There has thus been a rise in the demand for animal products like camel's milk (for the lactose intolerant) to plant-based products like soy milk and almond milk for vegans. And as more consumers queue up for ‘non-dairy’ dairy products, brands are also milking the trend, says Vinay Umaji.

For years, milk has been a cultural symbol of prosperity and nourishment in the country.

Poets, politicians and industrialists have drawn upon its eloquent imagery to make a point, drive an agenda or build a business.

But now as a group of consumers, driven by environmental and health concerns, gets more vocal and demonstrative about their concerns over milk and milk-based products, there is a shift in the way big and small brands are approaching the country’s dairy market.

Change has been imminent for a while, with a number of homegrown labels from the metros using the bustling e-commerce network in the country to serve a select clientele that sought to move out of cow and buffalo milk.

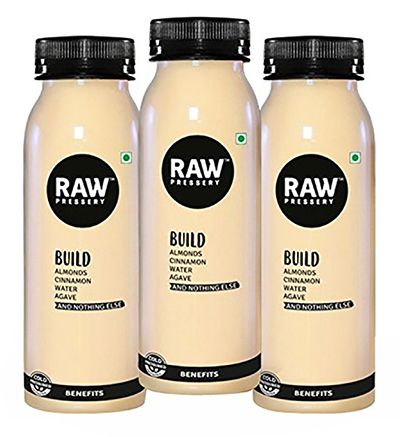

For example, Goodmylk, a Bengaluru-based start-up that sells lactose-free, vegan milk, curd and mayonnaise and Raw Pressery that retails coconut almond and almond milk -- both served a small group of consumers before taking the brand to a larger market. And

log on to any of the e-grocers or step into the large retail chains and the shelves are overflowing with non-milk dairy alternatives.

According to health surveys, a Raw Pressery spokesperson said, it is believed that three out of four persons in India are lactose intolerant. This makes roughly 75 per cent of the population incapable of consuming conventional dairy products like cow and buffalo milk.

Add to this, health and fitness concerns fuelling a vegan lifestyle, in urban and semi-urban areas, and the demand for alternatives to traditional dairy has risen sharply.

There has thus been a rise in the demand for animal products like camel's milk (for the lactose intolerant) to plant-based products like soy milk and almond milk for vegans. And as more consumers queue up for ‘non-dairy’ dairy products, brands are also milking the trend.

Sample this: According to Euromonitor International, the organised soy drink market has grown from Rs 90.5 crore in 2016 to Rs 125.2 crore in 2018 and is expected to grow at a compounded annual growth rate of 14.3 per cent between 2018 and 2023, at par with the projected 14.7 per cent CAGR for conventional organised milk market.

Rising health awareness has also led to a focus on product innovation, with manufactures adding more ingredients to their products, such as almonds, other nuts or dried fruits, to enhance their health credentials.

In addition, technological advancement in terms of product storage and hygiene has improved the shelf life of these products, "enabling retailers to store them for a longer period of time and facilitating transportation to rural areas so as to increase penetration,” said an analyst at Euromonitor International.

It comes as no surprise then that the largest dairy co-operative in the country, Gujarat Co-operative Milk Marketing Federation, owners of the Amul brand, has launched camel milk and added alternatives for the lactose intolerant to its stock keeping units.

The first mover advantage goes to Rajasthan-based Aadvik Foods, which has been tapping urban centres like NCR, Mumbai, Hyderabad, Bengaluru and Chennai with its fresh camel milk sold in frozen state as well as powdered milk online. Rising number of takers, especially diabetes patients, has meant that Aadvik Foods is now ramping up its production by 25-30 per cent.

“Nowadays due to more and more diagnosis of lactose intolerance, many cannot have regular milk. Also, vegan diets in urban areas are on the rise. This has led to growth in demand for dairy alternatives. When we started in 2016 we sold one litre a month, now we are able to sell 8000-10000 litres a month. Camel (milk) now accounts for 4 to 5 per cent of total animal-based dairy,” said Hitesh Rathi, founder of Aadvik Foods.

Raw Pressery, primarily a fresh juice brand, has also launched its dairy free almond milk (2018) and is currently growing its presence across retail and online channels. So much so, the Raw Pressery Almond Milk is now its leading SKU amidst its product portfolio.

“More and more people are making the shift to plant-based products. Raw Pressery in its direct to home business has significant number of subscribers for the Plain (unsweetened) version of Almond Milk,” a Raw Pressery spokesperson stated.

While changing customer lifestyles have encouraged brands to focus on their niche portfolios more keenly; the retail landscape -- with the deepening footprint of online marketplaces and the aggressive expansion among offline retailers -- is also helping dairy alternatives find mainstream relevance.

.jpg)

© 2025

© 2025