'Sectors like airlines and hotels are directly affected. Also, cyclicals like metals and oil exploration companies have been the most impacted.'

Joydeep Ghosh, Sanjay Kumar Singh and Bindisha Sarang report.

Retail investors would be at their wits' end after the Bombay Stock Exchange Sensitive Index, or Sensex, tanked as much as 3,000 points on Thursday.

And no one knows when this rout will stop.

"Many people are comparing this with the 2008-09 crisis, but that was a financial sector crisis. Things are different this time. Our economy was already in the slow lane, and this global pandemic and crude oil will hurt many sectors very badly," says a fund manager.

We also have the additional headwinds like the YES Bank crisis that will hit both customers and creditors.

Says Harsha Upadhyaya, chief investment officer (equity), Kotak Asset Management Company: "It is a situation of extreme panic. But we do see markets getting spooked by these kinds of events every 5-10 years. Locally, we had slower growth and stress in the financial system. We also had the developments at YES Bank. But the primary issue that has taken the market down is the spread of the coronavirus and the kind of selling that we have seen from foreign institutional investors. Until the third week of February, they had been investing in the Indian market consistently. But as the coronavirus spread in the US and Europe, they started pulling out."

Interestingly, a couple of months back, things were completely different.

As Nilesh Shetty, associate fund manager (equity) at Quantum Mutual Fund, puts it: "Last year or even a couple of months ago, markets were doing so well that someone who wanted to book profits could have done so easily. Everybody knew the market was expensive, but for some reason believed it will not go down."

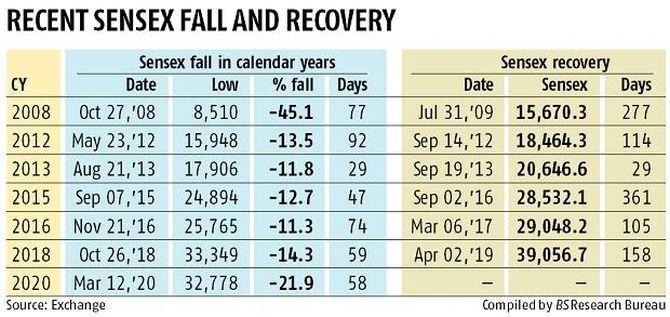

The Sensex is down a whopping 21 per cent since the beginning of the calendar year, which means we are officially in a bear market now.

In such circumstances, there are two things you can do.

As Mukesh Dedhia, director, Ghalla and Bhansali Securities, says: "If you need money in the short term, just sell immediately. Don't think that things will improve tomorrow because there is an overall downside trend. However, if you don't need the money immediately, continue to hold on."

Rajeev Thakkar, chief investment officer, PPFAS MF, has this advice for direct stock investors: "The economic slowdown will be harmful for fragile companies. So, stay away from highly-leveraged companies in sectors affected by the virus impact. Sectors like airlines and hotels are directly affected. Also, cyclicals like metals and oil exploration companies have been the most impacted."

Currently, according to Upadhyaya, the three-year returns are almost negative even in large-cap funds and five-year returns are in marginal single digit.

"Historically, we have seen that in periods of time when there is extreme panic and nervousness, if one holds on to stocks or mutual funds, or invests further, one earns great returns. Usually, markets do not sustain at such levels and they usually bounce back," he says, adding it would not be a bad time to make a lump-sum investment as there has been a massive correction in valuations.

Adds Shetty: "If you have a slightly longer term view and can ignore the noise that could happen over the next one- two months, this will be a great time to go ahead and allocate money to equity markets. Since no one can predict how low the market can fall, it will be better to stagger the investment. You should start now, if you want to begin allocating money."

For an investor through the systematic investment plan route, timing does not matter so much.

But starting now, when markets have corrected significantly, would make great sense.

Even if the market falls further, the number of units that he will get from his next purchase will be much more.

And these very units will improve returns substantially in the future.

© 2025

© 2025