Here's why equity-linked saving scheme is the best among section 80C tax-saving instrument for taxpayers

Options are numerous when it comes to tax saving. Merely knowing of all the options is not enough. Investment in haphazard manner may not extract the best benefit out of the available options. One should evaluate and then invest in any scheme which will fetch them maximum returns.

Saving of tax through investment options which are available for individuals under section 80C must be reviewed. Investments should have fixed return. While evaluating the options, target should not be mere saving of tax. Focus must be diverted to growth of money along with tax saving.

One such option is discussed here:

Equity linked saving schemes (ELSS) is among the options that are eligible for tax benefits under Section 80C. ELSS, a close-ended equity scheme, invests 65 per cent in equity related instruments and are notified to avail tax benefits. It allows investors to avail tax exemption up to Rs 1.5 lakh.

Rs 1.5 lakh deduction from taxable income under section 80C must be fully utilised. If you are in the 30 per cent tax bracket, you can save up to Rs 46,350 in taxes.

The returns from ELSS depend on the stock market and hence tend to be volatile. But they are generally higher than the returns generated from traditional tax saving instruments.

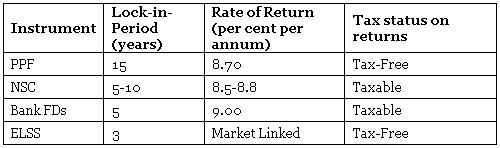

ELSS has a three-year lock-in period which is very less than any other investment option like PPF, NSC etc. Generally, when investors invest in other options, they withdraw the money whenever they get good return. Unlike this, ELSS has very short lock-in period which will debar investor from premature withdrawal. This ultimately will help your money to grow considering the market fluctuations.

Apart from ELSS, it is to be noted that none of the returns from tax-saving investment options other than PPF are tax free. However, interest in Public Provident Fund is tax free, but that comes with a 15 year lock-in period (apart from certain exemptions to withdraw in between).

Since ELSS mutual funds invest in equity related instruments, these are classified under equity funds. Any returns received from equity funds after one year is tax free, hence ELSS funds which comes with a 3 year lock-in period, dividends/returns/capital gains from such funds are also tax free.

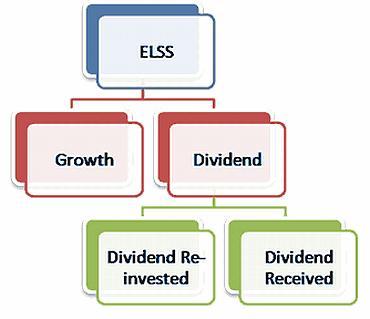

The schemes offer both growth and dividend option. Dividend option further offers dividend payout and dividend reinvestment option. However, when investors wish to redeem all their units, they realise that some of their units are still in lock-in period and cannot be redeemed immediately.

To overcome such issues, best Practices Circular issued by Association of Mutual Funds in India (AMFI) has directed mutual funds to discontinue reinvestment option in ELSS.

Investors seeking income should invest in dividend payout option and those looking for long term wealth creation, should opt for growth option of ELSS.

After knowing the pros and cons of ELSS, the question which hits is how to choose the best ELSS funds to invest. For this, few parameters suggested are:

- Crisil Ranking: Rank 1, Rank 2, Rank 3

- Online rated funds: 5star, 4star, 3star

- Asset Under Management: More than Rs 100 crore

- Past Performance: 3 to 5 years time frame

Thus, from above discussion, we can say that ELSS funds provide the best combination of:

- Long term inflation beating return (14-16 per cent)

- Lowest lock in period (only 3 years) among all 80C investments and

- Zero tax on your income from investment

ELSS: Best among Section 80C tools can be demonstrated from the following table:

So 3-in-1 Mantras of ELSS stands for:

- Invest: Mobilises savings

- Save: Savings in tax

- Earn: Growth in net wealth year over year.

Disclaimer: This article is just for your information and must not be considered as advice to invest by Taxmantra.

Alok Patnia founded Taxmantra.com, an expert in tax advisory & compliance. He is a Chartered Accountant having prior exposure with Ernst & Young and KPMG.