Photographs: Rediff Archives BS Reporter in Pune

After about a month of speculation on sale of stake in HCL Technologies and denial by the company’s founder chairman Shiv Nadar, Chief Executive Officer Anant Gupta on Wednesday sent a mail on the issue to his employees.

“I’m writing today specifically in response to some recent inexplicable rumors speculating HCL Corporation’s stake sale in HCL Technologies.

“In a letter to me, Shiv Nadar, chairman, HCL Corporation, has emphasised there is no plan to exit HCL Technologies.

“He considers the company a deep strategic asset,” Gupta’s mail said.

. . .

CEO denies Shiv Nadar selling stake in HCL Tech

Image: HCL Tech.Photographs: Rediff Archives

It added the company had publicly denied the speculation on multiple occasions, as well as through a statement released on stock exchanges on February 22.

“Despite our denial, the rumors have kept resurfacing, which leads us to believe these may perhaps be motivated,” the mail said.

Last month, a Wall Street Journal report said Nadar planned to sell his stake worth $10 billion (or about Rs 61,000 crore, based on Wednesday’s stock price of Rs 1,458.95) and was scouting for potential buyers.

Nadar holds about 62 per cent stake in HCL Technologies. Gupta said: “It’s rather unfortunate our company is being put under such speculative scanner.

“I hope this communication will put to rest any questions you may have had on the speculation.

. . .

CEO denies Shiv Nadar selling stake in HCL Tech

Image: Roshni Nadar.Photographs: Courtesy, Roshni Nadar's Facebook

“Looking ahead, I would say just keep your gaze focused on the bulls-eye. We have lots to look forward to in 2014.”

The denial by promoter Nadar had a huge impact on the company stock.

Between February 20 and February 28, the stock appreciated 7.9 per cent after the Nadar-led HCL Corporation (which controls HCL Technologies and former PC maker HCL Infosystems) said it had no plans to sell its IT services firm.

An analyst at a major brokerage said, “It’s a huge chunk of stake that Nadar has.

“Who will buy such a huge stake in one transaction?

. . .

CEO denies Shiv Nadar selling stake in HCL Tech

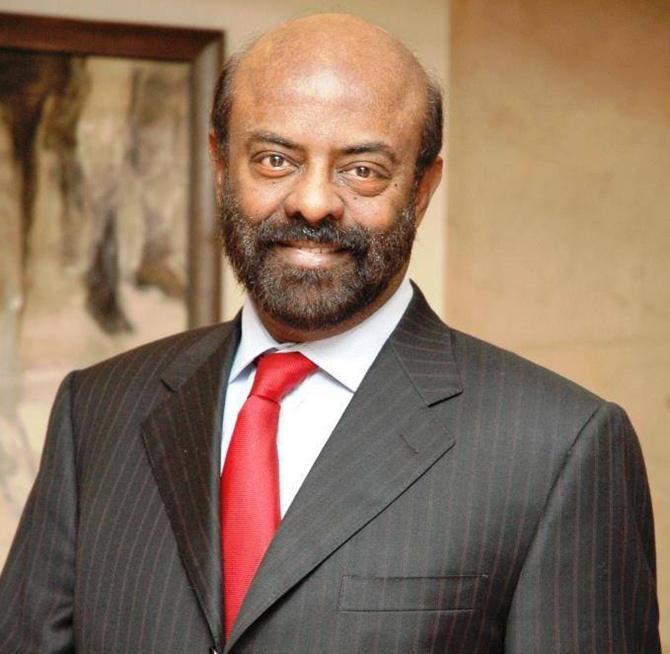

Image: Shiv Nadar honoured with 2013 BNP Paribas prize for philanthropy.Photographs: Courtesy, Shiv Nadar's Facebook

“The companies who have this bandwidth -- IBM or Accenture -- don’t need to acquire HCL. As for private equity players, this is too big an investment.

“Also, the promoter selling stake in smaller tranches is a known fact. They have done this in the past, too.”

Many expect Nadar to offload some stake for his philanthropic activities.

Another analyst said, “Once a year, you get to hear this, especially when the company management is out on road shows to meet analysts. Though promoter stake is not an overhang on the stock, Nadar is an astute markets player. So, his exit does matter.”

article