The government's target of hitting $52 billion to $58 billion in mobile phone exports in FY26 has been faltering; an Indian corporate group with financial muscle will help.

A year of hectic parleys went by before it could be announced, on October 27, that a Tata Group company would acquire Wistron Corp's India manufacturing business for an estimated $125 million.

This will make Tata Electronics the first Indian entity to make iPhones for the domestic and global markets.

It will join an exclusive club of iPhone assemblers, whose members are Foxconn, Pegatron, and Luxshare, and the outgoing Wistron.

The first three are seasoned global players in electronics manufacturing and services (EMS), which involves assembling and manufacturing.

Wistron was the first to begin iPhone assembly in India, in 2017.

Later Foxconn and Pegatron started to do it as well.

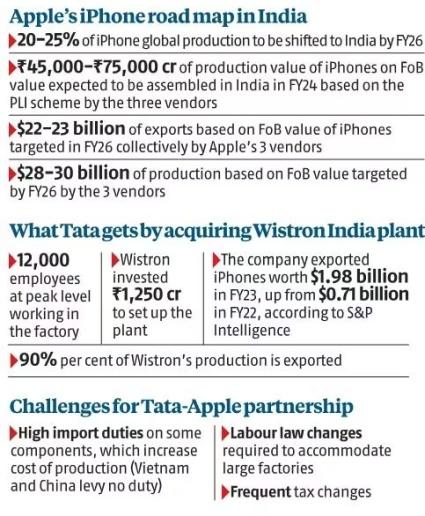

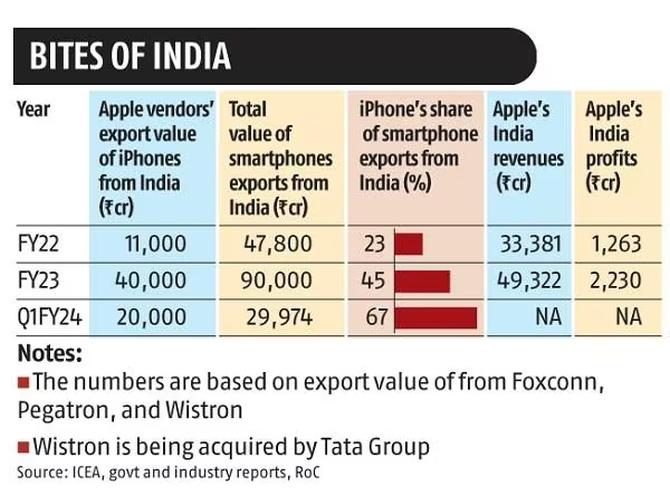

Already 7 per cent of iPhone's global production has shifted to India from China, and the target is to increase it to 20 to 25 per cent by 2025 tom 2026.

According to data from S&P Global Intelligence, Wistron was the second largest exporter of iPhones from India, after Foxconn, and is believed to have invested Rs 1,250 crore (Rs 12.50 billion) in setting up the plant.

It employed more than 12,000 workers and 90 per cent of its phones were exported.

The deal marks the most recent peak in the Tata Group's efforts to align with Apple, the world's most valued company by market capitalisation.

For the Cupertino-based technology giant, it furthers the agenda of building a local supply chain in India so it can increase the local value addition in iPhones, something it has committed to increase to 40 per cent at the end of the five-year production-linked incentive (PLI) scheme of the Indian government.

Currently, the local value addition in iPhones ranges from 12 to 15 per cent, according to sources.

China vs India

Apple had tied up with Tata Electronics to supply iPhone enclosures, a component that accounts for 9 to 12 per cent of the total cost of production.

After a learning curve of nearly two-and-a-half years to cut rejection rates, the Tata company began to export the India-made enclosures to Chinese assemblers of the iPhone.

Now the Wistron deal promises an opportunity for Tata Electronics to acquire a global EMS footprint.

The Tata deal also shows Apple, which sells more than $205 billion worth of iPhones across the globe, is keen to increase its bet on India.

In the next 30 months, based on commitments to the government, it wants to shift 20 to 25 per cent of iPhone assembly from China to India, compared to 7 per cent now.

It is keen to broaden its supply chain in India with Indian and non-Chinese players.

That is part of the efforts to ensure 50 per cent of iPhone components, in value, are manufactured in the country, not imported.

But it is going to be a tightrope walk for Apple, which currently depends on China for 90 per cent of its production.

Most of its supply chain is located in China and it commands a huge share of the domestic market there. In China, iPhone sales are 13 times their sales in India.

With the geopolitical tension that exists between India and China and tacit restrictions on investments by Chinese companies in this country, the US company has been stymied in its bid to bring its Chinese vendors to India.

Without that its local value addition in phones has been low, leaving a lot of ground to be covered under the PLI scheme.

A small window, which the Indian government opened by allowing Chinese entry in Indian joint ventures with majority Indian stake, has not taken off, although 14 Chinese iPhone suppliers were given security clearances.

Apple appears to have changed tack now. It has put its focus on building a supply chain based on home-grown and non-Chinese companies, though this is neither easy nor can it be done in a hurry. But it has tasted early success with the Tata Group, which has got its act together on enclosures for the iPhone.

Three years ago, Wistron sold its iPhone-making business in China and Vietnam to Luxshare, a Chinese EMS company.

Sources say it was keen on getting the same buyer for its India iPhone operation as well.

Luxshare was well-versed with the process of assembling iPhones. But Apple, aware of the Indian reality, decided to intervene and helped Wistron find an Indian buyer.

The iPhone maker is said to be looking to bring manufacturing of two key components, display and camera modules, into India.

It had earlier roped in its Chinese vendor, Sunny Opotech, to set up a camera manufacturing facility for iPhones in the country. But that is now on the backburner.

Instead, three or four Indian and non-Chinese companies are said to be in the fray.

Global footprint

By FY26, the combined sales revenue of the three iPhone assemblers in India is projected to touch $45 billion to $50 billion, or Rs 374,000 to Rs 416,000 crore.

That is more than three times Maruti Suzuki's revenues in FY23 and equivalent to a third of the Tata Group's total revenues.

Analysts say Tata Electronics, as one of the three iPhone assemblers in India and also as a manufacturer of enclosures, could become a $15 billion company in a couple of years or so.

That is assuming the three assemblers split the iPhone revenues equally.

At $15 billion, Tata Electronics will become the country's largest EMS player by far.

Dixon Technologies, which is now the largest Indian EMS company, currently makes Rs 12,200 crore (Rs 120 billion), or about $1.5 billion, in annual revenues.

By joining Apple's global supply chain, Tata Electronics will be able to tap into the global market.

It is already exporting enclosures to China. Once it begins to assemble iPhones, for which Apple is expected to help by bringing technical experts to India, it can replicate the model in other parts of the world, much as Foxconn and Pegatron were able to do.

That said, it will not be a cakewalk. "All of Apple's challenges in India will now become Tata's problems, such as taxation and handling labour laws, among others," says the top executive of an EMS company.

Import duties on components into India are generally higher than what other countries, including China and Vietnam, impose.

The EMS executive adds that when a company only supplies components through a contract, the contentious issues are not their headache; for instance, higher duties provide them protection. But for assemblers, higher duties increase the cost of production.

For the government, having an Indian corporate group with the financial strength of the Tata Group in the big electronics play helps.

The government's target of hitting $52 billion to $58 billion worth of mobile phone exports in FY26 has been faltering because Chinese as well as Indian players have exported less than anticipated. Apple could fill that gap by raising its exports.

But, as some analysts say, it will require smooth sailing in policy waters, such as quick visa clearances to Apple's Chinese experts in assembly operations, who can train Tata's technical team.

For many iPhone components, Indian companies that want to be part of the supply chain must buy or collaborate to get technology, some of which could very well come from China. That might require clearances from the government.

Thanks to the big push to exports by Apple's vendors, smartphones have jumped to the top five export items out of India in FY23, based on the harmonised systems code, from ninth place in the previous year.

Mobile device makers say if iPhone hits $22 billion to $24 billion in exports, smartphones could be among the top four in the exports pecking order.

Clearly, there is more riding on the Wistron deal than the hedging of Apple's geopolitical bets and Tata's global dreams.

Feature Presentation: Rajesh Alva/Rediff.com

© 2025

© 2025