The PNB fiasco falls into a family line that involves non-fund limits - read contingent liabilities which are off-books. Harshad Mehta did it with bankers’ receipts in 1992.

Ketan Parekh exploited the ignorance of bankers who did not know the difference between a cheque and a pay-order.

And the RBI blinked when it failed to insist the SWIFT platform be linked to the core banking solution.

Raghu Mohan & Abhijit Lele trace the banking mess that was just waiting to happen.

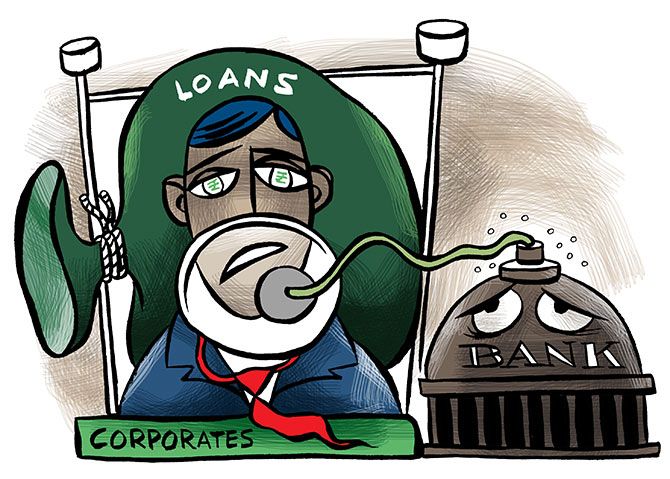

Illustration: Uttam Ghosh/Rediff,com

A few in India Inc, have for long lived by a unique worldview: “It’s against my principle to pay interest on the loan I took from you; and against my interest to repay the principal.”

Last winter, diamantaires Nirav Modi and Mehul Choksi, scaled up the wag’s idea - crafted their version of the direct benefit transfer scheme to bleed Punjab National Bank (PNB) of Rs 20,000 crore.

And proved that you can not only be led by the nose, but the nose-ring too.

A year on, you get to glean little on life after the blowout on a reading of PNB’s annual report for FY18.

The auditor line-up has changed as the bank replaced its three auditors - Chhajed & Doshi, R Devendra Kumar & Associates, and Hem Sandeep & Co.

All you get to know is in FY18 frauds in both borrowal and non-borrowal accounts went up to Rs 15,502 crore for which provisioning was done for Rs 9,224 crore with unamortised provisions of Rs 7,178 crore; in the preceding fiscal total fraud accounts were at Rs 2,809 crore, provisioning was done for Rs 1,970 crore, of which Rs 834 crore was unamortised.

And, of course, you have this gem: “Mission Gandhigiri was launched for recovery from borrowers wherein silent protests and demonstrations were made in front of premises of recalcitrant borrowers.”

You didn’t hear of it because the silence was deafening!

Mint Road, too, has made no overt reference to the fiasco in both reports on Trend and Progress of Banking in India released since.

The latest one though noted: “In view of the recent incidents relating to the Society for Worldwide Interbank Financial Telecommunication (SWIFT) systems, banks were directed to strengthen various operational controls in their SWIFT system in a time-bound manner.

"An expert committee (chairman: Shri Y H Malegam) was formed in February 2018 to examine asset classification and provisioning practices of banks and the incidence of frauds.”

A line trotted out after the fraud at PNB was that bankers and the RBI are not to be blamed - it was not a case of bad credit; but something akin “to deliberately jumping the red light” and the authorities can do little in such cases.

The charge-sheet filed by the Central Bureau of Investigation clearly states internal controls were breached.

You have another layer of complexity in all this.

V G Kannan, chief executive of the Indian Banks’ Association points to the passage of the Prevention of Corruption Act and Criminal Procedure Code, which is a relief to bankers in terms of legal action, and protects bankers taking bona fide credit decisions.

But as Abizer Diwnaji, partner and national leader (financial services) at EY points out: “I have not seen too many banks conduct risk management training programmes.

"There is no sustained change in the credit culture at state-run banks. They have to figure out not to just grow on balance sheet size, but improve the credit assessment process as well.”

Read together Kannan’s and Diwanji’s statements and what you have is a situation wherein you can be ignorant and still claim innocence when it comes to credit decisions.

The big blink

The PNB fiasco falls into a family line that involves non-fund limits - read contingent liabilities which are off-books. Harshad Mehta did it with bankers’ receipts in 1992.

Centurion Bank paid for its sins when it discounted bills under inland usance letters of credit opened by state-run banks in 1997.

Ketan Parekh exploited the ignorance of bankers who did not know the difference between a cheque and a pay-order (it sank Madhavpura Co-operative Bank that issued pay-orders of Rs 1,200 crore to Parekh which he discounted with Bank of India).

The RBI blinked when it failed to insist the SWIFT platform be linked to the core banking solution.

Yet another point is that despite repeatedly being told that Nostro balances be presented to banks’ boards - reconciled and unreconciled - at the end of day for the period before a meet, it was not done. (A Nostro account refers to an account that a bank holds in a foreign currency in another bank).

Says a former bank board member: “Even when they give us this information, it’s in aggregated form. We can’t get a sense of what’s happening at the operational level.”

In hindsight, it was a mess waiting to happen.

The Report of the Committee to Recommend Data Format for Furnishing of Credit Information to Credit Information Companies (2014) under the chairmanship of HDFC Bank MD Aditya Puri, had observed: “Borrowers have, in general, not been forthcoming in sharing such information with lenders, particularly with banks that are not part of the consortium.”

It included the off-balance-sheet too; just what took PNB by surprise.

While RBI’s supervisory bureaucracy was blindsided on PNB, it gave the sense of having put sound systems in place.

In its Report on the Trend and Progress of Banking (2016-17), it had pointed to the live reporting of Fraud Monitoring Returns from April 2017.

“Banks will submit fraud reports within the specified period in straight through processing mode, which will facilitate faster dissemination of fraud data.

"Banks will also update developments in fraud cases on ‘as and when required’ basis instead of doing it on a quarterly basis,” it notes.

And yet, PNB blew up exactly a year later.

What’s also not fully evident is the fallout under global regulatory commitments given that there are no precedents.

You have The Foreign Account Tax Compliance Act (2012), a US regulation under which banks report directly to the Internal Revenue Service certain information about financial accounts held by US taxpayers, or by foreign entities in which US taxpayers hold a substantial ownership interest.

Nirav’s Modi’s wife, Ami Modi, is a US citizen, but as on date, little is known about the nature of their overseas business or cross-country linkages.

Or take the Anti-Money Laundering and Countering Financing of Terrorism Act (2009) of the Financial Action Task Force (FATF).

At the June 2013 plenary meeting, the FATF decided: “India had reached a satisfactory level of compliance with all of the core and key recommendations and could be removed from the regular follow-up process.”

Says a lawyer: “Since PNB, we have seen another bank come into the spotlight with some questionable transactions with a global footprint, and the cross-border regulatory may well be revisited.”

As for the gems and jewellery sector, the reluctance of banks to lend has affected thousands of livelihoods.

Notes Diwanji: “I have not seen a single bank deploying a specialist team to understand the gems and jewellery sector, but many have stopped lending to these units.”

What’s also not in the headlines is the status of investments.

Jewellers without any taint are seeing their expansion plans being cut back due to lack of credit.

For now, the grime behind the glitter stays.

© 2025

© 2025