Those willing to take a higher risk for higher returns can look at AAA-rated non-convertible debentures from reputed issuers, says Tinesh Bhasin.

Illustration: Uttam Ghosh/Rediff.com

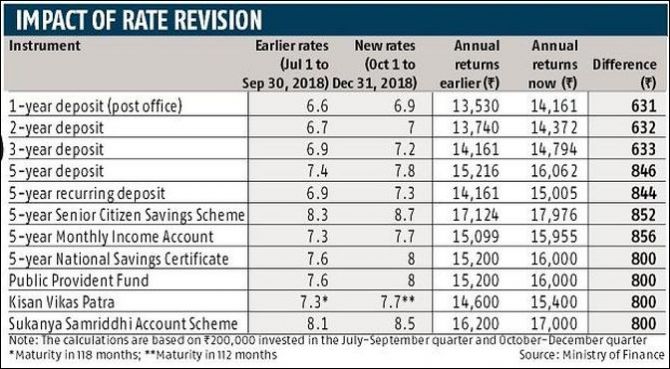

For those seeking the comfort of sovereign guarantee and the best return, the post office has once again become an attractive investment after the rate revision.

Those willing to take a higher risk for higher returns can also look at AAA-rated non-convertible debentures from reputed issuers.

Recently, Tata Capital and Indiabulls Commercial Credit raised money offering between 8.8 and 9.2 per cent coupon rates, depending on the tenure.

Experts say there are more NCDs in the offing.

Salaried class looking to create a retirement corpus can expect better returns by contributing more towards voluntary provident fund (VPF) than investing in the public provident fund (PPF).

Last year, the Employees Provident Fund had declared 8.65 per cent interest rate on EPF.

PPF now fetches 8 per cent. PPF remains a suitable option for the self-employed.

Increased annual returns (in the table) may look low. But can have significant impact on returns over the long term.

© 2025

© 2025