The government on Tuesday announced withdrawal of the 2 per cent equalisation levy or digital tax on overseas e-commerce supplies.

It is proposed that Equalisation Levy at the rate of 2 per cent of consideration received for e-commerce supply of goods or services, shall no longer be applicable on or after August 1, 2024.

This has been done keeping in mind ongoing negotiations on Pillar 1 and Pillar 2 global tax framework, Finance Minister Nirmala Sitharaman said in a post-budget briefing.

Under the proposed two-pillar solution for taxation of MNCs -- Pillar One is about the reallocation of additional share of profit to the market jurisdictions and Pillar Two consists of minimum tax and subject to tax rule.

Global minimum tax of 15 per cent will come into effect from next year and by 2025 almost 90 per cent of MNCs having revenues of more 750 million euros will be subject to the levy in every country of operation, the OECD had said in its report to G20 finance minister in July last year.

In the interest of Pillar 1 and Pillar 2 tax framework which is being negotiated, Equalisation Levy could not continue, she said.

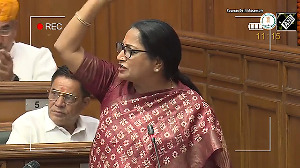

Presenting the Budget for 2024-25 in the Lok Sabha, Sitharaman said the standard deduction for salaried employees will be hiked to Rs 75,000, from Rs 50,000 under new income tax regime in FY25.

The government raised the deduction limit to 14 per cent from 10 per cent for employers' contribution to the National Pension System (NPS).

Besides, the government proposed to increase tax deduction on family pension for pensioners to Rs 25,000 from Rs 15,000.

The finance minister added that salaried employees under the new tax regime will save up to Rs 17,500 annually in taxes due to the changes proposed in the FY25 Budget.

© 2025

© 2025