Clearing GST Council voting is getting harder for the government as BJP is losing grip over states. The party, which controls 15 states, falls short of the 75% vote share needed to pass a decision. And it doesn't have an Arun Jaitley to broker a consensus on contentious matters.

The GST Council never ever had to resort to voting to decide an issue before its December 2019 meeting.

In fact, the provision for voting under GST law was more a matter of an academic interest prior to that meeting.

The controversial issue of the GST rate on lotteries was decided by voting when the Council met on December 18 last year.

Most of the votes were in favour of a uniform tax rate of 28 per cent on both state and private lotteries, with effect from March 1, 2020.

The move was a partial defeat for the proposal by Kerala Finance Minister Thomas Isaac, on whose insistence the voting was conducted.

Currently, there are dual rates for lotteries - 12 per cent tax on state-run lotteries and 28 per cent on state-authorised private lotteries.

Voting happened twice on the issue.

The first time it was a toss up between a uniform rate and a dual rate.

Seventeen states and the Centre are learnt to have voted for a single rate and seven for a dual rate.

Maharashtra, which was earlier for a uniform rate, voted for a dual rate this time.

Then there was voting on whether the rate should be 18 per cent or 28 per cent on lotteries.

All voted for 28 per cent.

Kerala had favoured a dual rate for the two kinds of lotteries.

Isaac had said if it came to a uniform rate, then the rate for private lotteries should not be lowered to 18 per cent, but the rate for government-run lotteries should be raised to 28 per cent.

Union finance minister and the chair of the Council, Nirmala Sitharaman, tried to play down the voting or differences in the Council.

“It (voting) was not imposed by the Council. It was not imposed by me as the chair. It was on the insistence of one member,” she asserted.

How the voting math works

As stated earlier, 17 states and the Centre voted for uniform rates and seven for dual. This means five states had abstained from voting.

Any decision has to be passed with 75 per cent of those present and voting. Under normal circumstances, when each of the states and the Centre vote on an issue, the union government can block the decision of the majority on its own.

But it will take as many as 12 states to do the same.

On the other hand, even if all the states combine, the do not have the power to pass a decision, as 75 per cent of the vote is required to ratify the decision.

This is so because the Centre has a third of the total vote, and the states combined together have two-thirds.

Given that there are 30 states and union territories with legislature, each state has 2.22 per cent of the voting power, irrespective of size.

Which means Uttar Pradesh and Goa enjoy the same percentage of voting power.

The Centre, on the other hand, will need the support of 19 states to get it through.

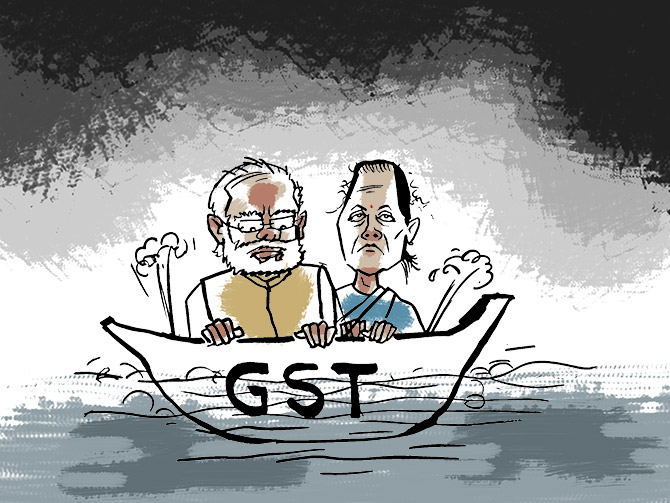

The BJP's dilemma

Now, juxtapose this voting structure to the reducing number of states that BJP or its allies rule.

The NDA is still ruling in 15 states out of 29 with one - Jammu and Kashmir - under President’s rule.

If one considers parties friendly to the BJP, such as YSR Congress, TRS, BJD and AIADMK, the BJP will have 21 states with it.

This means that it can pass any decision, if it is able to cajole its 'friends' to support it.

It isn't as if all decisions sailed through smoothly in the earlier GST Council meetings.

Before the GST was introduced from July 1, 2017, there were huge differences within the Council over the rate structure, powers of the state and the Central officials, among other things.

These got accentuated after demonetisation in November 2016, those in the know of the inside happenings in the Council said.

However, the personality of former finance minister Arun Jaitley and his style of evolving consensus on contentious matters ironed out the differences.

This might be tricky now, particularly if contentious issues such as lowering the revenue growth for the purpose of compensation to loss-making states come to the Council.

“Once, the voting option has been exercised, there appears to be much more chances of voting getting repeated for controversial issues such as reduced rate of compensation to states,’ said Abhishek Rastogi, partner at Khaitan & Co.

M S Mani, partner at Deloitte India, said it will be better if decisions in the Council meetings are taken with the consensus of all states, as has been the practice in the past.

There is no Jaitley now to broker a consensus and the BJP has been losing control over the states, a development that can prove detrimental in the passage of any vote-based decision.

© 2025

© 2025