Chances of a rate cut in April improve if core inflation continues to ease, growth falling below the projected 7.2% for FY19 and if the global trade slowdown exacerbates.

Anup Roy reports.

Minutes of the monetary policy committee meeting indicate that there would be more rate cuts in the coming days and the dovish stance would continue for long, economists say.

Disseminating the minutes, released on Thursday, February 21, economists are keying in another 25 basis points cut in the April policy.

MPC member Ravindra Dholakia had suggested cuts of 50 to 60 basis points to spur growth, minutes showed.

The members believe that inflation would remain low in the next 12 months.

Consumers and households are also keying in low prices in the coming days, opening up space for the central bank to cut rates.

'Softer-than-expected January CPI print of 2.05 per cent, MPC's downward revision of 60-80 bps to the MPC's H1FY20 (first half of 2019-20) inflation projections to 3.2-3.4 per cent and the opening up of the output gap have improved the probability of multiple rate cuts in 2019,' Kotak Mahindra Bank said in a report.

According to HSBC, in April, there could be a 25 basis points rate cut as inflation would likely remain 'well under' the 4% mark in the next one year.

The issues affecting the core inflation, such as health and education prices, GST, and crude prices could abate over the next 12 months.

'Once core inflation stabilises from 6 per cent now to the 4.5-5 per cent range, and food inflation begins to normalise, we expect headline inflation to converge gradually towards core, resting at the 4 per cent target one year from now,' HSBC said.

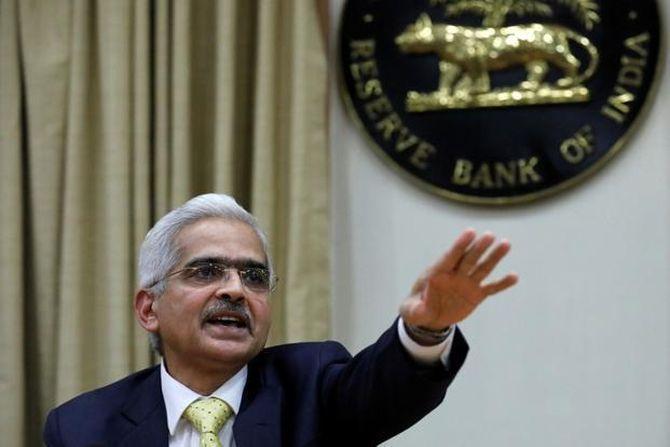

'We fully agree with RBI Governor (Shaktikanta) Das that the time is opportune to seize the initiative and create a congenial environment for growth,' wrote Bank of America Merrill Lynch.

'Lending rates should ease 50 basis points reversing the 30bp hike of 2018, on RBI rate cuts, RBI OMO as well as bank recapitalisation,' Indranil Sengupta of Bank of America wrote.

The transmission of policy rate cuts, though, would be dependent on liquidity support through secondary market bond purchases under the open market operations (OMO), he said.

Gaurav Kapur, chief economist, IndusInd Bank, wrote that the minutes suggest that chances of a rate cut in April improve if core inflation continues to ease, growth falling below the projected 7.2 per cent for FY19 (and this may require cut in cash reserve ratio too), and if the global trade slowdown exacerbates, led by China and the Euro-zone.

A global slowdown would soften oil prices and open up room for cuts.

'Weaker exports and softer oil prices would increase the need for some more monetary easing,' Kapur said.

© 2025

© 2025