Do you have personal finance queries?

Please ask your questions HERE and rediffGURU Ramalingam Kalirajan, founder, Holistic Investments (external link), will answer your queries.

Veera: Hi sir, my name is babu, my age is 33 years. Please review my mutual fund portfolio and i am keeping mf portfolio for 15 years for retirement corpus.

Lump sum: 1.quant flexi cap fund-1 lakh 2.parag parikh flexi cap fund- 1.2 lakh 3.icici prudential equity and debt fund-50 k 4.quant large and midcap fund-1lakh 5.icici prudential blue chip- 1 lakh 6.edelweiss mid cap fund-1 lakh 7.icici prudential nifty next 50 index- 1lakh Sip: 1.motilal oswal nifty midcap 150 index-4500 2.Quant active fund-3500 3.HDFC S&P BSE 500 INDEX-2000 4.parag parikh flexi cap-2500 5.icici prudential blue chip-2000 6.Quant flexi cap fund--1500 7.icici prudential nifty 50 index-3000 As i am keeping mf's for my future goals, i want to take minimal risk. Please review my portfolio and suggest.

Reviewing Your Mutual Fund Portfolio for Long-Term Retirement Goals

Understanding Your Financial Goals

Babu, it's commendable that you are planning for your retirement early. Investing with a 15-year horizon allows you to benefit from market growth and compounding. Your diversified portfolio shows good intent to balance growth and risk.

Evaluating Your Lump sum Investments:

1. Flexi Cap Funds

You have invested in flexi cap funds, which invest across market capitalisations. These funds offer flexibility and can perform well in varying market conditions. This allocation supports long-term growth.

2. Equity and Debt Fund

A balanced fund like an equity and debt fund can provide stability. It invests in both equities for growth and debt instruments for safety. This diversification reduces overall portfolio risk.

3. Large and Mid-Cap Funds

Your investment in large and mid cap funds targets stability and growth. Large caps provide stability due to established companies. Mid caps offer higher growth potential, albeit with more risk.

4. Blue Chip Funds

Blue chip funds invest in well-established companies with a strong track record. These funds are relatively stable and provide steady returns. This choice aligns with your goal of taking minimal risk.

5. Mid Cap Funds

Mid cap funds invest in medium-sized companies with high growth potential. These funds can be volatile but can offer significant returns over the long term. This investment adds a growth element to your portfolio.

Analysing Your SIP Investments:

1. Index Funds

You have invested in various index funds. Index funds track market indices and offer average market returns. They are cost-effective but do not aim to outperform the market. Actively managed funds, however, aim for higher returns through strategic investment decisions.

2. Actively Managed Funds

Your portfolio includes actively managed funds. These funds are managed by professional fund managers who aim to outperform market indices. Actively managed funds can adapt to market changes and potentially provide better returns than index funds.

Assessing Portfolio Balance

Your portfolio shows a mix of equity and balanced funds. This blend can provide growth while managing risk. However, the proportion of index funds suggests a need for a higher focus on active management for better returns.

Benefits of Actively Managed Funds

Actively managed funds are overseen by experienced fund managers. They make strategic investment decisions based on market analysis. These funds aim to outperform the market, offering the potential for higher returns compared to index funds.

Drawbacks of Index Funds

Index funds simply track market indices, providing average returns. They lack the potential to outperform the market. Actively managed funds, on the other hand, leverage the expertise of fund managers to achieve better performance.

Advantages of Regular Funds

Investing in regular funds through a Certified Financial Planner (CFP) ensures professional guidance. CFPs help tailor investments to your financial goals and risk tolerance. This professional advice can enhance your investment strategy.

Importance of Periodic Review

Regularly reviewing your investment portfolio is crucial. Market conditions and personal circumstances change over time. Periodic reviews ensure your investments remain aligned with your goals and risk tolerance.

Diversification and Risk Management

Your portfolio is well-diversified across different fund categories. Diversification helps in spreading risk and optimising returns. However, focusing more on actively managed funds can further enhance potential returns.

SIPs and Rupee Cost Averaging

Systematic Investment Plans (SIPs) offer the benefit of rupee cost averaging. Investing regularly helps mitigate the impact of market volatility. SIPs promote disciplined investing and can build substantial wealth over time.

Emergency Fund Consideration

Before investing, ensure you have an adequate emergency fund. This fund should cover at least six months of living expenses. It provides financial security and prevents the need to liquidate investments prematurely.

Tax Implications

Understanding tax implications is important for maximising returns. Some funds offer tax benefits which can enhance post-tax returns. Consulting a tax expert or CFP can help optimise your investment strategy.

Conclusion

Babu, your mutual fund portfolio is diverse and shows a good understanding of long-term investment principles. A higher focus on actively managed funds and regular portfolio reviews can help achieve your retirement goals effectively. Consulting a Certified Financial Planner for tailored advice will ensure your investments remain aligned with your objectives.

Jasha: Me 48 year ka hu aur sbi contra me 15000 aur sbi magnum tax gain me 5000 aur sbi small cap me 5000 aur sbi energy me 5000 ka sip chalu he 20 se 25 sal kya ye sahi he

Investing in Mutual Funds for Long-Term Goals: A Comprehensive Analysis

1. Assessing Your Current Investment Strategy

You have chosen a diverse range of mutual funds, which is commendable. Diversification is essential for risk management and potential growth. However, evaluating each fund's role in your portfolio is crucial.

2. Understanding Your Investment Horizon

A 20 to 25-year investment horizon is excellent. It allows your investments to grow and recover from market volatility. Long-term investments benefit from the power of compounding, which is advantageous for wealth accumulation.

3. Evaluating Each Fund Category

a. Contra Funds

Contra funds invest in undervalued stocks, expecting them to perform well over time. These funds require patience and a long-term perspective. Your decision to allocate Rs 15,000 to a contra fund aligns well with your horizon. These funds can offer substantial returns if market predictions hold true.

b. Tax-Saving Funds

Investing Rs 5,000 in a tax-saving fund like an ELSS (Equity Linked Savings Scheme) is wise. These funds provide tax benefits under Section 80C of the Income Tax Act. Besides tax savings, ELSS funds offer potential for significant returns due to their equity exposure.

c. Small Cap Funds

Allocating Rs 5,000 to small cap funds shows a willingness to take on higher risk for higher returns. Small cap funds invest in smaller companies with high growth potential. These funds can be volatile but can offer substantial long-term gains. Considering your long-term horizon, this allocation can be beneficial.

d. Sectoral Funds

Investing Rs 5,000 in an energy sector fund demonstrates your interest in sector-specific growth. Sectoral funds can provide high returns but come with higher risks due to their concentrated investments. These funds depend heavily on the performance of the specific sector.

e. Balancing Risk and Return

Your portfolio shows a mix of high-risk, high-reward funds. This balance is suitable for long-term goals. However, it's essential to periodically review and adjust your allocations based on market conditions and personal circumstances.

Benefits of Actively Managed Funds

Active funds are managed by professional fund managers who make investment decisions based on research and market analysis. They aim to outperform the benchmark index. This active management can potentially offer better returns compared to passive funds, especially in a volatile market.

Disadvantages of Index Funds

Index funds track a specific market index and do not attempt to outperform it. They tend to offer average returns, which might not be sufficient for high growth objectives. In an actively managed fund, you benefit from the fund manager's expertise and potential to achieve higher returns.

Benefits of Regular Funds

Investing through a Certified Financial Planner (CFP) ensures you receive expert advice tailored to your financial goals. Regular funds, as opposed to direct funds, come with the advantage of professional guidance and strategic planning. This can be particularly beneficial for achieving long-term financial objectives.

Importance of Periodic Review

Regularly reviewing your investment portfolio is crucial. Market conditions and personal financial goals can change. A periodic review helps in realigning your investments to ensure they remain on track to meet your objectives.

Considerations for Future Adjustments

As you approach your financial goals, gradually shifting to less volatile funds can help protect your accumulated wealth. This strategy ensures that market fluctuations have minimal impact on your investment value as you near your goal.

Conclusion

Your current SIP strategy shows a well-thought-out approach to long-term investing. The mix of funds chosen reflects a good balance between growth potential and risk management. Periodic reviews and adjustments, along with professional guidance, will help in achieving your financial goals effectively.

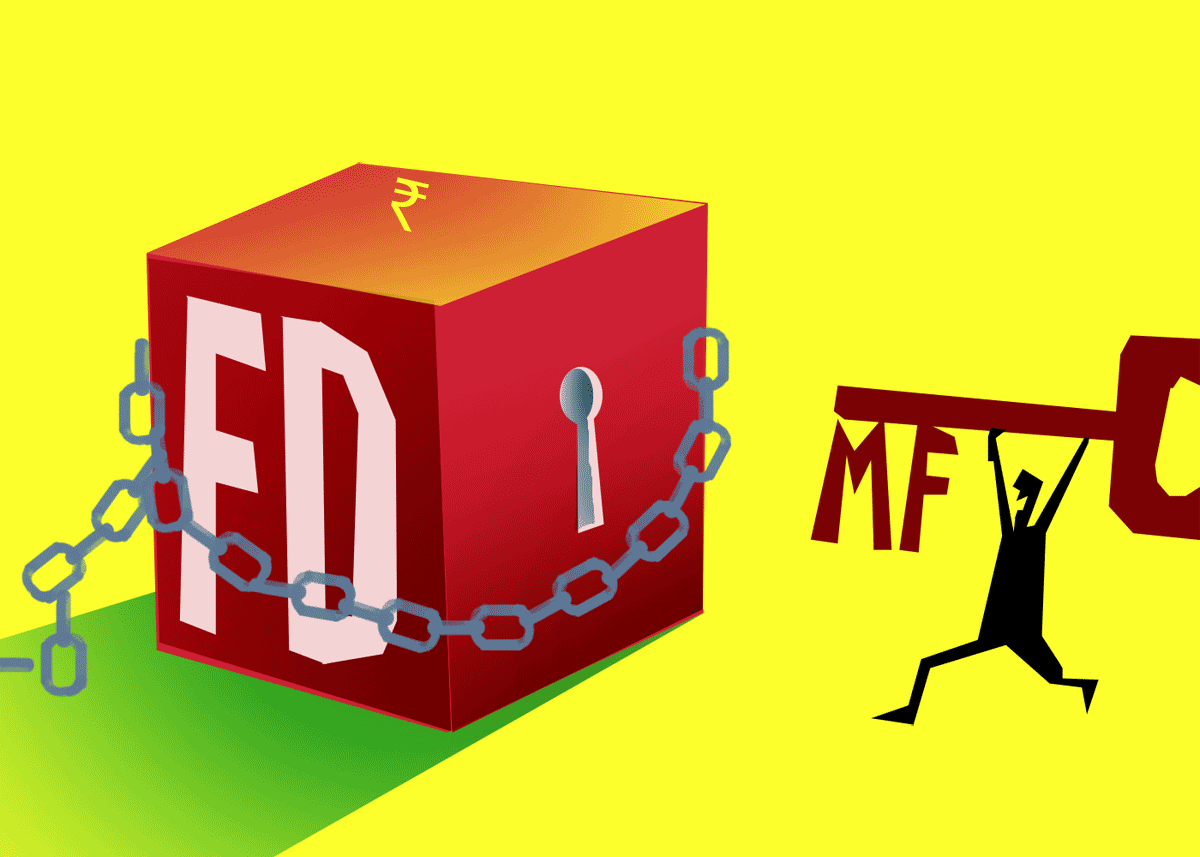

Anonymous: Hi Sir, I have deposited Rs 20 lakh in Fixed deposit. How can I invest in mutual fund lump sum amount for better returns?

Effective Strategies for Investing a Lump Sum in Mutual Funds

Investing a lump sum like Rs 20 lakh into mutual funds can provide better returns compared to fixed deposits. However, managing risk and ensuring steady growth requires a strategic approach. One effective method is using a Systematic Transfer Plan (STP).

- Understanding Systematic Transfer Plan (STP)

- What is an STP?

- Gradual Investment

An STP allows you to transfer a fixed amount from a debt fund to an equity fund periodically. This method reduces market timing risks and averages out the cost of investment.

Benefits of STP

1. Risk Management

STPs help manage market volatility by spreading investments over time, reducing the impact of market fluctuations.

2. Regular Investments

They ensure disciplined investing, taking advantage of market corrections and benefiting from rupee cost averaging.

Step-by-Step Guide to Using STP

Step 1: Choose a Debt Fund

Safe Parking

Start by investing your lump sum in a debt fund. Debt funds are less volatile and provide regular income, making them a safe place to park your money initially.

Step 2: Select an Equity Fund

Growth Potential

Choose an equity fund based on your risk tolerance and financial goals. Equity funds offer higher returns over the long term but come with higher risk.

Step 3: Determine the Transfer Amount

Consistency

Decide the amount to transfer from the debt fund to the equity fund periodically. Common intervals are monthly or quarterly, depending on your preference.

Step 4: Set Up the STP

Automated Transfers

Set up the STP with your mutual fund provider. Specify the transfer amount and interval, ensuring the process is automated and hassle-free.

Benefits of Using Debt Funds Initially

- Capital Preservation

- Minimise Risk

Starting with a debt fund helps preserve your capital while earning a steady return. It provides a cushion against market volatility during the initial phase of your investment.

Regular Income and Steady Returns

Debt funds offer regular income through interest payments, which can be reinvested or used for other financial needs.

Choosing the Right Equity Funds

- Diversification

- Spread Risk

Select equity funds that offer diversification across sectors and market capitalisations. This strategy spreads risk and enhances growth potential.

- Fund Performance

- Track Record

Evaluate the historical performance of the equity funds. Consistent returns over different market cycles indicate reliable funds.

- Fund Manager Expertise

- Professional Management

Consider funds managed by experienced professionals. Their expertise can significantly impact the fund's performance and your investment returns.

Advantages of Actively Managed Funds

- Professional Management

- Expert Decisions

Actively managed funds benefit from professional fund managers who make informed decisions based on market research and conditions.

- Potential for Higher Returns

- Market Opportunities

Fund managers aim to outperform benchmarks, providing higher returns than passively managed funds like index funds.

Disadvantages of Index Funds

- Limited Growth

- Market Replication

Index funds replicate market indices, limiting growth potential compared to actively managed funds, which can capitalise on market opportunities.

- Lack of Flexibility

- Fixed Portfolio

Index funds have a fixed portfolio and cannot adapt to changing market conditions, unlike actively managed funds.

Disadvantages of Direct Funds

- Lack of Guidance

- Navigating Complexity

Direct funds do not offer the expertise of a certified financial planner, making it challenging for less experienced investors to manage their investments effectively.

Time and Effort

Active Management Required

Direct funds require significant time and effort to manage, unlike regular funds managed by professionals.

Benefits of Regular Funds via MFD with CFP Credential

- Expert Advice

- Personalised Guidance

Investing through a CFP ensures personalised advice tailored to your financial goals, risk profile, and investment horiz on.

- Better Performance

- Professional Oversight

Professionally managed regular funds often perform better due to the expertise of fund managers, providing higher returns and better risk management.

- Holistic Planning

- Comprehensive Approach

A CFP considers all aspects of your financial situation, helping you achieve your goals efficiently and effectively.

- Building a Diversified Portfolio

- Mix of Funds

- Balance and Growth

A balanced portfolio includes a mix of equity, debt, and hybrid funds. This approach manages risk while optimising returns.

- Regular Review

- Performance Monitoring

Regularly review your portfolio to ensure it aligns with your goals. Make necessary adjustments based on performance and changing market conditions.

- Systematic Investment Plan (SIP)

- Disciplined Investing

- Consistency

SIPs promote disciplined investing by allowing you to invest a fixed amount regularly, leveraging the power of compounding over time.

- Flexibility

- Adjustable Investments

SIPs are flexible, enabling you to increase or decrease your investment amounts based on your financial situation and goals.

Suggested Mutual Funds for Diversified Investment

Here are some categories of mutual funds to consider for a diversified investment portfolio:

- Large-Cap Fund: Stability and steady growth from well-established companies.

- Mid-Cap Fund: Potential for higher returns with moderate risk.

- Small-Cap Fund: High growth potential with higher risk.

- Aggressive Hybrid Fund: Balanced growth with a focus on equities.

- Conservative Hybrid Fund: Stability with a focus on debt instruments.

- Short-Term Debt Fund: Lower risk for short-term investments.

- Long-Term Debt Fund: Better returns for long-term investments.

- Multi-Cap Fund: Diversified across large, mid, and small-cap stocks.

- Sectoral/Thematic Fund: Focus on specific sectors for higher returns.

- International Fund: Exposure to global markets for additional diversification.

Conclusion

Investing Rs 20 lakh in mutual funds through an STP can provide better returns while managing risk. Start by parking your funds in a debt fund and gradually transferring to equity funds. This approach ensures disciplined investing and takes advantage of market opportunities.

Consult with a certified financial planner to receive personalised advice and build a diversified portfolio tailored to your financial goals. Regularly review your investments to stay on track and achieve optimal returns.

- You can ask rediffGURU Ramalingam Kalirajan your questions HERE.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this QnA or an attempt to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

© 2025

© 2025