'The huge amount of investments being made by telcos in India for telecom gear, there is no way this demand could be met only by Europeans.'

'The Chinese are quick in installation and offer great value for money.'

Surajeet Das Gupta reports.

Debt-laden telecom service providers, fighting a bruising battle in the marketplace, love them.

That is why the Cellular Operators Association of India shot off a letter to the Department of Telecom vigorously defending Huawei and urging the government not to take any 'arbitrary' action in banning the equipment manufacturer.

Chinese equipment players offer them equipment 30% cheaper than the Europeans, throw in extended free maintenance schemes and even rope in their country's banks to provide cheap long-term loans, they say.

Ban them and capital costs will shoot up.

Taking them on are Indian telecom equipment manufacturers.

Despite all the noise about 'Make in India' by the government, these players are losing out to Huawei and ZTE even in tenders floated by public sector units such as BSNL.

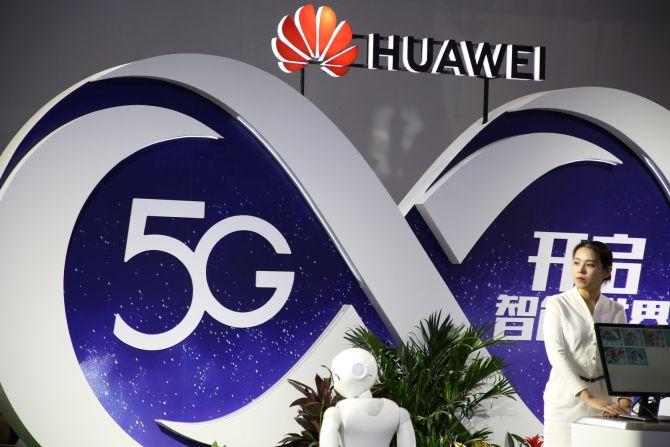

Indeed, despite the worldwide concerns about security that has ratcheted up tensions between the US and China following the arrest of the company's CFO who is also the founder's daughter, the government has taken a clear call to stick with Huawei -- and DoT has invited the Chinese company for 5G trials, which begin next year.

But the relentless global attack against Chinese telecom equipment companies -- apart from Huawei, ZTE was banned by the US government until the two countries came to an agreement earlier this year -- is raising the stakes on such fidelity.

More so given the growing number of countries, from the US and Australia to New Zealan, imposing bans or restrictions on the use of Huawei's 5G telecom equipment.

It is no surprise, then, that Indian manufacturers should be at the forefront of the anti-Huawei lobby.

Fighting a losing battle to the Chinese majors, especially in bread-and-butter government contracts, some of them are already considering closing shop.

It's a non-level playing field, they say which is why the Telecom Equipment and Services Export Promotion Council, a government-promoted export promotion body, has written to National Security Advisor Ajit Doval asking that India replicate the restrictions imposed on Huawei and other Chinese manufacturers that other countries have.

Lending support to their move is the Telecom Equipment Manufacturers Association of India.

Its Chairman Emeritus N K Goyal has urged the government to review the policy of procuring telecom and information technology equipment from Chinese companies 'in the national interest'.

India's concerns about Chinese telecom equipment is not new, but the action against them has been desultory.

In 2010, the government directed BSNL not to allow Huawei and ZTE to bid for 5.5 million GSM mobile lines, especially those near international borders.

It also rejected many contracts signed between the Chinese and private telcos on grounds that the equipment might contain spyware.

This restriction was scrapped within months after the government tightened the rules for telecom equipment imports that required suppliers to allow inspection and share equipment design as well as its source codes to pre-empt security issues.

Such was the competitive strength of the Chinese suppliers that BSNL challenged a decision by the customs department in Chennai in 2013 to impose anti-dumping duties on some of its equipment.

Yet, just a year later the BSNL site was hacked, underlining concerns on safety of the network.

So why has India gone soft on Chinese telecom players?

Prices and easy financing remain the compelling motivation, but so is their ability to make equipment to any specifications, which European telcos have found difficult to match.

With around 30% of the 4G market, India is one of the largest overseas markets for China.

"Considering the huge amount of investments being made by telcos in India for telecom gear, there is no way this demand could be met only by Europeans. The Chinese are quick in installation and offer great value for money," says a senior telecom executive.

For 5G there is an added dimension -- unlike earlier generations of telecom technology, the Chinese have made significant progress and, many say, are well ahead of giants like Nokia or Ericsson (the Europeans dispute this).

And the US lacks an equipment supplier worth the name.

Understandably, the world's most powerful country fears that the architecture of 5G makes it more vulnerable to security breaches which could spell disaster in this connected Internet of Things.

The country's power grid could collapse, for instance, or defence installations breached.

Given the rivalry between the extant superpower and emerging one, the US fears that the Chinese government could force companies like Huawei to not only spy but disable communications and even organise cyberattacks.

Huawei India CEO Jay Chen insists that most of the concerns have no basis.

The roll-out of 5G, he says, will require a global supply chain in which all equipment and software, irrespective of origin, will have to incorporate in-built securities based on standards laid down by the special group set up for this purpose in the Third Generation Partnership Project (3GPP).

This has been constituted by seven global telecommunication standards organisations.

Says Chen: "The intent of all this is to ensure that no entity can control the system and the in-built security measures are designed to make the system compliant with the standards."

These standards are aimed at making 5G more secure than 4G, with higher protection on customer identification, interconnection between carriers and superior encryption.

The second myth is on pricing.

Chen points out they are already technology leaders, and no longer the price leader in the market.

"Because of the profitability challenges and the need to bring enhanced solutions in India, we are becoming commercially less competitive," argues Chen.

COAI says apart from international standards that are being worked out to make 5G secure, India has incorporated safeguards in its licence terms as well as through frequent audits by DoT, which ensure that there are few security risks.

For the government, the challenges flow from the fact that Chinese companies work in tandem with their government that go beyond DoT's narrow concerns.

It is on Raisina Hill, therefore, that the solution to this conundrum lies.

© 2025

© 2025