Investors who decide to enter medium to long-duration funds should be cognisant of the risk.

The Reserve Bank of India halted its rate hike cycle in its April monetary policy review, prompting investors to anticipate a downward turn in interest rates.

According to data on interest-rate swaps, it appears that interest rates may begin to decline in the early part of next year.

The International Monetary Fund has also weighed in, stating that the recent surge in real interest rates is likely to be transitory.

"The effect of interest rate hikes will manifest in demand moderation, leading to lower inflation expectations. Inflation readings will come down gradually, validating the RBI's decision to maintain a status quo on the repo rate. In the coming months, bond market yields are likely to be range-bound with a downward bias," says Sandeep Bagla, CEO, TRUST Mutual Fund.

Debt funds to gain

Fixed-income investors with the requisite risk appetite are looking forward to gaining from the possible fall in interest rates.

According to Sandeep Yadav, senior vice-president and head-fixed income, DSP Mutual Fund, "If yields don't fall, investors will get an accrual of around 7.5 per cent per annum. However, if yields fall, as we expect them to, investors could end up getting significantly higher returns due to capital gains."

Debt funds register mark-to-market (MTM) gains when interest rates decline.

"Assuming that a bond's residual duration is three years and interest rate declines by 25 basis points (bps), its price will increase by 75 bps," says S Sridharan, founder and principal officer, Wealth Ladder Direct.

Enter medium and long-duration funds

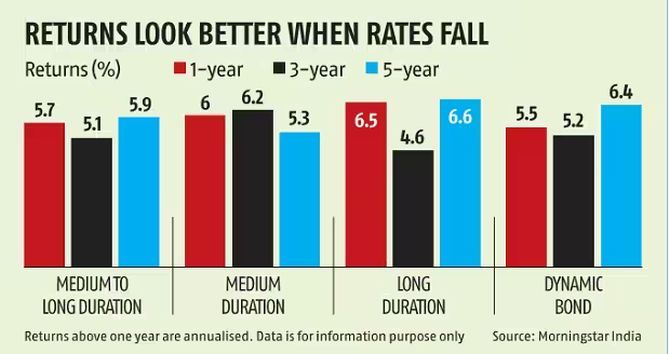

Medium and long-duration funds invest in longer-tenured bonds that respond more to changes in interest rates.

When interest rates fall, their prices rise more (compared to shorter-tenure bonds).

The funds investing in these bonds register higher appreciation in net asset value (NAV).

Medium-duration funds have portfolios whose duration ranges between three and four years.

Medium- to long-duration funds have duration between four and seven years, while long-duration funds have duration of more than seven years.

Temporary loss is possible

Investors who decided to enter medium- to long-duration funds should be cognisant of the risk.

The pace, quantum, and timing of rate cuts is hard to predict.

If the RBI chooses to keep the repo rate unchanged for a considerable period, investors in these funds will have to be content with accrual income.

A possible hike in the repo rate (whose quantum is unlikely to be very large) could cause a small, temporary loss in NAV.

"The main risk of investing in long-duration funds is hardening of inflation expectations. Bond yields would then reset to a higher level. Deterioration in credit quality could be another risk in portfolios that take exposure to corporate debt," says Bagla.

Adds Sridharan: "The interest rate pendulum is currently at the upside peak. It may drop immediately or after a small increase. Hence, investors should move to medium- and long-duration funds in a staggered manner."

Only investors with a high risk appetite, who can hold these funds for three to five years should consider investing in medium-duration funds, says Sridharan.

Investors should avoid funds with a high expense ratio, as high cost erodes fund returns. They should also examine the portfolio for credit risk.

Even though capital gains from debt funds will be taxed at the investor's slab rate, the MTM gains from a decline in interest rates could result in attractive returns for investors.

Start entering medium- and long-duration funds gradually over the next three to six months.

Remember that the bond market will respond in advance of the actual cut in interest rates.

The bulk of the portfolio should remain in short-duration funds. The exposure to medium and long-duration funds should depend on the investor's risk appetite.

Consider dynamic bond fund

Investors who don't want to take interest-rate calls themselves may opt for a dynamic bond fund, where the fund manager will take these calls on their behalf.

"By and large, active funds have performed well as they are able to dial up or down risks as underlying conditions change," says Yadav.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

© 2025

© 2025