Photographs: Reuters Arvind Panagariya

What will it take the next government to revive growth?

Arvind Panagariya, Jagdish Bhagwati Professor of Indian Political Economy at Columbia University and one of the world's leading economists, offers a checklist.

Continuing our series on the state of the Indian economy ahead of the general election.

Part I: From boom to doom: An uphill task to revive the economy

Part II: It will take three years for economic growth to pick up

Part III: 'US economy needs to improve for India to turn around'

Part IV: Reviving the economy: What the next government should do

Part V: 'Policy paralysis in India will continue'

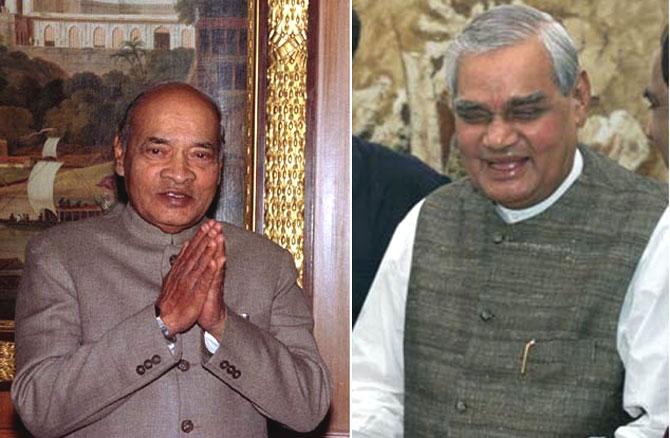

The economic reforms in India started in earnest in 1991 under Prime Minister P V Narasimha Rao and continued under Prime Minister Atal Bihari Vajpayee.

Those reforms launched India into an eight per cent plus growth trajectory. A measure of the gains from the reforms is that whereas the real per capita income in the first 40 years of development just doubled in 1990-1991, by 2012-2013, it had risen to 5.8 times that in the initial year.

The gains made in just 22 years in the post-reform era were thus 3.8 times those during the first 40 years of development. Unsurprisingly, the post-reform era has also seen much of the reduction in poverty that India has experienced.

In 2003-2004, the last full year under Vajpayee, the reforms had launched India into the eight per cent plus growth orbit. That year, India grew 8.4 per cent.

Subsequently, with the exception of the small dip in the global crisis year of 2008-2009, the economy grew at eight per cent until 2010-2011. But the growth rate plummeted during 2011-2012 and 2012-2013.

Please click NEXT for more...

4 ways the new PM can revive the economy

Image: Paralysis in decision-making at the Centre drove away investors, says Professor Arvind Panagariya.hor.Photographs: Babu/Reuters Arvind Panagariya

What caused this decline? Many, especially in the government, attribute the decline to the unfavourable global economic environment.

But facts belie this connection. At the height of the global financial crisis in 2008-2009, the economy experienced a decline in the growth rate to only 6.7 per cent. It then returned to the eight per cent plus level in the following two years.

With no major shock to the economy in 2011-2012 and 2012-2013, it is not credible to connect the decline to external factors. Instead, its origins must be sought internally.

There are three main culprits behind the growth slowdown. First, numerous consecutive hikes in the interest rate by the Reserve Bank of India under the former governor vitiated the investment climate.

Second and more importantly, paralysis in decision-making at the Centre has driven away investors. This paralysis first began with two successive environment ministers blocking clearances to all but a few major projects.

This was reinforced by a general freeze in decision-making following the revelation of multiple corruption scandals that landed a few politicians and senior bureaucrats in jail.

What better way to avoid being accused of having accepted a bribe than to take no decision?

Finally, measures such as retrospective taxation have made investors apprehensive that projects that are initially profitable may turn unprofitable if the government changes the rules retrospectively.

Please click on NEXT for more...

4 ways the new PM can revive the economy

Image: To revive growth, the next government will have to do a tightrope walk.Photographs: Babu/Reuters Arvind Panagariya

What will it take the next government to revive growth?

Luckily, the savings rate still remains relatively high and most of the reforms introduced by Rao and Vajpayee have not been reversed. Therefore, the next government can at least partially revive growth through a handful of pragmatic steps.

First, the next prime minister will have to appoint a pragmatic environment minister who will take quick decisions.

The protection of environment is important, but it must be balanced against the need to keep the growth process moving forward. Besides, even when the decision is negative, it must be made swiftly.

Second, the prime minister will have to quickly assure the bureaucracy that he stands behind all their legitimate decisions and that there is no place for a witch-hunt in his administration.

Third, he will need to forge a closer relationship with the state governments, which must provide land, electricity and water for all projects.

Finally, the prime minister will need to restore the health of the banks.

In recent years, restructured loans have rapidly piled up. In aggregate, non-performing and restructured loans have reached nine per cent of the total loans.

Please click NEXT for more...

4 ways the new PM can revive the economy

Image: Banks should be able to raise additional equity capital from the market.Photographs: Reuters Arvind Panagariya

For some specific banks, this proportion is much higher. This vulnerability has led to a slowdown in the flow of credit and therefore a sharp decline in the corporate investment.

Solution to the problem will be either an infusion of capital or relaxing the limits on private equity so that the banks can raise additional equity capital from the market, or a combination of the two measures.

While these measures can partially revive growth, its long-run sustainability will require a return to the reforms. Rapid growth in the last decade combined with a reform holiday has left the economy with many bottlenecks.

These bottlenecks will have to be systematically addressed in the next five to 10 years to accelerate and sustain growth over then next two decades.

As told to Suman Guha Mozumder/Rediff.com

article