If all 102 grounded planes could fly, there will theoretically be 400 more Delhi-Mumbai flights every day.

Aviation is one of the sectors that lost no time in taking off after the pandemic.

Naturally, airlines are in a rush to increase flights, expand networks, and augment capacity.

However, they are hobbled by the aircraft in their fleet that remain 'grounded'.

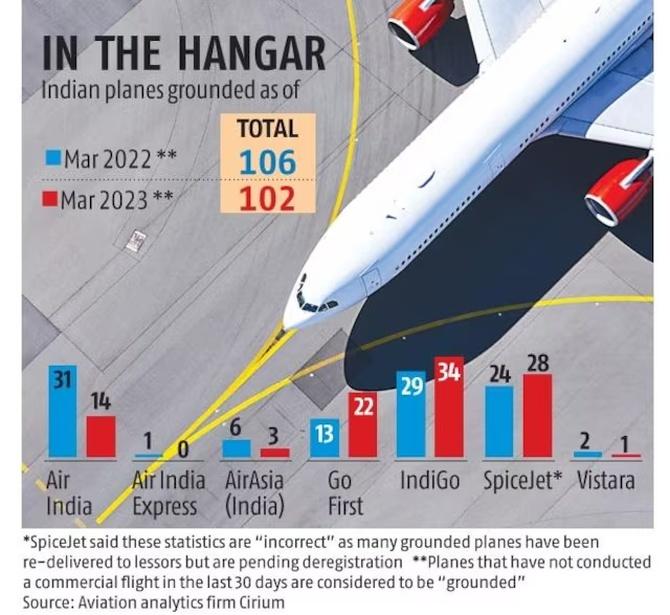

Data from aviation analytics firm Cirium shows 102 commercial aircraft are still grounded in India.

Given that a fully functional narrow-body plane, the most common on India's domestic routes, can make at least four flights a day of two hours in duration, theoretically we are talking more than 400 more flights every day between Delhi and Mumbai that could have been.

This is not a flight of fancy.

The number of domestic air passengers soared 47 per cent in 2022 and, at just 14 per cent less than 2019, is now within striking distance of the pre-Covid traffic, shows data from the Directorate General of Civil Aviation, the industry regulator.

Add to that the rising international traffic and the increasing share of Indian carriers in it.

In October-December 2022, the number of passengers flying into or out of India nearly doubled to 14.5 million, of which Indian carriers had a share of more than 43 per cent.

Indian air carriers are not unfamiliar with the problem of grounded aircraft, defined as one that has not flown in 30 days.

There were 106 of them a year ago as well. However, back then, aviation was still taking unsteady steps out of the pandemic, after the government allowed carriers to operate at full capacity from October 18, 2021.

It is now, as traffic surges, that grounded planes weigh airlines down like never before. This is driving them to turn every stone in search of solutions.

IndiGo has 34 of its planes grounded, about 11 per cent of its fleet, of which 31 are stuck due to delays in supply of engines by Pratt and Whitney.

Unfazed, an IndiGo official who did not want to be named said: "We are operating 18 per cent more flights now than a year ago."

That may have been possible because the airline has increased its fleet to 304 from 278 a year ago. In 2019, it moved from Pratt and Whitney to CFM for engines.

An IndiGo spokesperson told Business Standard: "We continue to receive new aircraft and also a supply of refreshed engines, albeit slower than what is required."

Pratt and Whitney did not respond to queries from Business Standard.

IndiGo is not taking things lying down, actively seeking compensation for grounded planes and getting some.

'We are working with engine makers to get some relief. Some of the compensation has already come in this quarter. We continue to keep working with them to get adequately compensated,' Chief Financial Officer Gaurav Negi said during a recent analyst call.

IndiGo, though, is the largest Indian carrier by far.

Smaller airlines, such as Go First, have a tougher task at hand with 22 of its 55 planes grounded, compared to 13 a year ago.

All 22 are powered by Pratt and Whitney engines. Go First's flight network has shrunk by a fourth in just one year to 1,536 flights a week.

Industry sources said Go First is considering legal action against Pratt and Whitney for failing to provide compensation after March 2020 for planes grounded due to engine supply delays.

For SpiceJet, this is the proverbial double whammy.

Cirium data shows 28 of its fleet of 90 or so planes are grounded.

The airline's spokesperson said this was "incorrect", adding: "Many of the grounded planes have been redelivered to lessors but are pending deregistration" and "a few of our aircraft are on the ground awaiting spares".

SpiceJet has been dealing with a shortage of funds, leading to delays in payment of dues to entities such as aircraft lessors.

Last month, its board restructured dues of more than $100 million to Carlyle Aviation Partners by giving the aircraft lessor a 7.5 per cent stake in SpiceJet and compulsorily convertible debentures in its cargo subsidiary.

"While supply chain issues have affected the availability of some aircraft, our flights have constantly increased with each aircraft addition, and there has been no impact on our operations," the SpiceJet spokesperson said.

Cirium data, on the other hand, says SpiceJet's flight network shrunk by a third in the last one year.

Last month, SpiceJet said it had not been operating various aircraft due to 'technical reasons', and despite its inability to undertake revenue operations, it continued to incur various costs related to these aircraft.

It is not just the engines, a scarcity of engine spare parts in the global market has aggravated the situation for all carriers, according to industry sources.

Rising over these issues is Air India, which the government handed over to the Tata Group in January 2022.

It has been buying spare parts and putting more and more planes back into service, reducing the number of its grounded aircraft to 14 from 31 a year ago.

As a result, Air India's flights have increased by a third in the last one year to 2,816 a week.

"As more aircraft have been brought into service, our network operations as well as density on existing routes have increased," said a spokesperson for Air India.

It was recently in the news for ordering a record 470 new planes from Boeing and Airbus.

Feature Presentation: Rajesh Alva/Rediff.com

© 2025

© 2025