Do you have health insurance or financial planning queries?

Please ask your questions HERE and rediffGURU Jinal Mehta, founder of Beyond Learning Finance, an authorised education provider for the CFP certification programme in India and a certified financial planner, will answer them.

Anonymous: Hi I purchased a flat, by a bank loan, for my elderly mother many years ago. The flat is jointly in my name and her name. I am a nominee on the flat. The understanding was that she was meant to will her share of the flat to me.

But given the difficulties in our relationship recently, I have no way of knowing if she has done so and maybe she has willed it to my sisters.

In order to ensure that the flat eventually comes to me is having my name as nominee good enough, or do I need to pay stamp duty and transfer it entirely to my name.

Most advice given to me suggests transferring the flat soon in order to avoid legal battles later.

If your name is mentioned in the agreement, then you don't have to worry. A will does supersede a nomination, but then she will be able to give away only her share (if shares are mentioned). There is no stamp duty that needs to be paid.

After your mother's death, just apply for the process of mutation. I think the fee for the same is Rs 1000.

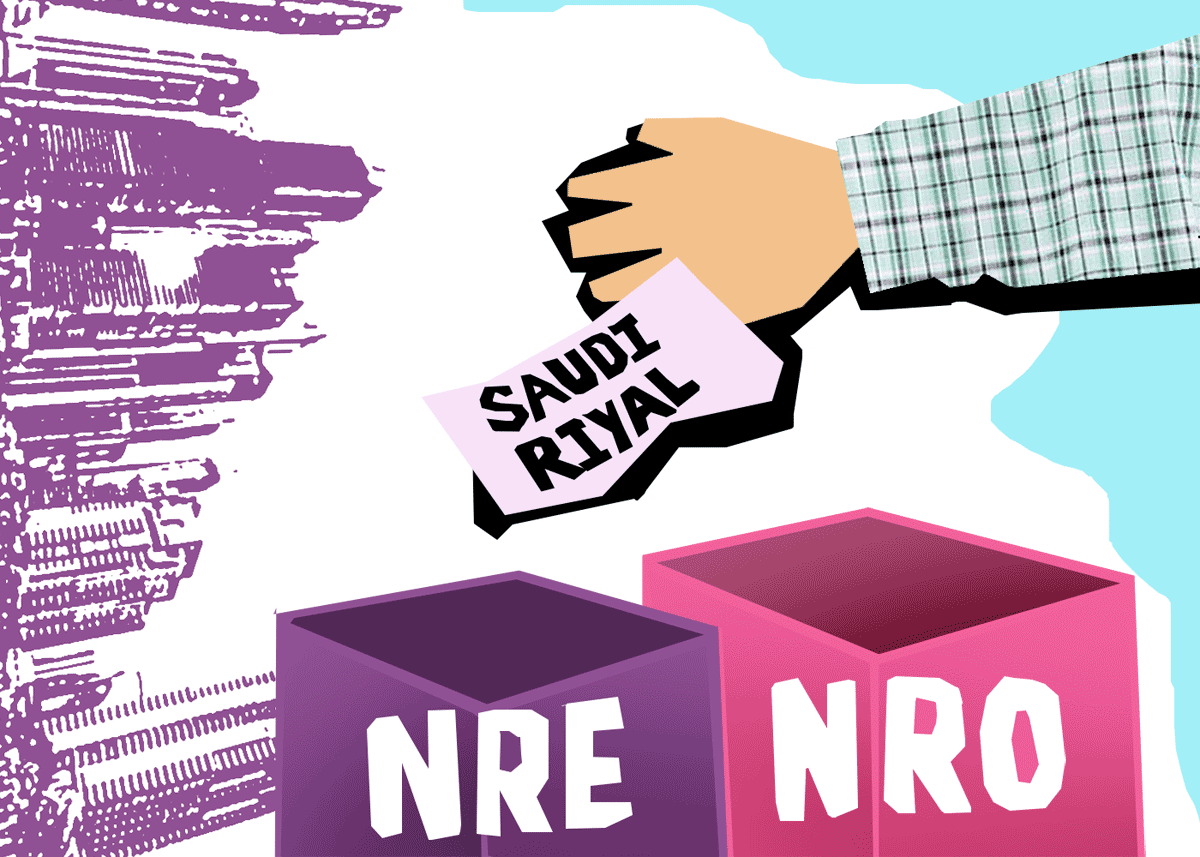

Sathish: sir, I am resident of India and currently working at Riyadh, KSA. I have invested in Dubai real estate sector and will be receiving returns starting from Dec 2024. I have salary account at Riyadh and NRE/NRO account back in India.

In which account should I park those returns? Pls advice

NRE account. As that balance is repatriable.

Anonymous: Hello Sir, I am 33 yr old, now from this month will have 1.25 lakh in hand, living in metro city. I am currently paying 20 k rent but soon will buy home whose EMI will be Rs 48 k.

I have 2 yr daughter, last yr started SSY with 2 k/month, and 6 kSIP started recently.

I had to pay previously my education and then some marriage loans so not accumulated much savings.

Kindly guide me how I can manage my funds, also soon my daughter's education will start.

So where should I spend. My monthly fix expenditure are around 50k, and currently through LIC+SIP+bhishi and other 25 k is fix outgo. So 75k is my fix outgo right now.

Kindly guide how I can secure my future with retirement planning and my child education.

Firstly pay off your existing loans. We suggest you should not commit to any additional investments options. If you to invest, just do a lump sum investment on a quarterly basis with whatever excess amount you have saved.

Anonymous: I am 51 and only earning member, my wife is housewife, my daughter is in 4th and son in 12th grade. As of now I have 1.10 cr in PF, 2 flats worth 1.5 cr, self-invested stock currently valued at 1.5 cr, and another stock managed by portfolio manager worth 1.1 cr.

I started MF SIP starting March 2024 of 50K/month. Only liability is of the first flat I bought which is now 5K/month, my expenses are around 1.2L per month major of it is Rent + children education + 25K/month of car loan started in Dec 24 for 5 years.

I have invested 1.5L/year on SSY when my daughter was 1 years old. Monthly in hand I get is 2.75L.

I keep 2L in Bank as emergency fund. Insurance of self and family is tied to my company, outside of which I have not taken any insurance.

I plan to meet my financial networth of 10-15 cr and then use most of the liquid corpus towards MF and go for SWP to cover an expense of 2L per month after I leave my job.

In next 5 years, is it realistic, or is there a way to get more in the next 5 years?And if I have the financial freedom once I meet my target, can I opt for Insurance once I leave the company.

Since your children are younger, it is not suggested that you leave the job unless you have a back-up. Company provided health insurance is often insufficient to meet the needs, especially now since health care expenses are increasing. So we suggest you take some additional term insurance to protect your family.

Anonymous: Hi experts, I am 41 years old and I have 2 cr. What would be the best way to invest it to get a steady income? Due to health issues, I cannot work anymore. Or keeping it in fixed deposit would be a good choice?

You can divide the amount into 2-3 buckets to manage your cash flow. A combination of FD and SWP should be decent. You may have tax incidences in both the scenarios.

- You can ask rediffGURU Jinal Mehta your questions HERE.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this QnA or an attempt to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

© 2025

© 2025