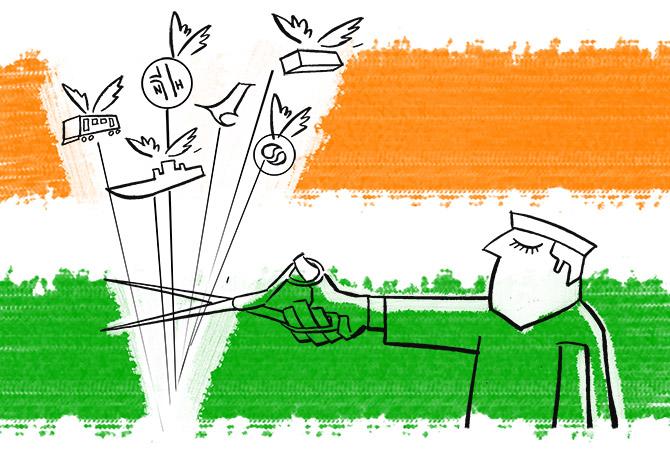

The Centre’s push to sell Air India on priority has led to delays in other strategic divestment proposals, such as privatising United India Insurance, as well as ongoing transactions, such as Shipping Corporation of India (SCI) and Bharat Petroleum Corporation (BPCL), revealed multiple officials involved in the process.

The Department of Investment and Public Asset Management (DIPAM) is yet to take new privatisation recommendations of the NITI Aayog to the core group of secretaries on disinvestment (CGD) headed by the Cabinet secretary, said one of the officials.

The priority now is to ensure all approvals for Air India are in place since the government intends to hand over the national carrier as early as this month.

This has inadvertently led to delays in moving ahead with the privatisation of United India Insurance as announced in the Union Budget.

The Aayog had recommended the state-owned insurer for privatisation, but Air India sale occupied greater mindspace, said another official.

This has raised concerns about the privatisation of the public-sector insurer not likely to get completed this year, added the official.

The sale of the national carrier has been pending for years, and is on the final lap.

There is also a limitation on the staff strength at DIPAM.

The process to appoint additional manpower is in progress, he added.

The sluggish progress on fresh privatisation proposals had also led to the Aayog directly seeking the Cabinet Committee on Economic Affairs’ approval after the think tank submits its recommendations on the candidates for privatisation, doing away with approval from the CGD.

With regard to the ongoing transactions, the process of privatising SCI has been halfhearted.

The inter-ministerial group met last month to consider the request for proposal (RFP) and share purchase agreement (SPA).

However, the same has not been approved by the CGD yet.

It is yet to be shared with interested bidders.

This had led to delays in the completion of due diligence by interested buyers.

Although the data-room access has been given to bidders, the process will formally move ahead only when the terms and conditions are made clear through RFP and SPA, said a third official.

Interested bidders are yet to get access to the company’s confidential information memorandum.

The approval of RFP and SPA of the SCI coincides with Air India’s bidding timeline, and has compounded the delay, he added.

The privatisation of BPCL is moving at a snail's pace since due diligence by interested parties is taking more time than usual.

The data room will remain open till November 15.

The financial bids will be accepted on November 16, said the official.

There are issues for undertaking due diligence of oil rigs because of high tides and other complications.

This may lead to extension of the deadline for submission of financial bids, he added.

However, another official said the process of privatisation of these companies is on track, and there are no delays as widely held.

Emailed queries to the finance ministry spokesperson did not elicit a response.

Besides Air India, on the government’s priority list is the initial public offering (IPO) of Life Insurance Corporation (LIC) of India.

It is touted to be India’s largest-ever public offer.

The government is targeting the IPO launch in January-March 2022.

It will help shore up the Centre’s divestment receipts, and meet the Rs 1.75-trillion stake sale target for the current fiscal year.

To be sure, DIPAM has been active on the IPO planning and preparations for LIC, and has held talks with potential investors.

It is awaiting the derivation of the insurer’s embedded value, which will be used for valuing LIC.

© 2024 Rediff.com -

© 2024 Rediff.com -