Direct stock investors should go by the thumb rule that exporters gain from rupee's depreciation while importers take a hit, says Sanjay Kumar Singh.

Illustration: Uttam Ghosh/Rediff.com

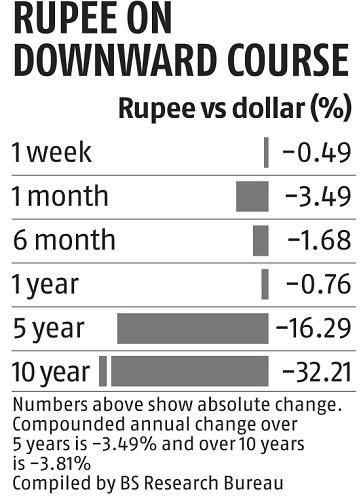

The rupee has weakened around 3.9 per cent against the US dollar over the past month.

Investors need to tweak their portfolios to protect themselves against the impact of this phenomenon.

A key reason for the rupee's depreciation is foreign institutional investors (FIIs) pulling money out of emerging market (EM) stock and bond markets.

FIIs have pulled Rs 33,348 crore out of Indian equities over the past three months.

"This has happened due to heightened risk perception in global markets, arising from the US-China trade war," says Abheek Barua, chief economist, HDFC Bank.

The Chinese Yuan has moved from 6.5 to 7.2 against the US dollar.

Many EM currencies have moved in line as the Chinese currency is perceived as an anchor for them.

"Negative news on the domestic front -- GDP, auto sales, etc -- has also led to capital outflows from Indian markets," adds Barua.

A depreciating rupee affects household budgets in several ways.

Households with children studying abroad could be forced to shell out more.

All imported items, like electronic goods, cars (made from imported components), etc become more expensive.

"At present, demand is weak, so companies will absorb costs. But as soon as economic growth picks up, they could pass them on to customers," says Barua.

The cost of overseas travel could rise, depending on the destination country.

"Costs will rise for countries where the currency is the US dollar, or it is pegged to the US dollar," says Vishal Dhawan, chief financial planner, Plan Ahead Wealth Advisors.

A weakening rupee also makes foreign investors more worried about earning positive returns.

They pull out more money, creating a vicious cycle in the markets.

A weaker rupee also makes crude oil, which India imports, more expensive.

This affects fuel bills of households and exerts upward pressure on inflation as transportation costs rise.

"At present, however, the global economy is slowing down, so the price of crude is also softening, cushioning the impact of the rupee's fall," says Dhawan.

Investors can take a few steps to counter the impact of a depreciating rupee.

One, they can invest in dollar-denominated international funds, like US-focused funds.

"Indian investors should build exposure to international funds to counter the impact of both short and long-term depreciation of the rupee against the dollar," says Dhawan.

Those who are starting out may take up to 10 per cent exposure, while seasoned investors can take up to 20 per cent exposure (of their equity portfolio).

Investors should also take a 10-15 per cent exposure to gold as it has the ability to act as an effective currency hedge.

If the rupee continues to depreciate, interest rates could move up eventually.

"Rupee depreciation combined with capital outflows could create a situation wherein a pickup in economic activity could lead to hardening of rates," says Barua.

Investors need to be cautious in their debt portfolios.

"Investors with short-term money should stick to liquid and low-duration funds. Those with a two-three-year horizon should go for short-duration funds, while those with a horizon of more than three years should opt for dynamic bond funds," says Mahendra Jajoo, head of fixed income, Mirae Asset Global Investments.

Direct stock investors should go by the thumb rule that exporters gain from rupee's depreciation while importers take a hit.

IT, pharma and chemicals are India's leading export-oriented sectors.

"Many exporters may not gain if currencies of countries they compete against have also depreciated. Many importers may also not get affected if they have pricing power. Investors should analyse the currency impact on a case-by-case basis," says Jatin Khemani, founder and CEO, Stalwart Advisors, a Sebi-registered independent equity research firm.

© 2025

© 2025