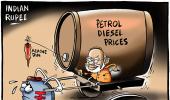

Petrol price will be hiked by over Rs 2.5 per litre and diesel by more than Rs 2.3 after Finance Minister Nirmala Sitharaman on Friday raised taxes on the fuels to part-fund her Budget for 2019-20.

Sitharaman raised excise duty and road and infrastructure cess on the auto fuels by Rs 2 per litre each to raise over Rs 28,000 crore.

Post considering local sales tax or value added tax (VAT), which is charged after adding central excise duty on base price, the increase in petrol price would be over Rs 2.5 per litre and that on diesel would be Rs 2.3.

On Friday, a litre of petrol costs Rs 70.51 in Delhi and Rs 76.15 in Mumbai. Diesel is priced at Rs 64.33 a litre in Delhi and Rs 67.40 per litre in Mumbai.

Also, the finance minister has levied Re 1 per tonne customs or import duty on crude oil. India imports more than 220 million tonnes of crude oil; and the new duty will give the government Rs 22 crore additionally.

At present, the government does not levy any customs duty on crude oil. Only a Rs 50 per tonne national calamity contingent duty (NCCD) is charged.

"Crude prices have softened from their highs. This gives me a room to review excise duty and cess on petrol and diesel. I propose to increase Special Additional Excise duty and Road and Infrastructure Cess each by Rs 2 a litre on petrol and diesel," she said in her budget speech.

Petrol currently attracts a total excise duty of Rs 17.98 per litre (Rs 2.98 basic excise duty, Rs 7 special additional excise duty and Rs 8 road and infrastructure cess).

On diesel, a total of Rs 13.83 per litre excise duty is charged (Rs 4.83 basic excise duty, Rs 1 special additional excise duty and Rs 8 road and infrastructure cess).

On top of these, VAT is charged which varies from state to state.

In Delhi, VAT is levied at the rate of 27 per cent on petrol and 16.75 per cent on diesel. In Mumbai, VAT on petrol is 26 per cent plus Rs 7.12 a litre additional tax while diesel attracts 24 per cent sales tax.

Import of petrol and diesel attracts customs duty equivalent to the total levy of excise. But the government has, with effect from July 6, removed Rs 9 a litre import duty equivalent to road and infrastructure cess.

The Modi government had, in its first term, only twice cut excise duty on petrol and diesel but raised it nine times. The last time, the duty was revised in October 2018 when excise duty was lowered by Rs 1.50 a litre each on petrol and diesel. It had in October 2017 cut the same by Rs 2 a litre.

The BJP-government at the centre had raised excise duty on petrol by Rs 11.77 a litre and that on diesel by Rs 13.47 a litre in nine instalments between November 2014 and January 2016 to shore up finances as global oil prices fell.

Hindustan Petroleum Corporation, Bharat Petroleum Corporation and Indian Oil Corporation shares were down after imposition of special additional excise duty on petrol and diesel.

IOC closed 2.84 per cent lower at Rs 152.10, HPCL fell 0.71 per cent at Rs 286.60 and BPCL shed 2.80 per cent to Rs 369.35 on the NSE.

© 2025

© 2025