If someone does reduce her/his contribution, s/he should scale it back to the 12% level as soon as s/he can, recommends Sanjay Kumar Singh.

Illustration: Dominic Xavier/Rediff.com

Employees within the organised sector may soon get the option to reduce their contribution to the Employees Provident Fund, which currently stands at 12% of their basic salary.

This provision, according to media reports, is a part of the Social Security Code Bill, 2019, which has received Cabinet approval.

Also, the labour ministry has dropped its earlier proposal to allow employees to switch from the Employees Pension Scheme (the pension portion of EPF) to the National Pension System.

Reduction in EPF contribution:

The government is taking this step to put more money in employees's hands so that they spend more and provide a fillip to consumption.

"Younger employees who have a low income and significant debt may view it as a welcome move," says Ritobrata Sarkar, head of retirement, Willis Towers Watson India.

This measure, however, poses risks over the long term.

"According to a study conducted by Willis Towers Watson, employees need to save at least 20% of their gross salary to build a reasonable retirement corpus.

The later you start, the more you need to save.

Moreover, EPF is the only mandatory retirement vehicle available to employees right now. By not making it mandatory, there may be a major risk that employees will fall short of their target retirement corpus," he adds.

Already, the savings through EPF are not very high.

"The employee's PF contribution, at 12% of basic salary -- and not the entire salary -- is not very high, especially in the private sector, where the salary has many components and the basic salary is often not high," says Deepesh Raghaw, founder, PersonalFinancePlan.in, a Sebi-registered investment advisor.

If someone does reduce her/his contribution, s/he should scale it back to the 12% level as soon s/as he can.

"Employees should, in fact, increase their contribution beyond 12%, via the Voluntary Provident Fund route, if their savings allow it," says Ankur Maheshwari, chief executive officer, Equirus Wealth Management.

Portability plan dropped

According to experts, the move to allow switching from EPS to NPS would anyway have been cumbersome, administratively complex, and difficult for employees to understand.

"This decision may lead to less flexibility for employees, especially those who are financially aware and would possibly have wanted to invest in riskier investments to generate higher returns under NPS. Employees should continue to look at NPS as an additional retirement option over and above EPF," says Sarkar.

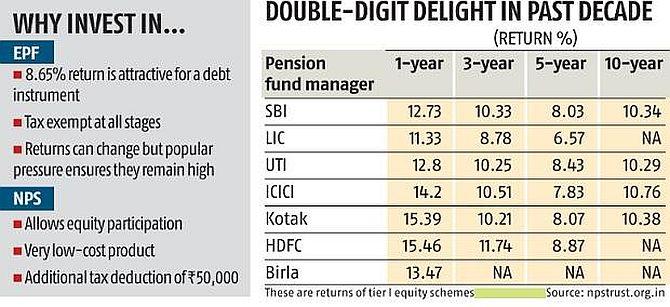

Where EPF scores:

EPF's return of 8.65% is very attractive for a debt instrument.

Even though the return can change from one year to another, it comes with an implicit government guarantee.

It also enjoys exempt-exempt-exempt tax treatment.

Where it doesn't

EPF does not allow investors the opportunity to participate in equities.

Also, any interest income from it after superannuation becomes taxable.

EPF also suffers from a structural issue.

The Employees Provident Fund Organisation now invests 15% of its incremental corpus in equities, a volatile asset class, and yet it continues to offer fixed returns.

"At some point, this could prove tricky. Ideally, fixed return should be offered only on the debt component of its investments. Returns from the equity component should be market-linked. There was a proposal to this effect, but we have not seen any progress on this front," says Raghaw.

What works in NPS

Investors can now take up to 75 per cent exposure to equities under the active choice option of NPS.

This has the potential to boost returns over the long term (see table).

At 0.01%, the investment management fee in NPS is very low.

NPS also enjoys favourable tax treatment.

First, a tax deduction of up to Rs 1.5 lakh is available under Section 80C.

There is also an additional deduction of Rs 50,000 under Section 80 CCD (1B).

Those who are part of corporate NPS can claim deduction of up to 10% of their basic salary under Section 80 CCD (2) on their employer's contribution.

NPS also does automatic rebalancing of your portfolio, something most investors do not do on their own.

What doesn't work

NPS investors may find its low liquidity irksome.

The investor's money gets virtually locked up till retirement.

In an emergency, they can only withdraw up to 25% of their own contribution (and not the entire corpus).

If someone wants to exit his NPS account before retirement, he gets only 20% of the corpus as lump sum.

80% has to go into purchasing an annuity.

"This can be problematic for people who retire early," says Raghaw.

Annuities bought at an early age also give a lower rate of return.

While these rules are meant to ensure a substantial retirement corpus, they can act as an impediment for people in urgent need of money.

Those who don't want their money to get locked up for the long term may avoid NPS.

After retirement, one has to compulsorily purchase an annuity with 40% of the corpus.

Annuity income is taxed at the marginal tax rate.

"People pay tax on their income during their working years. To tax the income from annuity again after retirement reduces the attractiveness of NPS," says Maheshwari.

Finally, if your EPF savings alone will not suffice to build the retirement corpus you wish to accumulate, and you want a product that provides forced saving discipline, opt for NPS.

Sanjay Kumar Singh covers personal finance for the Business Standard newspaper.