You can reduce your tax burden by wisely using partially taxable allowances, suggests Bindisha Sarang.

Illustration: Dominic Xavier/Rediff.com

Most salary structures have an allowance element, be it leave travel allowance or others.

But all of them do not get tax benefits.

As Archit Gupta, founder, and chief executive officer, Cleartax.in, says, "Allowances are monetary benefits given in addition to the basic salary. Some of the allowances are specifically granted to meet specific expenditures."

These allowances are part of the salary package, and included in the overall CTC, or cost to the company.

According to the Income Tax Act, since some of these are added to the salary, they are taxed under the head 'Income from Salaries'.

Allowance is a fixed monetary amount.

But it shouldn't be confused with reimbursement.

Employees are entitled to several reimbursements like medical treatments, phone bills, newspaper bills, and the like.

But it may not necessarily be part of the salary.

Allowances, on the other hand, are part of the salary.

There are three types of allowances based on taxation: The first is taxable allowances.

These are dearness allowance, compensatory city allowance, overtime allowance, and so on.

The second type or tax-exempt ones include allowances paid by the government to its employee rendering service outside of India and other specified allowances for specified categories of employees.

The third type is partially taxable.

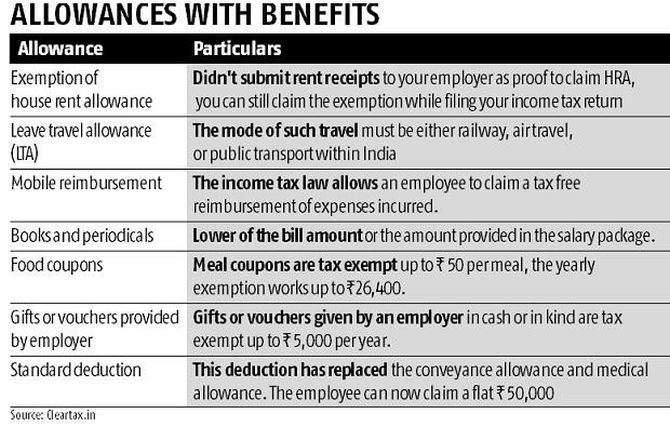

"These allowances include ones which can be claimed tax-exempt on the production of invoices or receipts. However, there are limits placed on the amount of tax exemption an employee can claim, for instance, the house rent allowance or leave travel allowance," says Anuj Shah, a Mumbai-based certified financial planner.

You can reduce your tax burden by making the most by wisely using the partially taxable allowances.

Three important ones are.

LTA

To reduce your tax burden, don't forget to claim your travel allowance.

Gupta says, "Travel allowance refers to LTA given by an employer to an employee. The allowance is provided as a component of salary. LTA is allowed in respect of the cost of travel incurred by an employee for themselves and their family on vacation within India. The exemption can be claimed for only two journeys in a block of four years. The block applicable for the current period is the calendar year 2018-2021."

The LTA salary component can be claimed by submitting travel bills such as air tickets, train tickets, bus, or any other recognised public transport system.

So next time you go on a family vacation, make sure you claim this allowance.

HRA

This is the component of your salary that helps take care of rent paid by you for the rental house you live in.

You can claim this only if you get HRA as part of your salary.

You can claim the HRA amount as tax-exempt, provided you meet a few conditions.

For instance, the lowest of the following amounts will be tax-exempt:

- Actual HRA received

- The rent paid in excess of 10 per cent of salary plus dearness allowance or DA

- 50% of salary plus dearness allowance, in case the house is located in metro cities like Mumbai, Kolkata, Delhi, or Chennai and 40% of salary plus dearness allowance, in case the home is situated in non-metro cities

Car maintenance allowance

Reimbursement of car expenses, if used partly for official and partly for personal purposes can be exempt up to specified limits depending on whether the car is owned by the employer or by the employee.

Shah says, "There is enough scope for you to take advantage of allowances officially and reduce tax burdens. If you are not able to make the most, then you should ask for restructuring on your salary in such a way that your tax burden decreases."

© 2025

© 2025