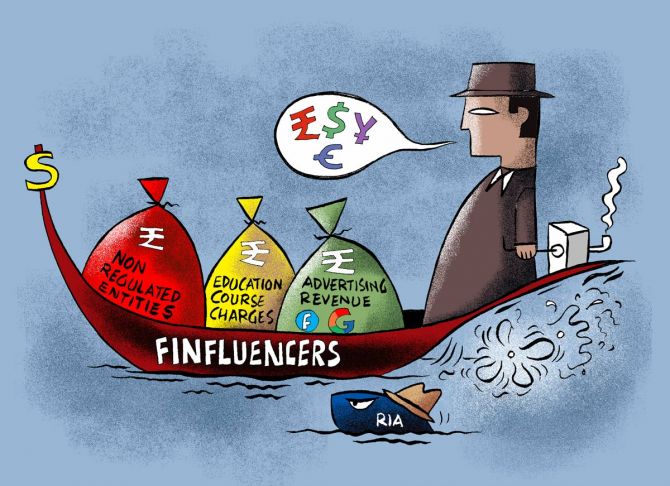

Sebi has barred Ravindra Bharti Education Institute, co-founded by finfluencer and YouTuber Ravindra Balu Bharti, from the securities market and directed to deposit Rs 12 crore "unlawful gain" earned from the alleged unregistered investment advisory business.

It has been directed to deposit the amount to an interest-bearing escrow account created specifically for the purpose in a nationalised bank.

Additionally, the regulator has barred Ravindra Balu Bharti, his wife Shubhangi Ravindra Bharti and directors -- Rahul Ananta Gosavi and Dhanashri Chandrakant Gosavi -- from the securities market.

Also, these persons have been restrained from associating themselves with any intermediary registered with Sebi in any capacity.

Ravindra Bharti Education Institute Pvt. Ltd. (RBEIPL) was founded in 2016 by Ravindra Balu Bharti and his wife.

The company claims to be primarily involved in imparting training or education related to stock market trading activities.

In its interim order issued on Friday, the regulator noted Ravindra Bharti Education Institute was involved in imparting advice relating to investing in, purchasing, selling or otherwise dealing with insecurities or investment products in lieu of consideration.

Investors were lured to take the advisory services by projecting returns in the range of 25 per cent to 1,000 per cent.

It further noted that Ravindra Bharti Education Institute was providing investment advisory services, without obtaining registration from Sebi, which is in violation of regulatory norms.

"An amount of Rs 12,03,82,130.91 being the total unlawful gain earned from the alleged unregistered investment advisory business, shall be impounded from Noticee no. 1 (Ravindra Bharti Education Institute)," Sebi said.

Further, these entities have been directed "to cease and desist from offering investment advisory services from acting as or holding themselves out to be investment advisors".

In October 2023, Sebi clamped down on unauthorised investment advisory services offered in the name of 'Baap of Chart' and barred three entities from the securities market and ordered impounding illegal gains worth over Rs 17 crore.

© 2025

© 2025