'Online aggregators offer discounts of 70% to 75%.'

'At a car dealership, the discount is usually in the range of 30% to 35%.'

Sanjay Kumar Singh finds out more.

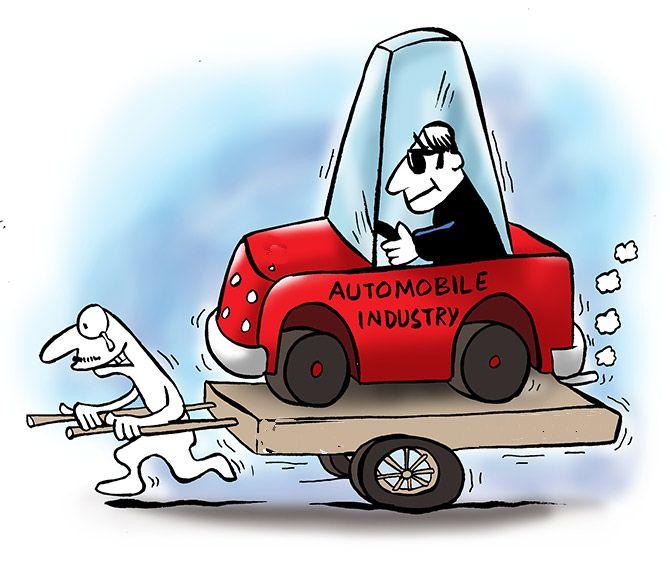

Illustration: Uttam Ghosh/Rediff.com

If you are purchasing a new car and decide to buy the insurance cover for it at the car dealership, instead of online, the premium you pay could be higher by as much as Rs 3,000 to Rs 20,000 (and sometimes even more), depending on the model of the car.

Furthermore, the chairman of the Insurance Regulatory and Development Authority of India, Subhash Chandra Khuntia, recently expressed concern that insurance companies may in some cases be paying higher commissions to motor insurance service providers (MISPs) than permitted by the regulator.

Auto dealers take the MISP licence to sell motor insurance.

When you put both these points together, it becomes clear that car buyers need to go online and compare premiums instead of blindly purchasing the insurance cover offered at the dealership.

One reason why a motor cover costs more at a dealership than online is basic.

Since an intermediary -- the MISP -- is involved, the commission paid to it gets built into the premium cost.

An insurer or an aggregator who sells online does not have to pay that commission.

While selling motor policies, the market practice is to offer discounts on own-damage (OD) premium.

Online aggregators sell to highly price-conscious customers.

On the other hand, car dealers sell to captive customers.

A person who visits the showroom is more obsessed with comparing models and features of the vehicle, and less with the cost of insurance.

So, online aggregators need to offer higher discounts.

"Online aggregators like us offer a discount of 70% to 75% on the OD premium. At a car dealership, the discount is usually in the range of 30% to 35%. That accounts for the difference in pricing," says Tarun Mathur, co-founder and chief business officer, PolicyBazaar.

Adds Kapil Mehta, co-founder and managing director, SecureNow Insurance Broker: "Premiums could be 10% to 30% higher at a dealership than when you buy from a broker."

The commission paid to the MISP is a percentage of the premium.

If the MISP is able to increase the ticket size of the cover, s/he can earn a higher commission.

"Sometimes, add-ons are attached to increase the ticket size, irrespective of whether they are useful to the buyer," says Animesh Das, head of product strategy, Acko General Insurance.

Many first-time car buyers are not even aware that they have the option to remove certain features and thereby reduce their premium.

The commission that an insurer can pay to an MISP is 15% of the OD premium.

Over and above this, it can offer another 4.5% (30% of 15%) as reward.

Thus, the total commission can go up to 19.5% of the OD premium (commission on the third-party cover is small -- around 2.5%).

The Irdai chairman's recent statement shows that some insurers may be offering higher commissions.

The obvious purpose would be to make car dealers push their products.

Ultimately, these added costs fall on the customer.

Instead of buying the insurance policy offered at the car dealership, go to the Web sites of insurers and aggregators and check premiums.

Also, get to know about the various add-ons available and buy only those you truly need.

© 2025

© 2025