Foreign currency loans raised by Indian companies nosedived to $210 million in the September quarter (Q2), 93.3 per cent less than the year-ago period when five firms raised $3.1 billion.

The Q2 amount is the lowest since December 2003 quarter when India Inc raised $191 million.

Companies cited volatility in the currency markets, sharp rise in interest rates in the United States, and fund availability in India as the main reasons behind the sharp fall.

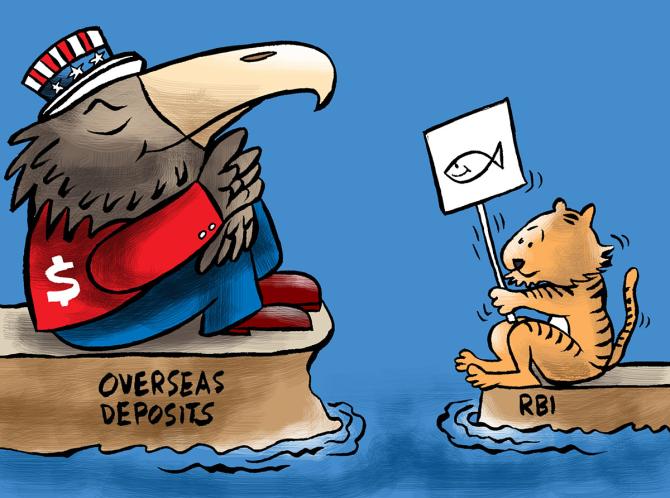

According to data sourced from Bloomberg, only two companies raised funds in the September quarter, which was marked by the Indian currency losing its value sharply against the US greenback and the Reserve Bank of India (RBI) taking several steps to stem the rupee’s fall.

In the quarter ending June this year, seven Indian companies raised $1.69 billion, while in the March 2022 quarter, 13 companies raised $6.9 billion (see chart).

“Indian companies almost stopped raising funds from abroad in the September quarter after the RBI made it mandatory to take forward cover and a sharp rise in rates in the US.

"With rising interest rates and additional cost of forward cover, the arbitrage between rates in India and those abroad is now over,” said Prabal Banerjee, international finance advisor and former finance director of Bajaj Group.

“Indian banks are also flush with funds and are encouraging good rated companies to take loans,” Banerjee said.

Another reason for falling demand for overseas loans is lower capital expenditure planned by the mid- and small-sized companies.

“With rising interest rates globally and the sharp weakening in rupee that we have seen in the last few months, the fall in India Inc’s overseas borrowing was expected.

"Going forward, the trend of rising global interest rates and weakening pressure on rupee is likely to continue, and India Inc’s reliance of foreign borrowing will remain low,” said Rajani Sinha, chief economist, CARE Ratings.

Analysts said manufacturing growth had already faltered in August, according to the index of industrial production (IIP) growth numbers.

A global slowdown is already weighing on exports — a key driver of IIP so far — which are in contraction now, and could hurt domestic credit and capex cycles in the coming months.

Several indicators of the world economy such as money supply, purchasing manager's index (PMI), new orders, US yield curve, US home sales, and credit spreads point towards a further global slowdown.

“The RBI, too, is raising rates and tightening liquidity, implying downside risks to the domestic economy.

"Thus, we expect industrial activity to continue to be weak,” Kapil Gupta of Nuvama Group (formerly known as Edelweiss Securities), said.

© 2025

© 2025