The group companies now lead the market capitalisation league table in sectors such as ports, power generation, gas distribution and transmission, and power transmission and distribution, ahead of incumbents in both public and private sector.

This has Gautam Adani family the second wealthiest in business in India.

Krishna Kant reports.

The past 12 months have been of the rise of the Adani group.

Once a medium-sized group based out of Ahmedabad, Adani’s companies now have the third-biggest market capitalisation among family-owned businesses in India after Tatas and Reliance Industries.

This has made the group owners and promoters — the Gautam Adani family — the second wealthiest in business in India, ahead of older and well-established industrial families.

Most of the gains to the group accrued in the past one year.

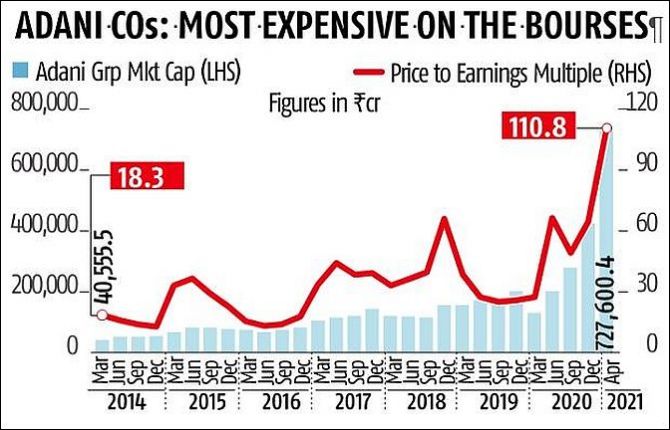

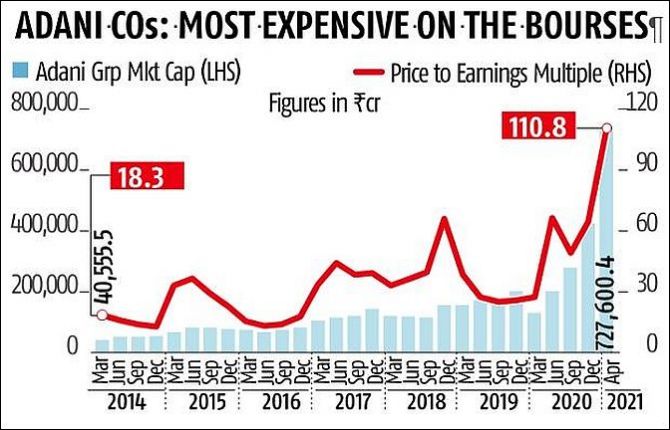

The combined market capitalisation of six Adani group companies is up nearly 455 per cent since the end of March 2020 against an 80 per cent rise in the combined market capitalisation of the country’s top 1,000 listed firms.

The Adani group companies now have a combined market capitalisation of around Rs 7.3 trillion, up from Rs 1.31 trillion at the end of March 20.

The group accounted for 7.3 per cent of the incremental rise in the market capitalisation of all companies in the past year even though it had 1.2 per cent share in the overall market cap at the end of March last year.

All six Adani group companies outperformed the broader market in the last 12 months.

This makes Adani the most successful business group in the country, at least in terms of stock market performance.

The group companies now lead the market capitalisation league table in sectors such as ports, power generation, gas distribution and transmission, and power transmission and distribution, ahead of incumbents in both public and private sector.

But the group’s finances are still to catch up.

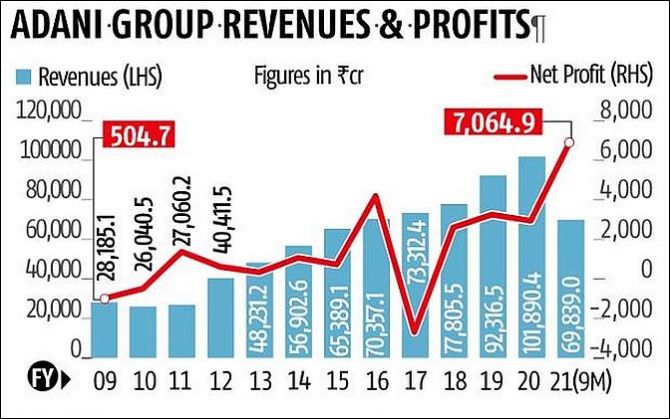

The group reported consolidated revenues of Rs 1.02 trillion and net profits of Rs 3,781 crore during FY20.

This makes Adani the sixth largest industrial group in terms of revenues behind Mahindra and eighth largest in terms of profits behind Hindujas.

At Rs 2.12 trillion at the end of FY20, Adani group assets were eighth biggest in the country behind L&T group but ahead of Mahindra’s.

However, the stratospheric rise in the Adani companies’ market capitalisation has little to do with the companies’ financial performance; it’s more a bet on growth potential.

“Many analysts expect a sharp jump in group revenues and profits by FY25 or FY26, thanks to a slew of licences and infrastructure assets won by the group companies in the last three years,” said an analyst on the condition of anonymity.

In the last two years, the group has acquired infrastructure assets worth nearly Rs 50,000 crore in the ports, power and airport sector.

Most of these assets were acquired from financially beleaguered promoters, making Adani a buyer of last resort in the infra space (see chart).

The spree of asset acquisition by the group is yet to translate into faster growth for the group.

The combined revenues of the listed Adani group companies were down 5.7 per cent during the trailing 12 months ending December 2020, while net profit was down 3.9 per cent.

This is not very different from the financial performance of the rest of India Inc.

For comparison, the combined revenues of all listed companies were down 7.6 per cent year-on-year and net profit was down 3.4 per cent in the same period.

The Adani group companies’ financial ratios are not very different from rest of India Inc either.

Adani group companies reported return on equity (RoE) of around 9.4 per cent during the first nine months of FY21, slightly less than 9.7 per cent RoE for Sensex companies.

The group is also among one of the country’s most indebted groups.

Total borrowings were up 14.3 per cent year-on-year in the first half of FY21 to Rs 1.25 trillion, while all financial liabilities were up 18 per cent to Rs 1.41 trillion.

This translated into gross debt to equity ratio of 1.8x for the group, up from 1.7x at the end of September 2019 (or H1FY20).

Many analysts feel that the sharp rally in Adani stocks is a classic case of irrational exuberance amplified by the group’s ability to bag large infrastructure assets in recent years.

For example, at Rs 1.28 trillion, Adani Total Gas market capitalisation is just a notch below the combined market capitalisation of the five biggest gas companies in India — Indraprastha Gas, Petronet LNG, Gujarat Gas, Mahanagar Gas and Gujarat State Petronet.

However, Adani Total Gas net profits in FY20 was just 5 per cent of the combined net profit of these five companies.

In August 2018, Adani Gas won rights to retail piped natural gas in 11 circles in the country — the most among all the bidders.

The period also saw French energy major Total SE picking up a minority stake in two Adani group companies for nearly Rs 23,000 crore.

Similarly, Adani Green Energy is now the country’s top power company in terms of market capitalisation, ahead of NTPC, Power Grid Corporation and Tata Power despite reporting a fraction of their revenues and profits.

In the past three years, the group has bagged seven airports, including the lucrative Mumbai International Airport, acquired two major ports worth Rs 16,000 crore and power assets worth nearly Rs 24,000, crore including Mumbai’s power, generation and distribution business.

Analysts, however, warn that it may be risky for investors to bet on the group’s future.

“Investors have rewarded Adani for its pace of asset creation and purchases in the infra space, but all these assets come with liabilities.

"There is a big risk that many of these may earn sub-optimal returns given the economic slowdown in India post-Covid-19,” says an analyst.

A questionnaire sent to the company remained unanswered when this report went to press.

In the last five-years (FY15-20), Adani group companies’ combined revenues have grown at a compounded annual rate (CAGR) of 9.3 per cent, while the net profit grew at a CAGR of 14.3 per cent during the period.

In the same period, group assets grew at a CAGR of 11 per cent to reach Rs 2.12 trillion at the end of March 20, up from Rs 1.26 trillion at the end of March 2015.

Some analysts also say the restriction on imports under the Atmanirbhar Bharat (self-reliant India) initiative is also negative for the ports and coal trading businesses, which are the group’s biggest cash cow.

Adani Ports & SEZ accounted for nearly 55 per cent of the group net profit in the nine months of FY21.

The group also faces challenges from a series of controversies it has landed in.

Early this month, S&P Dow Jones Indices removed Adani Ports & SEZ from its sustainability index following reports of its business ties with Myanmar’s military, which staged a coup in February.

The Adani Group firm is building a $290-million container port in Myanmar in partnership with a firm allegedly controlled by the military.

Farmers protesting against the new farm laws have also accused the Adani group of being a prime beneficiary of these laws.

In Australia, Adani’s Carmichael Coal mining project, which the group acquired in 2014, has been facing protest from local residents and environmentalists.

This has forced the group to scale down the project from $16.5 billion to around $2 billion now.

The group’s bid to acquire and operate the Thiruvananthapuram and Mangaluru airports is also facing legal challenges.

All these issues suggest that the group’s rapid growth trajectory could bear a high risk element as well.

Photograph: Amit Dave/Reuters