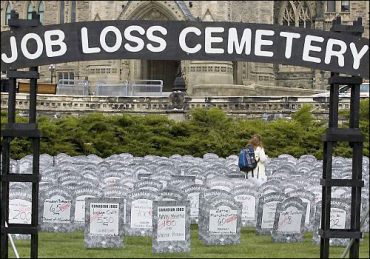

Photographs: Rediff Archives Prasanna D Zore

Will the current slowdown in the Indian job market become a tight squeeze for young people?

Will freshers find it tough to get jobs?

What will the employment scenario be in 2012 for new entrants and young people in the job market?

Rediff.com's Prasanna D Zore speaks with experts to find out more.

In September, the senior management of a financial services company debated a serious issue: Over spreadsheets and power point presentations projected on a giant screen, five people discussed whether to downsize a division that was eating into the company's profitability or close the entire division for good.

Early October, with the Indian and global stock markets in a tizzy and the shadow of the Euro Zone debt crisis looming over the world, this Bangalore-based company hurriedly summoned some 60 odd employees of this division for an 'urgent meeting.'

By the end of the day all 60 employees returned home with pink slips and the promise of a decent severance package -- a part of their contract -- in their bags.

"I couldn't figure out why they fired me," says 22-year-old Namit Singha (name changed on request), an economics graduate from Mumbai University who figured in the list of people who lost their jobs.

"The management didn't convey if our jobs were taken away because of cost cutting or a downsizing of the workforce. What I heard from others in the company was that our division was not making money," he adds.

Forty-five days later, Namit is still without a job. Not that there is a dearth of job offers for his profile of dealing in commodities. "I have four job offers, but all of them are offering me 30 to 40 per cent less than my last drawn salary. Perhaps early next year things will improve," says a hopeful Namit who is now fending for himself from his savings.

The same story played itself out, but on a much smaller scale, in a mid-sized IT company in Mumbai around the same period. Iqbal Shaikh (name changed on request) and seven other programmers working on a project of a large European insurance house were asked to leave with immediate effect.

Iqbal, 26, an electronics and computer science engineer from Hyderabad, was not as lucky as Namit. "The severance we got is a month's salary," says Iqbal who moved back to Hyderabad to stay with his parents, and search for a new job.

Note: All pictures used for representational purposes only.

Please ...

'In India we will see slower job creation'

Image: Used for representational purposes onlyPhotographs: Rediff Archives

Unlike Namit, Iqbal compromised on his job profile and salary to secure employment at a gems and jewellery company.

Unfortunately, Namit and Iqbal are not isolated examples.

A slowdown in the US, China and other countries in the West, amplified by the debt crisis in Europe, has slowly begun to reach Indian shores.

Insulated till now by a growth rate that touched between eight to nine per cent till recently, the Indian growth story too is losing steam as high interest rates, high inflation, policy indecision and a currency that is fast losing its value against the dollar, work in tandem to clip the country's gross domestic product to the seven per cent level.

The overall job scenario is not as bad as the situation was after investment bank Lehman Brothers collapsed in September 2008 say four experts and industry veterans Rediff.com spoke with to find if the job squeeze in India is for real.

But they are unanimous that if Europe fails to come out of the debt crisis and the US economy flounders too, downsizing of employees that is still a trickle currently, could tighten its grip on India too resulting in big layoffs.

"The global economic slowdown is real and it will impact all macroeconomic indicators including job creation," says Uday Sodhi, CEO, Headhonchos.com, an online job service for senior professionals.

Cautions Sodhi, "In India we will see slower job creation -- not a freeze on overall hiring."

This slow job creation Sodhi speaks about is likely to engulf sectors like information technology, manufacturing sector including auto, construction and engineering, the retail side of financial services companies, retail and fast moving consumer goods companies (there is some divergence of views amongst these experts on sectors that will be affected because of the slowdown).

Sectors like pharmaceuticals, health, banking, education and infrastructure are likely to offer some resilience to the Indian economy in the New Year is these experts's belief.

Giving a broader perspective, Rajesh A R, head, iRize, Manipal Education's Employment Services Division, offers the view, "The hiring squeeze is sharper in metros than in tier one and tier two cities."

He sees retail and FMCG companies hiring sales and customer support staff in tier one and tier two cities. His logic: Huge spending power and hence demand is coming into the system from these areas through the National Rural Employment Guarantee Act, that guarantees jobs for at least 100 days in a year to rural folks. "These cities," asserts Rajesh, "are not much affected by global issues."

Please ...

'There is lot of apprehension right now in the job market'

Image: Used for representational purposes onlyPhotographs: Rediff Archives

Amit Bansal, career counsellor and CEO, PurpleLeap, an organisation that works with colleges to make students employment-ready, further qualifies the distribution of this anticipated job squeeze.

According to Bansal, mid-sized IT companies will clamp down on their hiring plans.

Large IT companies like Wipro, TCS and Infosys, he says, will consolidate because they have long-term contract with their clients.

"There is lot of apprehension right now in the job market," adds Bansal. "What we are witnessing, especially in mid-sized IT companies, is that they are going extremely slow with their hiring process."

Interestingly, says Bansal, 70 to 75 per cent of hiring in these companies happens at the fresher's level. "And that is where the job squeeze could likely happen in case the economic indicators become gloomier."

The numbers here would, perhaps, put things into perspective in relation to the predicted job squeeze:

This year (in calendar year 2011) mid-sized IT companies hired about 100,000 freshers, says Bansal.

But if the slowdown becomes more evident, in 2012 the figure could drop by 30 per cent (70,000).

What further signals that the job squeeze is pretty much happening, but is still latent, is the fact that in normal times, by the end of every calendar year, the mid-sized IT companies hire half of their total requirement for the succeeding year.

"But the actual hiring for next year (calendar year 2012) around this time (in December 2011) is below normal at 15 to 20 per cent of their total requirement," says Bansal, sounding a note of caution.

While most sectors face the brunt of a sluggish global economic activity and the European debt crisis, the first major casualty happens to be the stock market, the mutual fund industry and financial intermediaries in India because of the apparent linkages between the Indian equity markets and global stock markets.

The sizing down of some of its businesses and employee strength by HSBC and more recently by Barclays is just a case in point.

"It could happen because the Indian economy is no more insulated," emphasises Hemendra Kothari, chairman, DSP BlackRock Investment Managers that has operations in mutual funds, fixed income securities and distribution of various financial products.

Like others, Kothari is keenly watching Europe and the outcome of the financial turmoil nations on that continent find themselves in.

"It all depends how the Euro Zone debt crisis pans out," he says, asked if the job squeeze could fast turn into big layoffs.

Please ...

'As of now it is sort of touch and go'

Image: Used for representational purposes onlyPhotographs: Rediff Archives

Reflecting on the general slowdown in the hiring of freshers, Hemendra Kothari says DSP BlackRock do not have plans to ramp up operations or hire manpower.

He adds that DSP BlackRock hires people based on their needs. "Right now, we have enough people and capacities to take care of what we are doing," he says.

This, interestingly, seems to have become the current trend in the Indian job market: Hire manpower based on you need -- a far cry from the heydays when most of the sectors led by the IT bellwethers would hire far more than their capacity in anticipation of big contracts to cater to bulging economic growth.

Without naming any IT company, iRize's Rajesh says that most of these top rung companies are not going for unbridled hiring (as one saw earlier this year), but go for staggered joining.

"While they may give offer letters now," Rajesh says of these IT companies, "the joining date will be sometime in the June or September quarter (next year)."

Nevertheless, in these hard times on the jobs front, some interesting hiring trends worth mentioning have emerged too.

One is obviously the attraction of stable companies for quality talent.

"Organisations from steady-growth sectors see the softening of the market as an opportunity to source high quality talent and stay invested in hiring," observes Headhonchos.com's Sodhi.

iRize's Rajesh points out another interesting trend. According to him while hiring of freshers is likely to drop by 10 to 15 per cent next year compared to this year (Bansal feels the drop could be 30 percent in this segment), the current slowdown is leading to a squeeze in lateral hiring of managers with three to seven years of experience.

"This is where the companies have literally put a hiring freeze," he adds with emphasis.

While these experts may differ on the extent of the slowdown and the creation of jobs in sectors under attack they believe India's future is linked to what happens globally. The unanimous opinion is if the West swims, we survive. If they sink, so will we.

"If it (the revival of Euro Zone economies) fails, we do see the trouble spreading to Indian shores," says DSP BlackRock's Kothari, when asked how India will fare in the new year on the economic and job front.

Bansal of PurpleLeap feels the fact that the IT companies are not saying they will not hire for the next year, but deferring their hiring plans, reflects a jobs squeeze.

"As of now," he says, it is sort of touch and go."

Comment

article