In the longer run, there is no substitute for a standard term, accident, and a comprehensive health cover, with adequate sum insured that will give you round-the-clock and year-after-year coverage, advises Sarbajeet K Sen.

While shopping online, booking tickets for travel, or using payment apps to send money, you may have received offers to purchase insurance covers.

These are usually for sachet or bite-sized policies that cover a specific risk for a limited period of time.

Most of us respond to such offers on a whim: Sometimes we buy them and sometimes we don't.

But we need to have a more well-considered response to such offers.

Small-ticket insurance is available to you as a member of a group -- be it as a fare-paying passenger, a payment app user, or a customer of an online marketplace.

The policy is issued to the master policyholder (the product/service seller), who negotiates the terms of the cover and its pricing with the insurer.

Small cover, small price

The sum assured is usually small -- in the range of Rs 1 lakh-Rs 10 lakh.

The cover is for a specific purpose or for a specific period.

For instance, if you buy accident insurance while making a reservation, the cover is limited just to that journey.

The premium is also small.

Sometimes, where the sum assured is small, but the cover lasts for a longer period, there is an option to pay as you go -- say, monthly.

"These covers are very cost-effective, but they typically cover low-probability events," says Naval Goel, CEO and founder, PolicyX.com.

Fulfil unique needs

Bite-sized insurance products are often created to meet specific needs and situations, like holiday home insurance, or fitness insurance.

"Most of them provide covers that may not be available through standard insurance policies," says Anik Jain, CEO, Symbo Insurance.

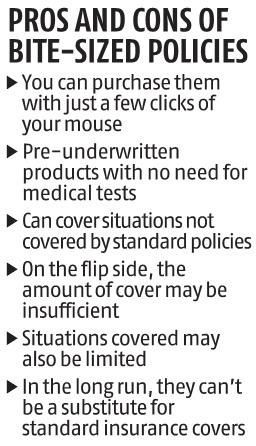

These covers are easy to purchase.

One example is the accident insurance offered by Indian Railway Catering and Tourism Corporation while you are booking tickets for long-distance travel.

All you have to do is click on the 'yes' button and you have the cover.

No medical test is usually required. At best you may have to make a health declaration.

Limited protection

The risk in these policies is of a mismatch between your insurance needs and the cover offered.

For instance, a life cover of Rs 2 lakh-Rs 5 lakh will not suffice to secure a family's future in case of an eventuality.

"These covers are grossly insufficient for covering life and health risks," says Goel.

Also, these covers are very limited in nature.

Take the case of a personal accident insurance cover purchased while booking a flight ticket.

If the passenger meets with an accident while commuting from his house to the airport, he will not get the claim.

Keep nominee in loop

If your family has no idea that you have purchased such a cover, the benefits may not reach it.

So, inform a family member if you buy such a cover.

Most buyers do not read the terms and conditions while purchasing and hence, are unaware of the exclusions.

This can cause unpleasant surprises.

"Each insurance product can have different exclusions," says Jain.

He, however, adds that the best designed bite-sized covers are 'parametric covers' that come with minimum exclusions and offer smooth claims.

Small-ticket policies can at best be a starting point for those who don't have standard policies.

They may also be purchased to cover situations where your standard policies won't protect you. You may also use them to enhance existing covers if you like.

But in the longer run, there is no substitute for a standard term, accident, and a comprehensive health cover, with adequate sum insured that will give you round-the-clock and year-after-year coverage.

Feature Presentation: Aslam Hunani/Rediff.com

© 2025

© 2025