A decline in demand from six of India’s top 10 import partners -- China, Saudi Arabia, Iraq, South Korea, Australia, and Singapore -- resulted in India’s imports hitting a 17-month low of $50.6 billion in January, showed the data compiled by the department of commerce.

Shipments from South Korea, Australia, and Singapore declined by 14.1 per cent, 26.7 per cent, and 9.8 per cent, respectively.

Among the 10, growth in inbound shipment was seen only in the case of the United Arab Emirates (12.1 per cent), the US (27.4 per cent), Russia (297.4 per cent), and Indonesia (22.9 per cent).

These 10 countries account for over 60 per cent of India’s merchandise imports, according to the data reviewed by Business Standard.

Imports from Russia grew at the fastest pace -- nearly four times -- at $4.48 billion in January as compared to a year ago, ahead of the US and the United Arab Emirates.

This sharp jump was mainly due to the discounted crude oil India buys from Russia.

In terms of value, Russia was the second-largest import partner in January, followed by China.

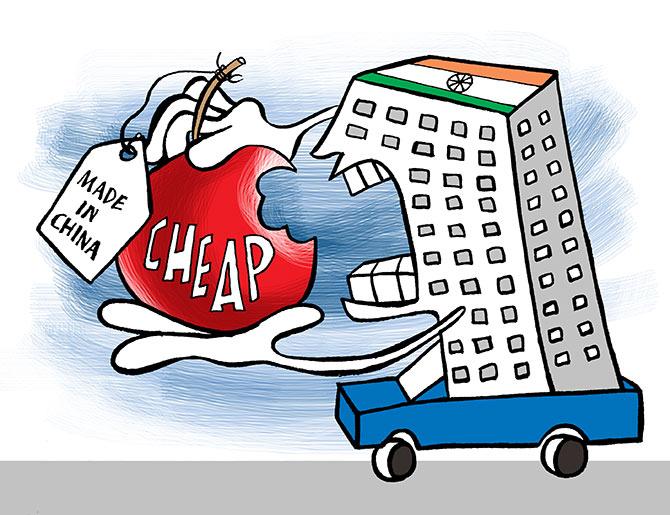

Interestingly, China, which has remained India’s biggest import partner for several years, witnessed a 13 per cent decline in January.

While the government is still compiling product-wise data from China and other countries, a drop in imports could be due to the impact of Covid-19 as well as weak domestic demand.

Import from India’s key crude oil suppliers -- Saudi Arabia and Iraq -- contracted 14.3 per cent and 11.2 per cent, respectively.

The January trade data, released on Wednesday, showed imports contracted 3.6 per cent year-on-year and the decline was sharper on a sequential basis at 13 per cent.

This was due to a combination of factors such as the government’s curbs on non-essential imports such as gold, weak domestic demand, and easing commodity prices.

A senior government official said the drop in imports indicated the “Make in India” programme was succeeding.

However, on a cumulative basis, import growth was nearly 22 per cent at $602.19 billion during April-January, as the value of inbound shipment remained elevated due to high commodity prices triggered by the conflict between Russia and Ukraine.

As many as 17 sectors, such as organic and inorganic chemicals, plastics, pearls, precious and semi-precious stones, machinery, electronic goods, among others, witnessed a contraction in imports.

As far as exports are concerned, six of India’s top 10 export partners — the US, China, Singapore, Bangladesh, Brazil, and Germany — witnessed a contraction in January, leading to 6.5 per cent reduction in overall exports.

These 10 nations have a share of 47.4 per cent in India’s exports.

India’s merchandise exports contracted 6.5 per cent year-on-year in January to $32.91 billion due to slowdown in demand from key markets because of monetary tightening by central banks. On a sequential basis, the decline was 4.5 per cent.

The US, which has been India’s largest export market for a decade, saw a dip in its value of exports by 12.1 per cent to $5.7 billion in January.

On a sequential basis, at $1.16 billion, the contraction was 11.3 per cent in the case of China, which is India’s second-largest trade partner and fourth-largest export partner.

This was mainly due to slowdown in economic activities in China due to its zero-Covid policy.

The four nations that saw growth in exports are the United Arab Emirates (3.7 per cent), the Netherlands (33.3 per cent), the United Kingdom (8.1 per cent), and Saudi Arabia (77.2 per cent).

© 2025

© 2025