Do you have mutual fund queries?

Please ask your questions here and Nikunj Saraf, vice president, Choice Wealth, will answer them.

Raghav: Hi Nikunj, I’m turning 35 by this year end and investing in SIP's since last 2 years. I had to sell most of the SIP's last year to purchase a vehicle. Now I am investing below.

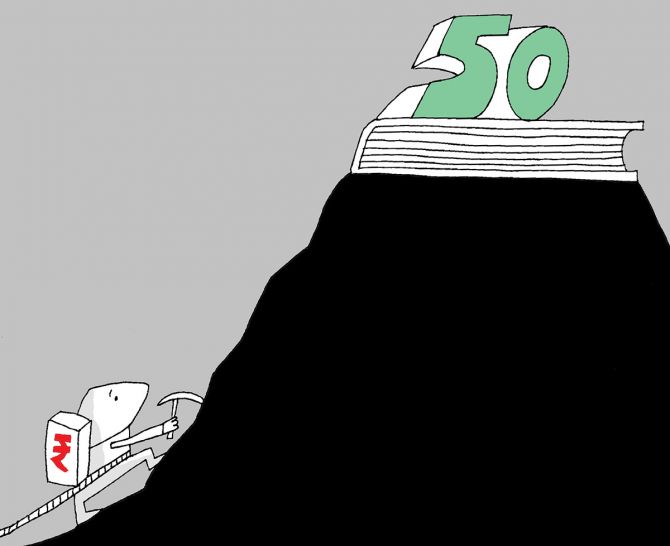

I want to build up minimum Rs 50 lakh for my child's higher education by 2035.W

Quant tax plan- 3000/month (4 months old)

Kotak tax plan-2000/month (4 month old)

Mirae asset tax saver fund- 1000/month (27 month old)

Parag Parikh tax saver fund- 2000/ month (1 month old)

Mirae asset tax saver fund- 1500/month(1month old).

Hello Raghav. Based on your requirements, the selected schemes are well aligned with the market. As your target amount is for over 10 years, I recommend you diversify by category.

Additionally, it is recommended that you increase your SIP to 14k in order to achieve a corpus of Rs 50 lakh. You may consider small-cap, mid-cap, and multi-cap funds for your increased SIP amount.

Vivek: My investments as per month

Parag Parikh flexi cap - 5k

Mirae Asset Tax Saver - 6k

ICICI liquid fund - 5k

SBI gold fund - 2k

Rd - 20k for 2 years

I earn around 80k per month.

Am planning to open sip of 10k in one small or mid cap for at least 3 years.

Please advice should i continue with this or do some changes. My age is 26 years.

Hello Vivek. Considering your age factor and requirement, I would advise you to reconsider ICICI liquid fund and start investing in Large & mid cap for the same AMC.

The rest of your portfolio report sounds good.

Additionally, you can consider midcap fund for your future investment.

Anonymous: Sir, I am a working professional with kids aged 1 and 5 year and want to set aside some amount right now (10-20 lakh) that could be used for their higher education and wedding.

What is best instrument among following where money might multiply fastest by the time of its utility: Equity MF Plots Any other scheme?

Hello Value Investor.

For the children's education and marriage, it is suggested you reconsider equity mutual funds.

Assuming your required goal is for 17 and 13 years. You may consider small-cap, mid-cap, flexi-cap and large-cap fund for your portfolio.

Additionally, you may start SIP with Rs 5k monthly.

Anonymous: Hi Nikunj, I am a 44 year old working professional (IT sector) who wants to build a corpus of 5 crores during retirement.

I am currently investing in the following MFs:

1) Axis Gold Fund- 5000/month

2) Kotak Gold Fund- 5000/month

3) ICICI Prudential Nifty 50 Index Fund- 7,500/month

4) Aditya Birla Sun Life Tax Relief 96 Fund- 1000/month

5) ICICI Prudential Long Term Equity Fund (Tax Saving)- 1000/month

6) Axis Long Term Equity Fund- 1,500/month

7) DSP Tax Saver Fund- 1,500/month

8) DSP Equity & Bond Fund- 6,250/month

9) SBI Equity Hybrid Fund- 6,250/month

10) Canara Robeco Equity Hybrid Fund- 6,250/month

11) Mirae Asset Hybrid Equity Fund- 6,250/month

12) SBI Focused Equity Fund- 7,500/month

13) Axis Small Cap Fund- 7,500/month

14) Aditya Birla Sun Life Corporate Bond Fund- 20,000/month

15) PGIM India Midcap Opportunities Fund- 20,000/month

16) Nippon India (AMC) (Short Term Fund, Gold Savings Fund, Nifty Next 50 Junior BeES FoF, Nifty Midcap 150 Index, Index Fund Nifty 50 Plan)- 10,425

I am not sure if my portfolio is good enough for long term goals or if I am investing in a lot of redundant schemes. I have a moderately medium risk appetite with focus on maximum corpus build. Please give your opinion and suggest if some changes are required. Thanks much in advance.

Hello Value Investor.

I can see over diversification with your current investments with the SIP amount.

I would suggest that you concise your MF investments and reshuffle the portfolio.

Additionally, reconsider Aditya Birla Sun Life Tax Relief 96 Fund, Axis Long Term Equity Fund and SBI Focused Equity Fund for your portfolio.

You can achieve your target till retirement with your current SIP amount.

Debashish: I am investing Rs 2500 every month in SIP of SBI MF like Bluechip, banking and financial, gold fund and SBI equity savings with a target for 20 years. Completed 4 years. Shall I continue?

Hello Debasish.

Your portfolio report sounds good. I can see that 100% of the investments are in SBI AMC. Hence, will suggest AMC-wise bifurcation for future investment.

You can reshuffle the current SIPs or start investing in AMCs like ICICI Pru, Nippon, Parag Parikh, etc. AMC diversification is also required in your portfolio.

- You can ask rediffGURU Nikunj Saraf your mutual fund-related questions HERE.

Choice Wealth Disclaimer: Choice Wealth Private limited, to the best of its ability, considered various factors -- both quantitative measures and qualitative assessments, in an unbiased manner while choosing the fund(s) mentioned above. However, they carry unknown risks and uncertainties linked to broad markets, as well as analysts’ expectations about future events. They should not, therefore, be the sole basis of investment decisions. Investors are requested to review the prospectus carefully and obtain expert professional advice concerning specific legal, tax, and financial implications of the investment/participation in the scheme.

Choice Wealth accepts no liability for any damages or losses, however, caused, in connection with the use of, or on the reliance of its product or related services.

Rediff.com Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this QnA or an attempt to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

© 2025

© 2025