'Opt for this facility only after doing a cost-benefit analysis: Will the savings in interest cost by parking your surpluses in the home loan overdraft account outweigh the higher interest cost of this loan?'

Sarbajeet K Sen finds out more.

When you seek a loan to finance the purchase of your new home, the lender may offer you a home loan overdraft facility to go along with it.

Weigh the pros and cons of this instrument before you decide to opt for it.

In this facility, the borrower's home loan account gets linked to his current or savings account.

S/he is allowed to deposit his surplus funds into this linked account.

If the amount deposited is higher than the equated monthly instalment (EMI), the surplus is treated as pre-payment of the home loan and goes towards reducing the outstanding principal.

This, in turn, reduces the total interest outgo and even the tenor of the loan.

This facility also offers flexibility by allowing the borrower to withdraw the deposited amount anytime he wants.

The withdrawal facility acts as a cushion in case of financial emergencies.

"Paying the extra amount for a home loan out of savings can result in a shortage of cash. So, in case of need, you can simply withdraw the surplus amount from the linked account. When you do so, the outstanding principal gets restored to the normal level, and normal interest cost is levied thereafter," says Deo Shankar Tripathi, managing director and chief executive officer, Aadhar Housing Finance.

Borrowers should also be aware of the downsides of this product.

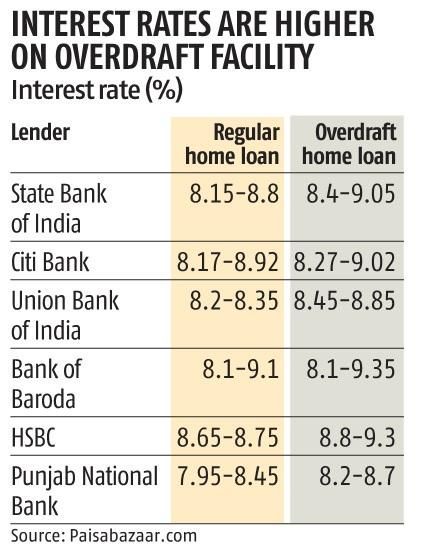

The interest rate on it is usually 20 to 50 basis points higher than on a regular home loan.

"Opt for this facility only after doing a cost-benefit analysis: Will the savings in interest cost by parking your surpluses in the home loan overdraft account outweigh the higher interest cost of this loan?" says Ratan Chaudhary, head of home loans, Paisabazaar.com.

A tax deduction is available under Section 80C of the Income Tax Act on repayment of home loan principal to the extent of Rs 1.5 lakh each year.

However, any surplus that the borrower deposits to the linked account is not treated as principal repayment, and s/he does not get a tax deduction on it.

Savvy investors can, instead of depositing their surplus savings into the linked account, invest in financial instruments that earn a higher rate of return.

"If you can earn a higher return by investing your surpluses in other assets, then using them for home loan repayment would be counter-productive," says Tripathi.

The home loan overdraft facility works best for the self-employed and businessmen who have fluctuating cash flows.

Salaried individuals who get high bonuses or incentives in lump sum can also take advantage of it.

"Opt for home loan overdraft facility only if you have surplus funds available with you often. Otherwise, given the higher interest rates of these loans vis-a-vis regular home loans, you will end up incurring a higher interest cost on this facility," says Chaudhary.

Take into account your long-term financial plan and savings potential before opting for this facility.

"High repayments on the home loan could affect your regular savings, which may not be financially prudent. "Repaying over a longer period will also help you save for the future," says Tripathi.

"Only those who have sufficient savings for the future should repay their home loan within a short period," adds Tripathi.

© 2025

© 2025