The Centre has garnered around Rs 2,500-3,000 crore in the first five weeks after it imposed a windfall tax on oil and gas companies for the export of fuel, Business Standard has learnt.

It is likely that the government will continue with the one-time tax till the Indian crude basket is above $80 a barrel, sources said.

The next review of the windfall tax on oil companies is early next week.

The average price of the Indian crude basket has averaged $98.29 a barrel so far in August.

“Till the first week of August, we have got about Rs 2,500-3,000 crore,” a top government official said.

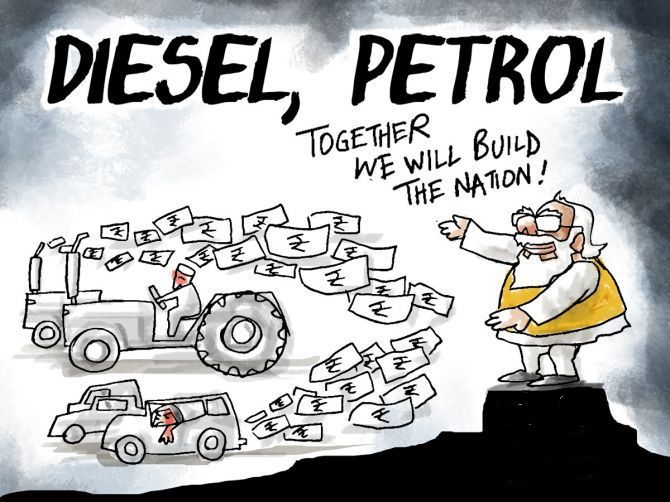

On July 1, the government had announced a windfall tax on upstream oil production of Rs 23,250 per tonne, an export tax on petrol of Rs 6 per litre, on diesel of Rs 13 per litre, and on aviation turbine fuel of Rs 6 per litre.

This was in light of high crude prices due to the war in Ukraine.

After a review, on July 20 the Centre lowered the windfall tax on upstream oil production to Rs 17,000 per tonne, scrapped the petrol export tax, and reduced the export tax on petrol and diesel to Rs 10 per litre and on ATF to Rs 4.

It also exempted the export of petroleum products from units located in special economic zones (SEZs) from the windfall tax. According to analysts, this move provided significant relief to Reliance Industries (RIL), 55 per cent of whose refining production comes from its two refineries located in SEZs at Jamnagar in Gujarat, from where a majority of products are exported.

Other beneficiaries included the government-owned Oil and Natural Gas Corporation (ONGC) and Oil India.

JP Morgan in a report said the revision in taxes would result in revenue foregone of Rs 67,600 crore.

Moody’s had earlier estimated that the government might generate Rs 94,800-crore revenue from the windfall tax after it was imposed on July 1.

However, government officials believe these numbers are too optimistic, and since crude prices are cooling because of fears of a recession in advanced economies, the windfall tax could also be reduced after every review and withdrawn eventually.

© 2025

© 2025