The combined net profit of software and FMCG companies was up 6.9 per during the April-June 2019 quarter against a 10.1 per cent decline in the combined earnings of top listed companies, ex-financials and oil and gas.

Krishna Kant reports.

As the economic slowdown hits more sectors, software exporters and fast-moving consumer goods (FMCG) companies have emerged as a safe haven for investors, with steady growth in revenues and profits.

It has also helped that most of the top companies in these sectors, such as Tata Consultancy Services, Infosys, Wipro, HCL Technologies, ITC, Hindustan Unilever, Nestle, Britannia, and Colgate Palmolive, are debt-free.

This means there is no balance sheet risk for investors.

The combined net profit of software and FMCG companies was up 6.9 per during the April-June 2019 quarter against a 10.1 per cent decline in the combined earnings of top listed companies, ex-financials and oil and gas.

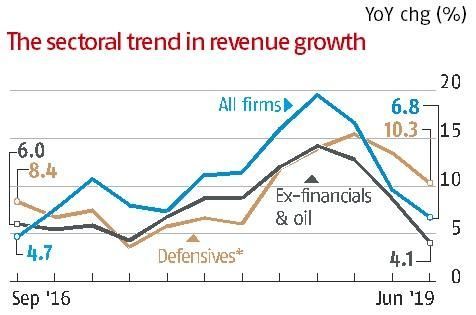

These defensive sectors also grew faster, with combined net sales of software and FMCG companies up 10.3 per cent YoY during the quarter under review, compared to 4.1 per cent growth reported by others.

These two defensive sectors together accounted for nearly 40 per cent of the combined net profit of all companies, ex-financials and energy, during the first quarter of 2019-20, up from 34.1 per cent a year ago and 36.5 per cent during in the March 2019 quarter.

Their revenue share is now at a four-year high of 16.4 per cent.

Top companies in these sectors have outperformed during the current sell-off on Dalal Street.

For example, in the last one month, the BSE FMCG index is down only 1.7 per cent, while the BSE IT index is down only 0.2 per cent, against 4.1 per cent correction in the Sensex.

Many analysts expect both sectors to fare better than the rest of corporate India if the earnings slowdown lasts longer.

"We remain overweight on consumer stocks, especially FMCG stocks, as they would be chief beneficiaries of any fiscal stimulus by the government," said Dhananjay Sinha, strategist and chief economist, IDFC Securities.

Software exporters are expected to gain from the depreciation in the rupee against the dollar, rising contribution from the digital business, and large deal wins in the recent quarters.

"IT exporters are expected to do better than the domestic market-focused companies but growth is accruing largely to top-tier firms," said G Chokkalingam, founder and managing director, Equinomics Research & Advisory Services.

The sector, however, faces challenge from a growing mismatch between volume growth and employee cost, leading to a steady decline in the industry's margins.

Salary and wages now take away 54.2 per cent of the industry's net sales on average up from 52.7 per cent a year ago and nearly 50 per cent three years ago.

The combined net profit of all 1,637 companies in our sample was up 7 per cent YoY during the first quarter to against 8.4 per cent YoY growth a year ago and 31.9 per cent YoY growth during the March 2019 quarter.

Combined revenues were up 6.8 per cent YoY, growing at the slowest pace in 11 quarters.

Public sector banks (PSBs) and retail non-bank lenders such as HDFC and Bajaj Finance were the largest contributor to incremental growth in earnings during the quarter.

Quite a few PSBs turned profitable during the quarter, leading to a nearly Rs 21,000-crore positive swing in the industry's combined net profit on a YoY basis during the quarter.

Some of the PSBs turning around during the quarter were State Bank of India, Punjab National Bank, Allahabad Bank, Central Bank of India and United Bank among others.

Listed airlines InterGlobe Aviation and Spice Jet also reported a sharp turnaround in profitability during the quarter thanks to gains from the closure of Jet Airways.

The industry reported combined net profit of Rs 1,472 crore against Rs 55 crore a year ago.

Other top performers during the quarter include cement makers, pharmaceutical companies and sugar companies, besides FMCG and IT exporters.

In contrast, telecom operators, oil and gas companies, auto and auto ancillary manufacturers, metal and mining companies and capital goods makers were the biggest laggards during the quarter.

Companies in these sectors either reported losses or YoY contraction in earnings.

For example, telecom operators have now reported losses in 10 consecutive quarters -- the longest money-losing streak for any major sector in recent memory.

While analysts rule out an immediate turnaround in corporate earnings, they feel top software and FMCG companies could provide a floor to earnings and the broader market given their rising share.

*Combined numbers for FMCG and software exporters / Note: Change in total income for all companies and net sales for others / Source: Capitaline.

© 2025

© 2025