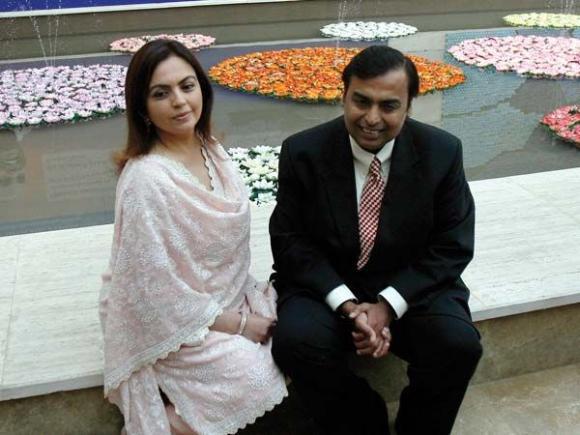

Photographs: Reuters Dev Chatterjee in Mumbai

Over the next five years, plans to pump money in KG-D6, refining, petrochemical, retail and telecom.

Mukesh Ambani, chairman of Reliance Industries Limited (RIL), is investing Rs 179,000 crore (Rs 1.79 trillion) in its core refining and petrochemicals businesses through the next five years, as the business sentiment of its key units, both in India and abroad, improves.

"We are planning to invest Rs 27,096 crore (Rs 270.96 billion) in the development of the Krishna-Godavari gas fields," a senior RIL official said, soon after its muted FY13 annual results.

The investment comes at a time when gas production from its KG-D6 gas fields fell to a new low of 19 million cubic metres a day in the March quarter, even as the government and the company fought over the expenditure incurred on the fields.

Of its massive investment budget, about Rs 151,000 crore (Rs 1.51 trillion) would go towards the company's core oil, gas, refining and petrochemical sectors in the next five years; the rest would go towards the telecom and retail sectors, which analysts term "non-core".

...

RIL opens its purse to invest Rs 179,000 cr

Image: Reliance Industries petrochemical plant at Jamnagar.Photographs: Reuters

An important factor behind the huge investment is the fact that as RIL rolls out its investments, it would be the biggest beneficiary of the 15 per cent additional investment allowance announced by Finance Minister P Chidambaram in Budget 2013-14.

Insiders say RIL's core businesses are well placed to see long-term growth, as demand for its refining products in India is set to rise in the coming years.

Oil sector analysts say with crude oil prices declining, diesel subsidy would also fall sharply, prompting the company to reopen its petrol pumps across India.

As of now, the company is unable to compete with government-owned companies, as these companies get subsidy on diesel sales.

...

RIL opens its purse to invest Rs 179,000 cr

Image: Prime Minister's Economic Advisory Council Chairman, C Rangarajan.Photographs: Reuters

Another positive is the recommendations made by a committee led by the Prime Minister's Economic Advisory Council Chairman, C Rangarajan, which suggests the price of gas produced from the KG-D6 block be doubled from $4.2 a unit.

RIL officials say they plan to arrest the decline in KG-D6 gas production through "work-over" activities this year, as well as through additional "compression" capacity in 2014-15.

Substantial revival in volumes is likely only when satellite-I, other satellites and R-Series discoveries start production, after their field development, say analysts.

Last week, Mukesh Ambani and Bob Dudley, chairman of BP and RIL's equity partner in the D6 fields, met Prime Minister Manmohan Singh and sought a rise in the price of gas.

...

RIL opens its purse to invest Rs 179,000 cr

Image: The gas supplied from RIL's fields to power, fertiliser and manufacturing companies would be cheaper compared to imported fuel.Photographs: Reuters

With expectations of an imminent rise in price, the company would restart investments in gas production, including in the new NEC-25 field.

RIL is investing heavily, as demand for gas from power, fertiliser and manufacturing companies is rising sharply. Many power plants were shut, as RIL failed to supply gas in time.

Analysts say the gas supplied from RIL's fields would be cheaper, compared to imported fuel.

Back to the basics

In the last annual general meeting, Ambani announced the company was setting up a gas cracker at Jamnagar, and this would be among the largest in the world.

...

RIL opens its purse to invest Rs 179,000 cr

Image: The company is setting up a gas cracker at Jamnagar, which would be among the largest in the world.Photographs: Morteza Nikoubaz/Reuters

This would include setting up a 1.8-million-tonne (mt) paraxylene plant, doubling the purified terephthalic acid capacity to 4.3 mt and expanding the polyester portfolio by 1.5 mt. Ambani said the elastomer business would cater to the growing demand from the automobile sector and the investment in petrochemicals expansion would be about Rs 48,000 crore (Rs 480 billion).

This would raise RIL's total annual petrochemicals capacity to 25 mt, making it among the top five global producers.

Currently, RIL is executing three projects in its core refining and petrochemicals businesses - a petcoke gasification plant at a refinery, polyester capacity expansion in petrochemicals and a refinery off-gas cracker in petrochemicals.

...

RIL opens its purse to invest Rs 179,000 cr

Image: Customers shop in the chilled foods section of a Reliance Fresh supermarket in Mumbai.Photographs: Danish Siddiqui/Reuters

The company has already placed orders for long lead items for its gasification; it has also finalised a technology licensor for these projects.

Analysts expect the planned petcoke gasification unit would raise RIL's refining margins, as the "syn-gas" output from the petcoke gasification unit would replace the expensive liquefied natural gas RIL currently uses for utilities associated with the refinery.

With the focus returning to its core businesses (which accounts for 82 per cent of the new capital expenditure), analysts say the company is on the right track.

Booster for retail, telecom

RIL's 2012-13 annual results showed one of its non-core retail ventures finally broke even. After a long wait, its telecom venture will finally take off by the year-end.

...

RIL opens its purse to invest Rs 179,000 cr

Image: RIL would invest about Rs 13,500 crore in telecom business.RIL would invest about Rs 13,500 crore (Rs 135 billion) in this business and another Rs 19,500 crore (Rs 195 billion) in the retail business.

In 2012-13, the retail segment broke even. It now accounts for 1,466 stores, covering about nine million sq feet.

Through the past two years, the retail business recorded revenue growth of 33 per cent. In 2012-13, this segment saw the inclusion of 184 stores.

The question is when RIL shareholders would see returns on the company's massive investments. Through the last five years, the shareholders have been waiting for the company's stock to rise; till now, they have been a disappointed lot.

Would RIL's investments change their fortunes? That is something the three-million-strong RIL shareholder community is eager to know.

article