A century-old European bicycle brand gets a makeover under its new Indian owner.

But is there room for yet another premium commuter bike?

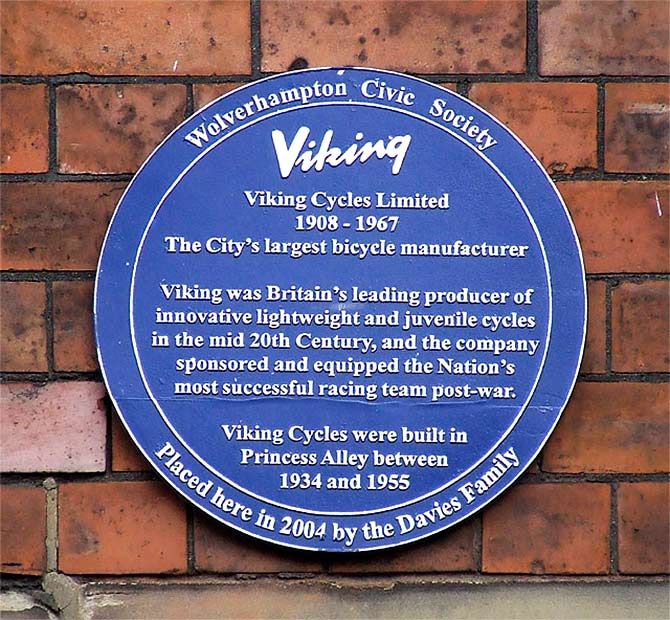

Three years after bicycle maker Hero Cycles acquired the then moribund Viking Cycles, it is taking baby steps to revive the brand’s legacy in its old markets in Europe and to build a small footprint in its new home in India.

Given that the 1908-born brand has been off the roads since the 1980s, experts see a tough climb ahead. Especially since the marketplace has changed as have the expectations that customers have from a commuter bicycle.

Princess Alley, Wolverhampton was home of the first workshop of world famous Viking cycles. Photograph: Courtesy Shenk and Trish/Princess Alley, Wolverhampton/CC BY-SA 2.0/Wikimedia Commons.

Viking can always draw on its legacy status but a lot depends on how it tells the story of its revival and also how it positions the product in different markets, say experts.

But more important, is there room for a yet another premium commuter bicycle?

Two countries, one brand

There is always place for a heritage brand in the premium category says a competitor. Harish Bijoor, CEO Bijoor Consults says that Viking’s legacy will help make place in a crowded market.

But it needs to craft a differentiated strategy for Europe and India.

In Europe, where consumers are familiar with the brand, the big task is to keep the premium status and emphasise that this is not just old wine in a new bottle. Here the Pawan Munjal-owned Hero Cycles is talking up new pedal technology and the cycle’s traditional all-steel body, hinting that the heritage brand is now available in a contemporary avatar.

In India, the brand is looking to separate itself from other global brands such as Firefox (part of the Hero family), Trek, Giant and others. The size of the super-premium cycle market is estimated at 8,000-10,000 units a month. Also, Hero Cycles has been likening its Viking re-launch with that of Royal Enfield’s tryst with the Bullet brand on European roads and the Tata group’s success with Jaguar Land Rover, in an effort to set an Indian context to the brand’s global story.

Would it have been simpler to stick with the UK market alone? “Reviving the brand only in the UK doesn’t make sense. India is a very important market for us,” Sreeram Venkateswaran, CEO, Avocet, Hero Cycles said.

He outlines the plans: In Europe, the company is working towards getting the bicycle reviewed by professional riders to re-establish its credentials among biker communities and has brought several professional riders on board as brand ambassadors.

It is also building a digital marketing and distribution channel that the company believes will help keep its costs down as it takes the brand across countries.

Bijoor said, “I don’t see why Viking can’t build a brand in this country. The challenge is deep pockets and extremely creative and involved storytelling around the brand.”

For India, the big concern would be keeping prices affordable. “The price points are a little bit prohibitive to start with, because the frame itself is going to cost about £300 to £400. It is expensive steel,” said Venkateswaran. Viking is expected to come to India in January 2019.

In the UK, the strategy is to promote Insync, the umbrella brand that has Viking (men’s bike) for urban commuting and road bikes, all terrain bikes brand Riddick, women’s brand Ryedale, and children’s brand Denovo. The family of labels will be brought to India too. The aim is to keep the brand premium and modern. “Otherwise it will be lost in the crowd,” said Venkateswaran.

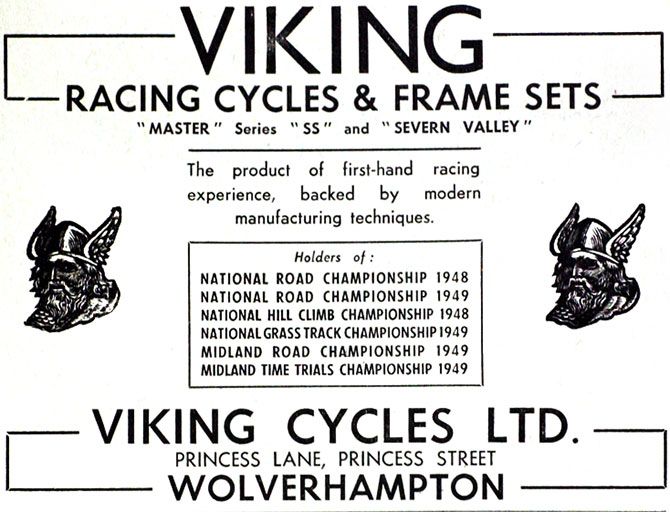

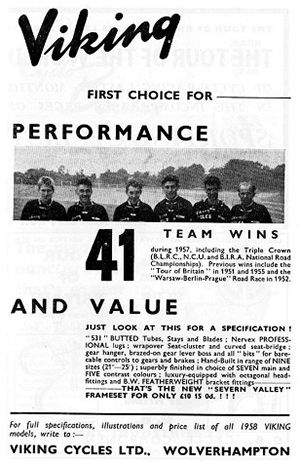

Viking wants to remind consumers about its racing credentials too. It had won the Tour of Britain four years in a row, but from some time around the 1960s investments dried up and the brand died in the 1980s. Hero sees an opportunity in this segment and believes that Viking can cut the clutter through design and a promise of its old prowess.

While design and brand identity are a mix of the old and new, Hero has overhauled the distribution process by drastically cutting down its dependence on physical retail. It has tied up with ‘Hut’, an e-commerce channel, even though it has around 550 retailers selling products in the UK.

Physical stores are losing their business and in the direct to consumer channels, margins are better and the customer gets a better deal the company said.

Hero said it had operationalised the direct to consumer strategy in the UK and by September-October it is expected to go to the Scandinavian countries, then to Belgium, Austria, Germany and other countries.

“We have been ten weeks in the market with direct to consumer and we already have about 120,000 unique visits. We have got 1.3 million impressions. As we start stabilising on supply chain, we will keep expanding,” Venkateswaran said.

Digital also ensures greater visibility and enhances the consumer experience with the product. It is also cost-efficient.

“When I go direct to consumer, I can give the brand experience through my web stores, I have enough money and margins to go and create pop up and experience centres wherever we want through the year,” he said.

In India, the company is looking at using materials that are better suited for the local environment and helps manage costs.

“My most expensive Viking bike in the range of £1,700 pounds, if I were to launch a similar bike in India, I don’t need to launch it in Rs 1,70,000. It can actually be launched for Rs 35,000 by cutting down a lot of components which are critical and essential for European market, but not essential or not even desirable in India context,” he said.

© 2025

© 2025