Photographs: Jayanta Shaw/Reuters Vrishti Beniwal & Manojit Saha in New Delhi/Mumbai

India Inc can expect some good news from Raghuram Rajan who takes charge as Reserve Bank of India governor on Wednesday.

The central bank may roll back the controls imposed on overseas investments by companies -- a move that had invited widespread criticism from industry.

Officials familiar with the developments, however, said the restrictions on outbound investments by individuals would continue for some more time.

. . .

Rajan may lift capital controls on India Inc

Photographs: Reuters

The central bank on August 14 reduced the limit for overseas direct investment by domestic companies, other than oil PSUs, under the automatic route from 400 per cent of their net worth to 100 per cent.

It had also barred resident individuals from using remittances for purchase of property outside India.

The limit for remittances under the Liberalised Remittances Scheme was also lowered from $200,000 per financial year to $75,000.

Rajan may also do away with the mid-quarter reviews of monetary policy as they created unnecessary speculation.

. . .

Rajan may lift capital controls on India Inc

Image: Raghuram Rajan.Photographs: B Mathur/Reuters

“As the RBI can decide on the required changes in the key policy rate or the cash reserve ratio on any day, mid-quarter reviews defy logic,” said a central bank watcher.

The review slated for September will, however, take place as it’s too late to stop that.

To speak to the market more often, outgoing RBI Governor Duvvuri Subbarao had in September 2010 started mid-quarter policy reviews -- policy documents of a couple of pages -- between quarterly reviews.

As a result, the RBI now announces its policy eight times a year as compared to four earlier.

The move for more frequent policy reviews faced criticism as it forced the RBI to bear the burden of market expectations every 45 days.

. . .

Rajan may lift capital controls on India Inc

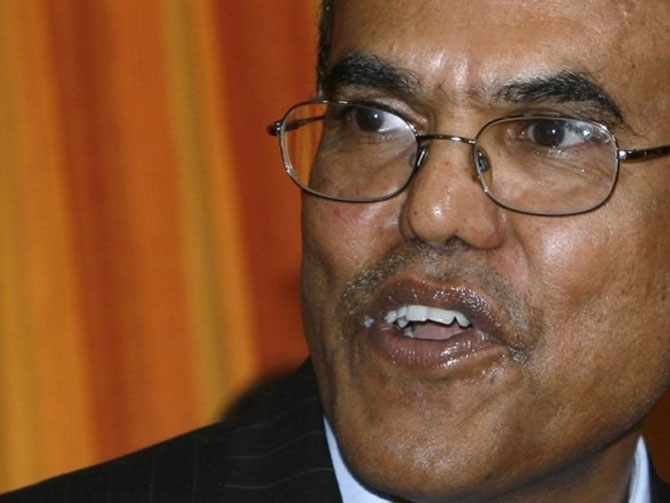

Image: Outgoing RBI Governor D Subbarao.Photographs: Reuters

Another of Rajan’s priority areas will be to improve the communication policy of the central bank.

Though Subbarao brought in critical changes in the communication policy to “demystify the governor’s office”, openness on the policy stance also drew criticism on the ground that since the objective of the monetary policy was forward-looking, there should be an element of surprise.

Subbarao was often criticised for being behind the curve, as the market would have already factored in what was in store in the policy.

The RBI could also issue the first new banking licence by December this year, the sources said.

This, however, may be a tough ask as the central bank has not set up an external committee to examine applications being shortlisted by an internal committee.

. . .

Rajan may lift capital controls on India Inc

Image: Finance Minister P Chidambaram.Photographs: Reuters

The officials said measures would also be taken to deepen the bond markets as well as currency and derivatives over the medium term.

The finance ministry is also planning to push key reforms in the financial sector.

To lift the sentiment, the finance ministry is planning to go for a slew of reforms in the medium term.

“Tapering of quantitative easing by the US will be a reality in five to six months.

Interventions in the forex market alone cannot help.

“There is an urgent need to push reforms.

“No investor will put his money into the country if there is no growth,” said an official who did not wish to be identified.

. . .

Rajan may lift capital controls on India Inc

Photographs: Jayanta Dey/Reuters

Officials said all the unfinished agenda taken up during 2005-2009 would be revived and reforms stalled after 2009 would be pushed.

Action will also be taken on reports by the committees headed by Rajan himself and Percy Mistry.

In 2008, a high-level committee on financial reforms, headed by Rajan, had suggested a shift to a true auction method for securities besides seeking a reduction in the period between auction and listing.

It wanted the RBI to adopt a hands-off approach in managing exchange rates and suggested that the central bank shift to inflation targeting, using short-term rates to manage liquidity and changing interest rates when inflation went above or below the objective.

. . .

Rajan may lift capital controls on India Inc

Image: Raghuram Rajan.Photographs: Reuters

While opposing capital controls, the panel had suggested a steady opening up of the rupee bond market.

In 2007, former World Bank economist Mistry had authored a widely acclaimed report on making Mumbai an international financial centre.

The Mistry Committee had recommended full capital account convertibility by 2008-end, abolition of the securities transaction tax and stamp duties, pruning of public debt and doing away with restrictions on foreign investment in sovereign bonds.

It had also proposed the creation of a currency spot market and a rupee-settled exchange-traded currency derivatives market.

article