'Investing in a factor-based fund can be beneficial provided you have chosen the right factor.'

Many mutual fund houses have launched factor-based funds, also known as smart-beta funds, over the past couple of years.

The recent new fund offer of UTI Nifty 500 Momentum 30 Index Fund belongs to this category.

Various factors based on which funds are available include value, alpha, quality, growth, momentum, and volatility.

While many of these funds are based on a single factor, others combine two or more factors.

"Factor investing involves looking at the underlying persistent drivers of returns. Each factor tends to perform in a particular market environment. Investing in a factor-based fund can be beneficial provided you have chosen the right factor," says Ravi Kumar TV, founder, Gaining Ground Investment Services.

Single-factor funds perform in phases

Each of the factors listed above does well in a particular phase of the market.

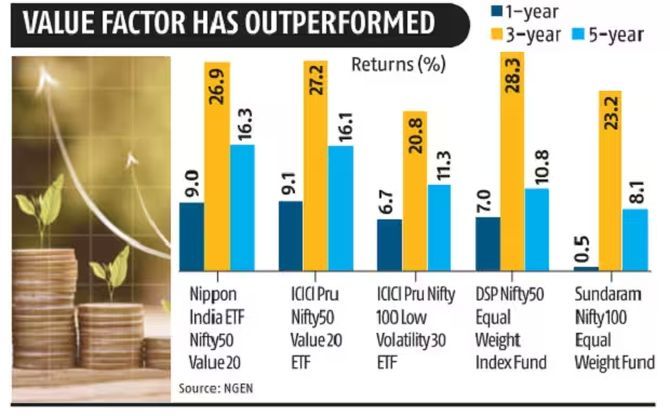

For example, quality-focused stocks did well in 2018-2019 while value stocks started doing well after 2020.

High momentum stocks tend to do well when stocks are in a secular bull run.

However, the investor must bear in mind that there will be periods when these single-factor-based funds will underperform a market-cap based index.

A single-factor fund can yield good performance over the long-term, provided the investor is prepared to stomach periods of intermittent underperformance.

Multi-factor funds are less volatile

Multi-factor funds invest in more than one factor.

These funds have a more diversified portfolio, provide better risk-adjusted return, and reduce the impact of a single factor underperforming.

"If an investor is seeking a more diversified portfolio and is willing to pay a higher expense ratio, a multi-factor fund may be more suitable," says Bharat Phatak, director, Scripbox.

"A multi-factor approach allows you to diversify across investment styles and reduces downside risk. A multi-factor fund should be the preferred option if one wants lesser volatility over the long term. One can select funds having two-three factors," says Ravi Kumar.

Beware of risks

Factor-based funds, especially those based on a single factor, are riskier than diversified funds.

"Factor-based funds carry higher concentration risk as they are narrowly focused on a specific factor, which may not perform well in certain market conditions, leading to periods of underperformance," says Phatak.

Should you invest?

Investors looking for alpha over and above the returns generated by market cap-based index funds may consider investing in a single or a multi-factor based fund via the systematic investment plan route, provided they have a long investment horizon.

While market cap-based index funds should be kept in the core portfolio, factor-based index funds may be made part of the satellite allocation.

Make a limited allocation to these funds initially.

"Limit exposure to factor-based funds to 10-15 per cent of your portfolio. This will make your portfolio more diversified, allow you to benefit from any potential upside, while limiting the potential downside risk. The exact exposure to these funds can vary depending on one's circumstances and investment goals," says Phatak.

Ravi Kumar suggests a higher limit. "Around 20 per cent of the portfolio can be in factor-based funds, depending on the investor's risk profile and investment horizon," he says.

When to exit?

If a factor-based fund begins to underperform, is that a signal for you to exit? "All factors experience occasional periods of underperformance.

If a fund's underperformance is in line with the performance of other funds that implement different variants of the same factor, it is most probably happening due to certain temporary market conditions affecting the entire factor.

In such circumstances, it would be wise to remain invested in the strategy.

However, if the fund is underperforming compared to other funds implementing the same factor, that is a cause for concern.

It may indicate that there is an issue with the fund's execution of the factor.

It may be prudent to exit from the fund," says Arun Kumar, vice president and head of research, FundsIndia.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

© 2025

© 2025