Hybrids have helped Maruti acquire leadership in SUVs, a segment that was never its forte.

Toyota has also risen with the hybrid tide to clock its highest-ever annual sales in 2023.

In the latest bitter battle in motown, the one between electric vehicles and hybrids, the latter seem to be getting their nose ahead, with the government setting up a panel to examine whether hybrid cars deserve policy support in the form of lower taxation.

Recently, missives have floated across the top tier of policymaking, as a result of which the ministry of heavy industries has formed an internal committee to examine whether the cess on hybrid cars should be reduced.

Speaking unofficially, officers confirmed the move.

It is a move that will raise the hackles of EV makers, which claim to be the ones truly mitigating the ill effects of vehicular pollution.

Despite attracting GST of only 5 per cent and no cess, electric cars continue to cost a bomb to make, because of higher battery costs, and it was seen as a major feat when Tata Motors, the EV market leader, managed to price its cheapest EV in the region of Rs 10 lakh.

Hybrids, which combine a battery with an internal combustion engine (ICE), usually petrol, are cheaper and suffer no range anxiety while boosting the overall fuel efficiency.

Of late, they have been finding more rapid adoption than pure electric cars that have no IC engine and have to be plugged in to charge the battery after the car has done its 'range'.

The range could be anywhere from 300 to 500 km, depending on the make and price (Mercedes Benz EQS, said to go 857 km on one charge, costs about as much as a good house in a Delhi suburb).

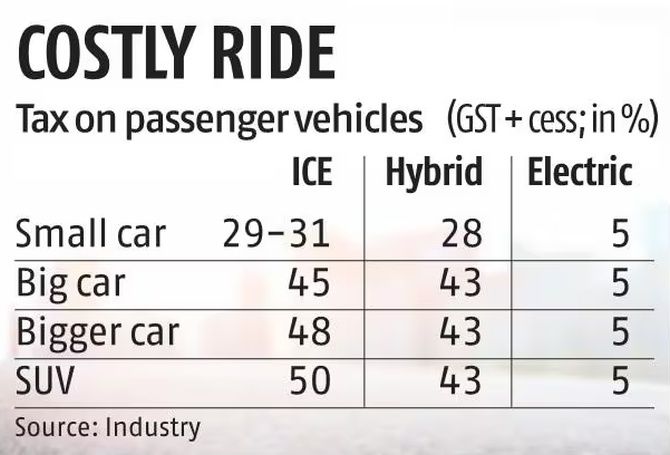

Hybrids attract 28 per cent GST, but the cess takes the total tax incidence to 43 per cent, unless it is a small car.

ICE cars incur the same GST, but the cess takes the total to up to 50 per cent, varying on the size of the body and engine.

The issue of taxation, as it often does, has once again brought fault lines to the fore.

Speaking to PTI last month, Tata Motors Passenger Vehicles Managing Director Shailesh Chandra said only zero-emission cars (read electric) could cut air pollution and reduce fuel imports.

Off the record, people close to Tata Motors use stronger language.

Hybrid cars, they say, are essentially fossil-fuel vehicles using a two-decade-old technology that is being dumped on India.

Tata and its fellow homegrown auto major, Mahindra & Mahindra, are betting on pure EVs.

On the other side of the divide is Maruti Suzuki, the country's largest carmaker that has swelled on hybrid technology sourced from its partner, Toyota.

Hybrids have helped Maruti acquire leadership in SUVs, a segment that was never its forte.

Toyota, which does cross-badging of vehicles with Maruti, has also risen with the hybrid tide to clock its highest-ever annual sales in 2023.

Expectedly, those on Maruti's side have a bone to pick with Tata's assertion.

They say hybrids have seen four distinct generations of improvisation and their penetration in the developed markets of the United States and some other countries is on the rise.

A New York Times report last month spoke of a hybrid renaissance, saying sales were robust, 'underscoring what may be the enduring reality check of 2023: Many Americans are hugely receptive to electrification, but they're not ready for a fully electric car'.

Those on the Maruti-Toyota side project cumulative passenger vehicle sales in India between FY23 and FY30 to be 42 million, of which EVs will be about 6 million, leaving a large number of the other kind.

'As long as there is a single ICE car sold in India,' says the hybrid side, 'there should be an effort to at least partially electrify it and get at least a 30-35 per cent reduction in oil consumption.'

Feature Presentation: Rajesh Alva/Rediff.com

© 2025

© 2025