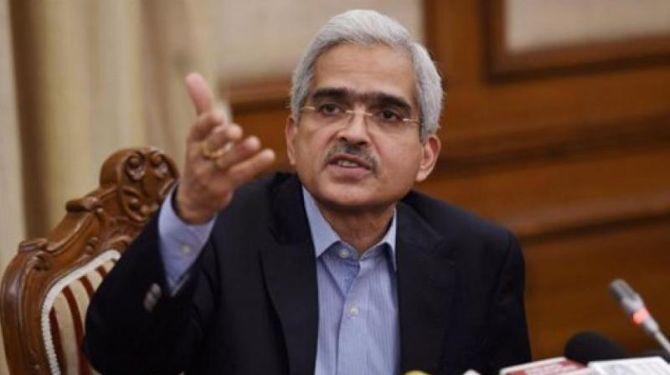

Following are the highlights of RBI Governor Shaktikanta Das's statement and resolution of the Monetary Policy Committee (MPC):

- RBI cuts repo rate by 40 bps to 4 pc

- Reverse repo rate reduced to 3.35 pc

- Second sharp reduction in key policy rates in 2 months

- GDP growth in FY21 estimated to remain in negative territory, with some pick-up in H2

- Moratorium on term loan instalments extended by another 3 months till Aug 31, 2020

- Lending institutions permitted to allow deferment of interest on working capital facilities till Aug 31

- RBI decides to extend time for completion of remittances against imports from 6 months to 12 months for imports made before July 31

- RBI extends a line of credit of Rs 15,000 crore to the EXIM Bank

- Maximum permissible period of export credit increased to 15 months from 12 months

- RBI announces measures to improve functioning of markets and market participants

- Forex reserves increase by USD 9.2 bn in 2020-21 (up to May 15) to USD 487bn.

- Top 6 industrialised states accounting for about 60 pc of industrial output largely in red/orange zones

- High frequency indicators point to collapse in demand beginning in March

- MPC opined macroeconomic impact of COVID-19 is turning out to be more severe than initially anticipated

- Various sectors of economy are experiencing acute stress

- Economic activity other than agriculture likely to remain depressed in Q1 due to lockdown

- Inflation outlook highly uncertain

© 2025

© 2025