Young investors could allocate in the proportion of 70:20:10 to equity, debt and gold.

Inflation has emerged as a major cause for worry in recent months.

The wholesale price index (WPI)-based inflation rose to a four-month high of 14.6 per cent in March.

It has been in double digits for 12 straight months now.

Retail inflation rose to 6.95 per cent in March, the highest in 17 months.

Such high levels of inflation will impact retail investors' portfolios in myriad ways.

High and sticky inflation

During the coronavirus pandemic, the capital expenditure that many commodity producers, like mining companies, were undertaking came to a halt.

Supply chains got disrupted.

In countries like the US, the government provided fiscal assistance to people, which increased demand.

This spurt, amid constrained supply, led to the first round of inflation.

In February, Russia invaded Ukraine. The West retaliated by imposing economic sanctions.

This led to further constraints in the supply of energy, food, etc, causing the second round of price spurt.

The Reserve Bank of India, in its April 8 monetary policy review, raised its inflation estimate for FY23 from 4.5 per cent to 5.7 per cent.

Inflation causes bond yields to harden based on the expectation that central banks will hike interest rates.

"Rising interest rates affect the returns of long-term debt funds. Stock prices, too, get impacted, especially during the initial period. And flexible-rate loans get costlier," says Amol Joshi, founder, PlanRupee Investment Managers.

Opt for short-term debt

As interest rates rise, bond prices fall.

"Debt portfolios, especially the ones that hold long-term bonds, will face trouble. Investors should move out of them and invest in shorter-duration debt funds," says Pankaj Mathpal, managing director, Optima Money Managers.

On the equity side, prefer large- or flexi-cap funds for long-term goals.

Exposure to small-cap funds may be avoided or curtailed.

Exit thematic funds, which are likely to be more volatile, unless you understand the theme well and can stick to the fund for the long term.

Avoid leveraged companies

Direct stock investors must bear in mind that higher interest rates affect equity valuations in several ways.

With interest rates in the US also up, borrowing money there to invest in Indian equities makes less sense, which is why foreign institutional investors have pulled out heavily.

Higher interest rates also impact the profitability of highly leveraged companies as their interest cost goes up.

Valuations also go down because the present value of future cash flows reduces (due to a higher discount rate).

Stocks trading at higher valuations are at risk of correcting sharply.

"A portfolio consisting of businesses with reasonable valuations and lower leverage will be best suited for the current environment," says Sorbh Gupta, fund manager-equity, Quantum Mutual Fund.

Adds Harshad Chetanwala, co-founder, MyWealthGrowth.com: "Market share could consolidate in in the hands of bigger players, as the smaller ones struggle due to challenges related to demand and fundraising."

Joshi advises sticking to quality companies.

"Over the medium term, strong companies that are leaders in their segments, are likely to benefit. This will get reflected in their bottom-line, and eventually their stock prices," he says.

Hedge with gold, diversify

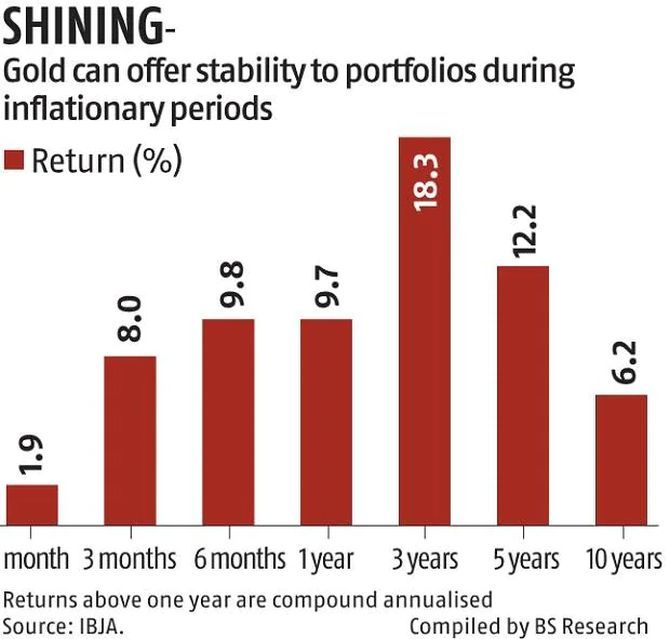

Gold has traditionally served as a good hedge during periods of high inflation.

"Invest a part of your savings in gold, preferably in gold exchange-traded funds (ETFs) and Sovereign Gold Bonds (SGBs)," says Mathpal.

Ensure that your portfolio is in line with your ideal asset allocation.

Mathpal suggests that young investors allocate in the proportion of 70:20:10 to equity, debt and gold.

Joshi suggests a slightly more conservative allocation of 60:25:15 for long-term investors.

Avoid knee-jerk reactions

Above all, avoid knee-jerk reactions in such periods when the macroeconomic climate is changing.

Chasing momentum stocks in the hope of high returns could prove risky.

Also, market leadership tends to shift in such times.

A diversified portfolio--instead of random stocks--is better placed to capture the shift.

Leveraged trading must be avoided. Finally, stagger your investments to benefit from heightened volatility.

Feature Presentation: Aslam Hunani/Rediff.com

© 2025

© 2025