Private sector employees will soon get the declared interest rate of 8.5 per cent on their Employees' Provident Fund (EPF) savings for the financial year 2019-2020 at one go.

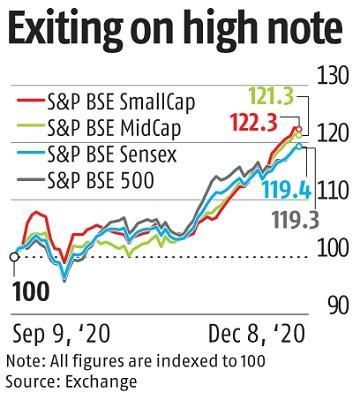

The current bull market prompted the Employees' Provident Fund Organisation (EPFO) to offload its equity investments and gain higher-than-expected returns in December -- leaving it with double the surplus projected three months back, a senior EPFO official said, requesting anonymity.

Following the development, the Union labour and employment ministry has written to the finance ministry, seeking 8.5 per cent interest to be credited into around 190 million EPF accounts for 2019-2020.

"The labour ministry has proposed to notify the interest rate at one go now," a top government official said.

The EPFO's central board of trustees led by Labour and Employment Minister Santosh Kumar Gangwar had in September announced that the organisation would be crediting the interest in two instalments for the first time due to the COVID-19 pandemic's impact on its income.

The EPFO had decided that 8.15 per cent interest from its debt income would be credited immediately and the remaining 0.35 per cent capital gains from the equity sale would be given later, subject to its redemption.

However, the EPFO decided to wait till December to examine its equity returns before crediting interest.

"Patience paid off well for us. Though it has taken a bit longer to credit interest to subscribers, the good news is that the EPFO has received higher income from the sale of exchange traded funds (ETFs) now," the EPFO official said.

"With an interest rate of 8.5 per cent now, we will be left with a huge surplus of around Rs 1,000 crore," the EPFO official added.

The EPFO had projected a surplus of Rs 500 crore in September, when it had decided to credit interest to subscribers in two tranches.

"The return on ETF investments is so healthy that we can easily give up to 8.6 per cent interest rate to our subscribers, but since the trustees have decided to credit 8.5 per cent for this year, we will stick to it and carry forward the higher surplus to the next fiscal year," the official cited above said.

The EPFO had expected to redeem its ETF investments made in 2016 for FY20 and gain around Rs 2,800 crore from it.

This transaction was supposed to take place in March 2020.

However, in view of the unprecedented sell-off in March, triggered by the COVID-19 pandemic, the EPFO decided not to sell its ETF investments then, even though it had announced the interest rate of 8.5 per cent on March 5, factoring in the return from its equity investment.

At 8.5 per cent, the interest rate for EPFO subscribers would be at a seven-year low.

Subscribers got 8.65 per cent interest rate in the previous financial year.

The EPFO invests up to 15 per cent of its incremental corpus in ETFs.

In FY20, the EPFO's equity investments accrued a return of minus 8.3 per cent, down from 14.7 per cent in FY19.

In FY20, the benchmark Sensex dropped 24 per cent, its worst showing in a decade due to the sell-off in March after the pandemic hit the country.

Feature Presentation: Aslam Hunani/Rediff.com

© 2025

© 2025