After several years of downgrades to the country's medium-term growth outlook, the estimates are likely to be upgraded now, Credit Suisse said in a report.

The country's economy is showing signs of bottoming out, it said.

According to the report, the consensus forecasts of GDP growth for FY2022 over FY2020 stopped falling after October 2020 (currently at (-) 1 per cent).

Analysts at Credit Suisse expect these estimates to be revised upwards.

"After several years of downgrades to India's medium-term growth outlook, we believe upgrades are now likely.

“The easing of monetary conditions reverses the tightness of 2015-18, with the large balance of payments (BoP) surpluses that have allowed for this also providing the macroeconomic scope for a stimulus," Credit Suisse co-head of equity strategy, Asia Pacific and India equity strategist Neelkanth Mishra told reporters on Thursday.

The multi-year real estate cycle is no longer a drag on the economy, he said, adding that there is a pro-growth shift in the country's industrial policy.

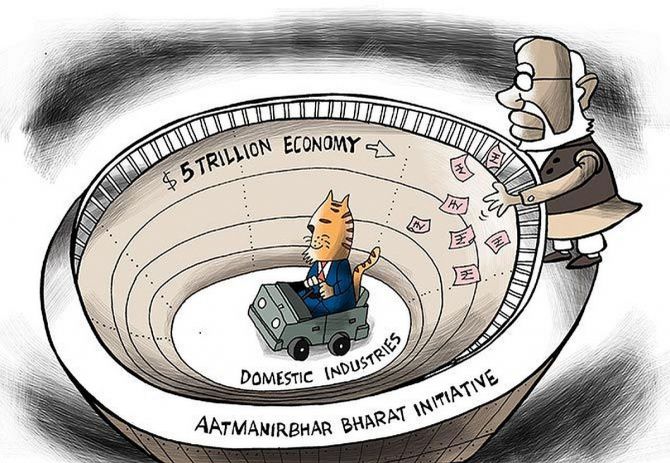

Mishra said the production-linked incentive (PLI) schemes can add 1.7 per cent to GDP by FY27, or an average of 0.3-0.5 per cent a year.

The cuts in corporate tax rates in September 2019 and the labour law reforms should contribute as well.

The report said a pro-cyclical fiscal policy was a drag on growth in the September 2020 quarter and is now likely to support it as the earlier-than-expected rebound in economic momentum boosts (central and state) government tax receipts.

The restocking-led momentum in manufacturing is likely to boost GDP for a few quarters, it added.

Indian equities are no longer cheap, the report said, adding "in fact, they have rarely been more expensive".

"Any reasonable investment strategy must factor in lower or at best unchanged P/E (price-to-earning) going forward - if Nifty and current FY22 and FY23 index EPS (earnings per share) forecasts sustain, in a year P/E ratios are only likely to go back to pre-pandemic levels," it said.

© 2025

© 2025