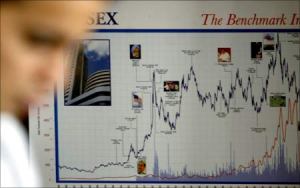

The benchmark indices ended weak despite the robust IIP data for November and better-than-expected results declared by Infosys.

The benchmark indices ended weak despite the robust IIP data for November and better-than-expected results declared by Infosys.

Fears that the central bank will tighten monetary policy at its next policy review meeting on January 29 dented the sentiment on the Street.

The Sensex ended at 17,422, lower by 104 points and the Nifty closed at 5210, down 39 points. The mid-cap and small cap indices caved in to selling pressure as well, surrendering more than 1% each.

The industrial output in November grew at its fastest pace in two years. The Index of Industrial Production numbers surged by 11.7 per cent in November 2009 as against 2.5 per cent in the corresponding period of the previous year, fuelled by the demand for manufactured goods.

Manufactured goods, which have around 80 per cent weightage in the index, rose by 12.7 per cent in November 2009 from 2.7 per cent in the same month a year ago. The mining output was up 10% and power generation rose 3.3% during the same period.

The industrial output growth in the fiscal year to March 2010 will be higher than 2.6% recorded in 2008/09, the deputy chairman of Planning Commission Montek Singh Ahluwalia said.

And Infosys surpassed street expectations to report a 3.6 per cent decline in net profit to Rs 1,582 crore (Rs 15.82 billion) and a reduction of nearly 1 per cent in total income to Rs 5,741 crore (Rs 57.41 billion) for the third quarter ended December 31, 2008.

The fears on the interest rate front took a toll on rate sensitive-sectors such as realty and banking. DLF was the top loser on the BSE, weakening by nearly 4% at Rs 383. ICICI Bank lost 3.1% at Rs 841 and SBI shed 2.87% at Rs 2203.

Tata Steel was another significant loser, correcting by 3.4% at Rs 626. Besides, telecom major, Bharti Airtel lost 2% despite announcing plans to acquire 70% stake in Bangladesh-based, Warid Telecom, for $300 million.

And India's largest private sector company by market capitalisation, Reliance Industries Limited ended flat at Rs 1083. The stock had lost 1.85% on Monday after the firm raised $763 million through a block sale of 3.3 crore (33 million) shares.

The IT stocks had a field day. Infosys ended higher by nearly 4% at Rs 2587. And the positive sentiment rubbed onto the other software stocks. Wipro emerged as the leading gainer on the Sensex, strengthening by 4.8% at Rs 694 and TCS closed up 4.8% at Rs 749.

The mid-cap IT stocks were not to be left behind. HCL Technologies, MphasiS and Oracle rallied around 2% each.

The market breadth was weak. Out of 2990 stocks traded on the BSE, there were 1080 advancing stocks as against 1848 declines.

SBI topped the value charts on the BSE with a total turnover of Rs 142.21 crore (Rs 1.42 billion). This was followed by Infosys (Rs 141.22 crore), Reliance (Rs 137.53 crore or Rs 1.37 billion), Tata Steel (Rs 115.93 crore or Rs 1.15 billion) and DLF (Rs 81.25 crore or Rs 812.5 million).

Unitech led the volume charts with trades of 12.71 million. It was followed by IFCI (8.62 million), Suzlon (8.31 million), Ispat (5.68 million) and Reliance Natural Resources (3.84 million).

© 2025

© 2025