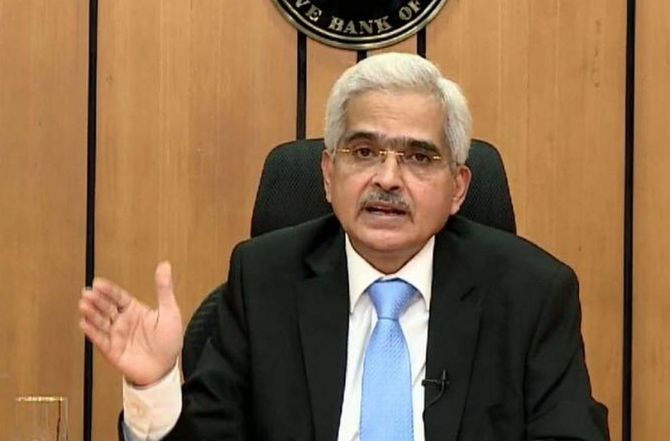

Reserve Bank of India (RBI) Governor Shaktikanta Das has said the decision on interest rate moderation will be based on long-term inflation trajectory and not monthly data.

The Monetary Policy Committee (MPC) headed by the RBI Governor is scheduled to meet between October 7 and 9 and take call on interest rate.

The RBI kept the repo rate unchanged at 6.5 per cent for the ninth time in a row amid risks from higher food inflation.

In the August meeting, four of six MPC members voted in favour of the status quo.

In an interview to CNBC International, Das said the focus will be on the month-on-month momentum -- whether inflation is building up or moderating and the upcoming inflation trajectory will be carefully monitored with a forward-looking approach, and decisions will be made based on that assessment.

"It is not a question that in the current context, like in July, the inflation came to about 3.6 per cent, that is the revised number, and August has come at 3.7 per cent.

So, it is not so much how the inflation is now; we have to look at, for the next six months, for the next one year, what is the outlook on inflation.

"So, therefore, I would like to sort of step back and look more carefully at what is the future trajectory of inflation and growth, and based on that, we will take a decision," he said.

On whether the RBI's Monetary Policy Committee (MPC) will be actively considering a rate cut in early October, Das replied, "No, I can't say that."

"We will discuss and decide in the MPC but so far as growth and inflation dynamics are concerned, two things I would like to say.

"One, the growth momentum continues to be good, India's growth story is intact and, so far as inflation outlook is concerned, we have to look at the month-on-month momentum," he said, adding that based on that a decision will be taken.

Das further said the rupee has been one of the least volatile currencies globally, especially since the beginning of 2023.

"The rupee has been very stable vis-a-vis the US dollar and the volatility index," he said.

Asked why the RBI had not allowed more volatility in the rupee, the governor said, "If you allow volatility, whom does it benefit? It does not benefit the economy. So why would we allow volatility?"

He further clarified that while fluctuations in exchange rates are natural, excessive volatility would be damaging.

"Our stated policy is to prevent excessive volatility of the rupee," he said, adding that maintaining a stable rupee instils confidence in the market, investors, and the broader economy.

Das further remarked that the RBI is committed to maintaining financial stability and the bank will take steps to ensure this.

© 2025

© 2025