If you invest for the shorter-term now, you will be able to roll over to higher rates when the interest rate cycle turns, advises Sarbajeet K Sen.

While it is difficult to predict the trajectory of stock prices, equity funds or gold, one thing is certain: Interest rates will remain low in the near future.

The repo rate has declined from 6.25 per cent in February 2019 to 4 per cent (since May).

Returns offered by liquid funds and other short-term investments have fallen in tandem.

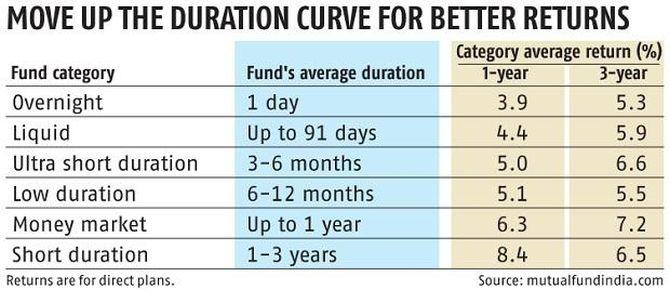

Liquid funds have given average returns of 4.4 per cent over the past year.

Traditionally, conservative investors have parked their short-term money in fixed deposits (FDs).

The savvier ones have used liquid and overnight funds.

With the returns from these funds declining below the consumer price index (CPI)-based inflation rate, and the real rate of returns turning negative, investors may be tempted to invest in equity funds and gold.

However, these asset classes can be volatile and should be avoided for the short term.

Do not avoid the traditional fixed-income options altogether.

Conservative investors in the lower income tax brackets should hunt for the better-yielding options among FDs.

"Investors with low risk appetite should look for options among small finance banks and smaller private-sector banks, which usually offer higher rates than those offered by the major public and private sector banks," says Sahil Arora, director, Paisabazaar.com.

He suggests that investors should opt for FDs of shorter tenures -- of one-two years -- at present.

By not locking themselves for the long-term at the current low rates, he says, investors will be able to re-invest at higher rates when the interest-rate cycle turns.

Those who can tolerate some volatility and are willing to accept market-determined returns may invest in ultra-short-term bond funds of large fund houses.

These funds invest in securities maturing in three to six months.

Low-duration funds and money-market funds could be considered by those willing to stick for a year.

Instead of going by past returns, look at the portfolio's yield to maturity (YTM) to get an idea of the returns you can expect.

"Those with slightly higher risk appetite may consider ultra-short duration funds for 3-12 months. Those with investment horizons of one-three years may consider short-duration bond funds. Ultra-short, low and short-duration funds usually generate higher returns than bank FDs," says Arora.

To enjoy the superior long-term capital gains tax treatment, an investor needs to stay invested in a debt fund for at least three years.

If she invests for less than three years, capital gains will be treated as short-term and will be taxed at her slab rate.

Arbitrage funds should only be considered by those who have a horizon of at least one year.

"The market could be volatile for the next few quarters due to factors like the US elections, Indo-China border tensions, and another possible lockdown. Arbitrage funds can provide safety and good tax-adjusted returns if investors stay invested for more than one year," says S Sridharan, Sebi-registered investment advisor and founder of Wealth Ladder Direct.

Feature Presentation: Aslam Hunani/Rediff.com

© 2025

© 2025